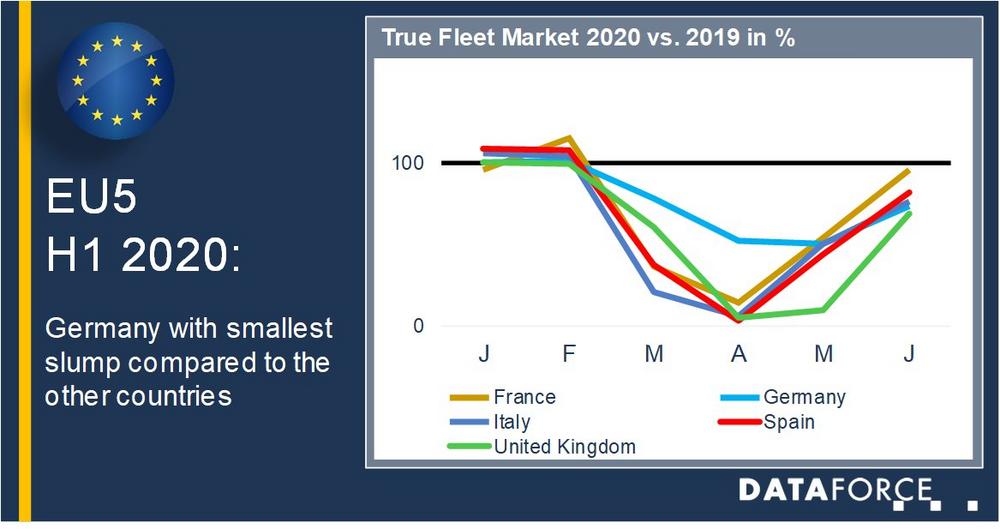

First Half Year 2020 Fleet Market Review of EU5 Countries

world. After the first half year and the tremendous shock for society and economy called Coronavirus,

we look back and give our analysis of the five largest markets in Europe: Germany, Spain, France, UK

and Italy. Where has the virus had the greatest impact? Which market is slowly recovering and is

there a segment in the fleet market that has been spared?

Germany: BEVs and PHEVs stabilise the True Fleet Market

By Benjamin Kibies – Automotive Analyst (benjamin.kibies@dataforce.de )

New car registrations in Germany plummeted by 34.5% in the first half year of 2020. Within the channels, the True Fleet Market showed the “best” performance with registrations shrinking only by 25.6% when compared to the same period in 2019. The other end of the scale was taken by RAC registrations that contracted by 40.4%.

In terms of fuel type, alternatives have made their way out of the niche and conquered 12.4% market share in H1 True Fleet registrations. In particular PHEVs were extremely popular, growing by an astonishing 339.7%. Downward pressure was headed primarily towards petrol engines that have lost 36.4% while diesel (- 27.8%) was mostly in line with the general market contraction.

UK: Registrations still upside down but continue to improve

By Richard Worrow – Automotive Data Specialist (richard.worrow@dataforce.de )

The UK car market does appear to be getting back on the road as registrations continue to recover, albeit slowly in both May and June. As one of the late lockdown markets the registrations in March did not show the same downturn severity as Italy, France or Spain. But given the usual significant registrations that come on the plate change month, we still saw the start of the effects with a market down by 44.4% over March 2019. Year to date (YTD) June shows the UK total market down by 48.5% and as in most other markets the most effected channel has been RAC which is down by 66.7%.

Good news and positive figures can be found in the market though and they come from the fueltype splits. Electric car registrations are up by 154% YTD for the total market while True Fleet shows a 259% uplift and registered the largest volume. PHEVs also showed a 37.6% increase for the total market and again the largest volume is in True Fleet. Further good news if you can call it that, is that both the Private channel and True Fleets recovered to post solid June volumes of 73,000 and 54,000 registrations respectively. And while these are still down on last year June figures, show the promise of the industry returning from its forced hibernation.

France: After the plunge, there comes recovery

By Florian Kreutz – Automotive Analyst (florian.kreutz@dataforce.de )

The first half year in France was dominated by Covid-19 and government incentives to support the automotive industry. After dealership closures on 17 March, new car registrations slumped by 88.8% in April.

In May, Emmanuel Macron announced a ‘plan to support the automotive industry’ which led to a rapid recovery, with registrations in June even exceeding the previous year’s figures. Regarding the fuel type mix, a strong increase in registrations of alternative drives can be observed. With market shares at 6.3% for BEVs (compared to 1.8% in 2019) and 7.3% for hybrids (4.1% in 2019), the governmental incentives for buying electrified vehicles appear to be working well.

Italy: RAC Segment hit very hard in first half of 2020

By Salvatore Saladino – Country Manager (salvatore.saladino@dataforce.it)

During the first half year in Italy, new car registration fell by 47.9% compared to the same period in 2019. Most affected by the virus was the RAC segment: With a fall of 97.1% in March and 99.7% in April compared to the year before, there were almost no new registrations. This decrease continued in May with 92.4%. Car rental companies in Italy did obviously not expect tourists this year. But in June, we can already see an increasing number of car registrations in the Rent-A-Car segment.

True Fleets market registered 127,444 cars against 223,621 of the same period in 2019, with a 43.0% fall. Still, there are no measures to reduce company car taxation to the other EU countries’ level.

Spain: True Fleets in Spain on the way to recovery

By Michael Gergen – Automotive Data Specialist (michael.gergen@dataforce.de)

In the first half year of 2020, Spain was also hit by the corona virus. After a good start in January and February, the virus hit Spain in March were new car registrations fell by 69,5%. Following a disastrous April and a still horrible May new car registrations in June were down by “only” -36.1%.

But, the analysis by market segment reveals a positive aspect in June 2020: while the volume on Rent-A-Car companies and especially manufacturer & dealerships decreased by 76.0% and 48.2% respectively, the drop for registrations on private households was much smaller with -11.4%.

True Fleets declined by 18.2% in June which reduced the total loss for the first half year to 38.2% which is clearly better as the other major market channels. With these figures there is a light at the end of the tunnel for the end of H1 2020.

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Kontakt für Presse

Telefon: +49 (69) 95930-232

Fax: +49 (69) 95930-333

E-Mail: Benjamin.Kibies@dataforce.de

![]()