FIORE GOLD reports record fiscal Q2 gold production and operating cash flow

Fiscal Q2 2020 Highlights

(all figures in U.S. dollars unless otherwise indicated)

Operating & Financial

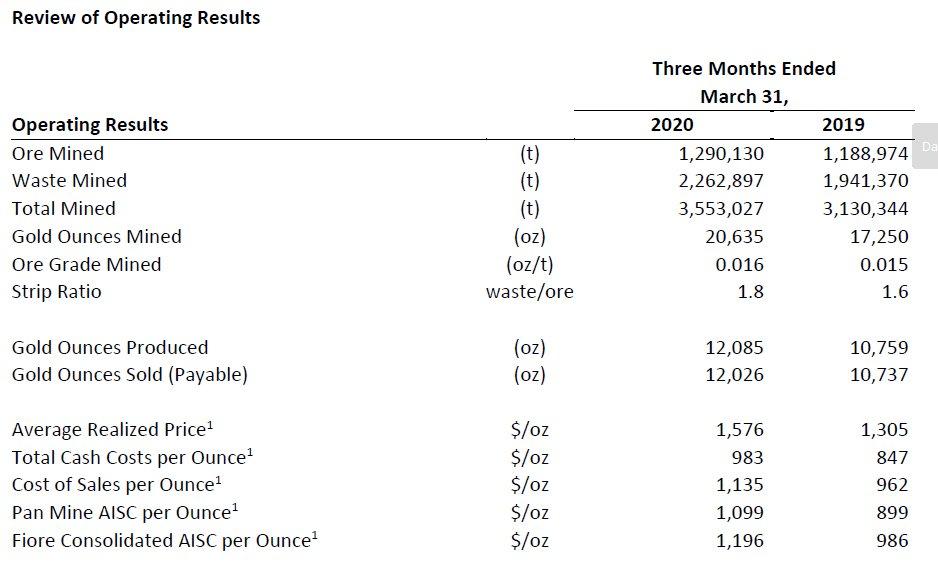

- Q2 gold production of 12,085 ounces representing a production record for the Pan Mine and a 38% increase compared to Q1 2020

- Gold sales of 12,026 ounces at an average realized price of $1,576 per ounce, all sales unhedged

- Recorded quarterly revenues of $19.0 million with mine operating income of $5.3 million

- Net income of $2.9 million

- Generated Pan operating cash flow1 of $6.0 million and consolidated operating cash flow of $3.9 million, both records for Fiore Gold

- Closing cash balance of $9.1 million, an increase of $2.6 million relative to our last reported cash balance as of December 31, 2019

- Strengthened balance sheet with net working capital of $28.7 million as of March 31, 2020

- Mined ore production in Q2 of 14,177 tons per day with a stripping ratio of 1.8:1.0 and grade of 0.016 ounces/ton

- Q2 2020 Pan Mine AISC1 per ounce sold of $1,099 and cash costs per ounce sold1 of $983

- Q2 2020 Fiore consolidated AISC1 of $1,196 per ounce sold

- Mining costs of $2.01 per ton mined demonstrate continued operational efficiencies

- 73,555 total site man-hours worked in Q2 with one reportable incident and zero lost-time injuries

- Mining declared an essential business in Nevada and the Pan Mine continues to operate with strict protocols in place focused on protecting the health and safety of our employees

- We are pleased to reiterate our 2020 production and cost guidance

Organic Growth

- Pan drill results released May 12, 2020 continue to expand oxide gold mineralization, with a resource and mine plan update expected in the second half of 2020

- Results of a Preliminary Economic Assessment (“PEA”) released on April 9th demonstrating positive economics for the Gold Rock project with opportunities to further enhance value. On May 13, 2020, Fiore Gold filed the related technical report.

- Completed construction of the Pan to Gold Rock access road

- On May 19, 2020, Fiore Gold announced a 2.0 million ounce measured and indicated resource at its Golden Eagle Project in Washington State, USA

Tim Warman, Fiore’s CEO commented, “Fiore’s achievements in Q2 continue to advance our goal of becoming a multi-asset US gold producer. The Pan Mine set multiple records in profitability and cash flow with production increasing and costs declining quarter on quarter. Pan continues to be our cornerstone asset allowing us to advance the adjacent Gold Rock property without diluting our shareholders. With a strengthened balance sheet, a positive PEA, and the access road constructed, we are now taking the next steps to move Gold Rock toward feasibility. And with the subsequently announced 2 million ounce resource at Golden Eagle, we hope to drive even further shareholder value. We continue to recognize the inherent risk posed by COVID-19. The health and safety of our employees comes first as they are the foundation of our success in Nevada. We have put a range of operating protocols in place to best mitigate the risk to them. We are fortunate that we have no reported cases at site and continue to operate with minimal disruption.”

Ore tons and total tons mined were higher than the prior year as mining efficiencies allowed us to achieve the required increase in stripping ratio, which is the primary driver for the increase in Pan and Fiore consolidated AISC1 relative to the prior year. As indicated in our guidance, strip ratio is expected to decline in the second half of 2020. Gold ounces mined in the quarter improved relative to 2019 due to increased ore tons and ore grade mined. The quarter also benefitted from some higher-grade areas of the ore deposit that were mined earlier in the year than planned. Gold production of 12,085 ounces was higher than the prior year quarter due to the increased recoveries related to the installation of the primary crusher.

1 This is a non-IFRS financial measure. Please refer to “Non-IFRS Financial Measures” at the end of this news release for a description of these non-IFRS financial measures and to the Non-IFRS Financial measures in the March 31, 2020 Management’s Discussion and Analysis for a reconciliation to operating costs from the Company’s interim financial statements.

Key Developments

Pan Mine

With Pan operating well, we continue our focus on drilling to expand the resource and reserves, and increase mine life. Initial results of the current resource expansion drill program were announced on December 10, 2019. Subsequent to the quarter-end, on May 12, 2020, we released drill results on a further sixty-four holes drilled at several locations around the main North Pan pits, as well as the smaller Syncline and Black Stallion satellite pits. The holes were intended to test the potential to expand the existing oxide reserves both at depth and laterally beyond the current reserve boundaries.

Highlights from these sixty-four holes, all from the North Pan area, include:

- Hole PR20-006 returned 32.0 metres of 0.75 g/t gold

- Hole PR20-008 returned 30.5 metres of 0.76 g/t gold

- Hole PR20-013 returned 27.4 metres of 0.74 g/t gold

- Hole PR20-016 returned 38.1 metres of 0.92 g/t gold

- Hole PR20-031 returned 25.9 metres of 0.74 g/t gold

- Hole PR20-040 returned 74.7 metres of 0.74 g/t gold

- Hole PR20-052 returned 27.4 metres of 0.68 g/t gold

- Hole PR20-053 returned 30.5 metres of 0.60 g/t gold

- Hole PR20-055 returned 15.2 metres of 2.60 g/t gold

Gold Rock

On April 9, 2020, we announced results from a PEA completed for the federally permitted Gold Rock gold project located approximately 8 miles southeast of the Pan Mine. This PEA represents the first ever economic and technical analysis of mining at Gold Rock and shows the project can deliver solid returns for a modest capital investment. The PEA provides an updated mineral resource estimate and a base case assessment of developing the Project as a satellite open pit operation that will share significant infrastructure and management with the adjacent Pan Mine. The PEA also identifies a considerable number of opportunities to enhance the project economics as Gold Rock advances to the Feasibility stage by drilling to increase the mineral resource, further metallurgical testing aimed at improving recoveries, and geotechnical drilling aimed at reducing the stripping ratio. On May 13, 2020, Fiore filed the related technical report.

We have prepared a detailed development plan for Gold Rock that lays out the drilling, metallurgical testing, engineering, state permitting, and other activities required to advance the project towards production. Based on our experience operating the nearby Pan Mine, we intend to proceed directly from the PEA to a Feasibility Study in order to shorten the development timeframe. To assist drilling and on-going work related to the Feasibility Study, we completed the construction of an access road connecting Pan and Gold Rock

Rio Loa

In February 2020, Fiore entered into an agreement with a private Chilean company to assign all of our obligations under the Rio Loa Option Agreement. The divestment of Rio Loa focuses the Company firmly on the United States, one of the world’s top mining jurisdictions.

Relative to the prior year quarter, Fiore demonstrated improvements on all profitability and cash flow measures noted above. This was due to record gold production and the benefit of higher realized gold prices, offset in part by higher costs related to increased stripping. Our liquidity and financial position strengthened with a higher cash balance of $9.1 million and working capital of $28.7 million. Refer to the Company’s MD&A and Financial Statements for additional information. The improvement in financial strength puts Fiore in a good position to continue to progress our growth assets and mitigate potential risks posed by COVID-19.

1 This is a non-IFRS financial measure. Please refer to “Non-IFRS Financial Measures” at the end of this news release for a description of these non-IFRS financial measures and to the Non-IFRS Financial measures in the March 31, 2020 Management’s Discussion and Analysis for a reconciliation to operating costs from the Company’s interim financial statements.

Corporate Strategy

Our corporate strategy is to grow Fiore Gold into a 150,000 ounce per year gold producer. To achieve this, we intend to:

- grow gold production at the Pan Mine while also growing the reserve and resource base;

- advance exploration and development of the nearby Gold Rock project; and

- acquire additional production or near-production assets to complement our existing operations

Qualified Person

The scientific and technical information contained in this news release relating to Fiore Gold’s Pan Mine was approved by J. Ross MacLean (MMSA), Fiore Gold’s Chief Operating Officer and a "Qualified Person" under National Instrument 43-101. The scientific and technical information contained in this news release relating to the Gold Rock and Golden Eagle projects were approved by Paul Noland (AIPG CPG-11293), Fiore Gold’s VP Exploration and a "Qualified Person" under National Instrument 43-101.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Non-IFRS Financial Measures

The Company has included certain non-IFRS measures in this document, as discussed below. The Company believes that these measures, in addition to conventional measures prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company. The non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

“Adjusted net earnings” and “adjusted net earnings per share” are non-IFRS financial performance measures. Adjusted net earnings excludes the following from net earnings: certain impairment charges (reversals) related to intangibles, goodwill, property, plant and equipment, and investments; gains (losses) and other one-time costs relating to acquisitions or dispositions; foreign currency translation gains (losses); significant tax adjustments not related to current period earnings; unrealized gains (losses) on non-hedge derivative instruments; and the tax effect and non-controlling interest of these items. The Company uses this measure internally to evaluate our underlying operating performance for the reporting periods presented and to assist with the planning and forecasting of future operating results. We believe that adjusted net earnings are a useful measure of our performance because these adjusting items do not reflect the underlying operating performance of our business and are not necessarily indicative of future operating results.

We have adopted “all-in sustaining costs” measures for the Pan Mine and Fiore as a consolidated group, consistent with guidance issued by the World Gold Council (“WGC”) on June 27, 2013. We believe that the use of all-in sustaining costs is helpful to analysts, investors and other stakeholders in assessing our operating performance, our ability to generate free cash flow from current operations and our overall value. These measures are helpful to governments and local communities in understanding the economics of gold mining. The “all-in sustaining costs” measure is an extension of existing “cash cost” metrics and incorporates costs related to sustaining production. The WGC definition of all-in sustaining costs seeks to extend the definition of total cash costs by adding reclamation and remediation costs, exploration and study costs, capitalized stripping costs, corporate general and administrative costs and sustaining capital expenditures to represent the total costs of producing gold from current operations. All-in sustaining costs exclude income tax, interest costs, depreciation, non-sustaining capital expenditures, non-sustaining exploration expense and other items needed to normalize earnings. Therefore, these measures are not indicative of our cash expenditures or overall profitability.

“Total cash cost per ounce sold” is a common financial performance measure in the gold mining industry but has no standard meaning under IFRS. The Company reports total cash costs on a sales basis. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The measure, along with sales, is considered to be a key indicator of a Company’s ability to generate operating earnings and cash flow from its mining operations. “Costs of sales per ounce sold” adds depreciation and depletion and share based compensation allocated to production to the cash costs figures.

Total cash costs figures are calculated in accordance with a standard developed by The Gold Institute, which was a worldwide association of suppliers of gold and gold products and included leading North American gold producers. The Gold Institute ceased operations in 2002, but the standard is considered the accepted standard of reporting cash cost of production in North America. Adoption of the standard is voluntary, and the cost measures presented may not be comparable to other similarly titled measure of other companies.

“Total cash costs per ounce”, “cost of sales per ounce”, “all-in sustaining costs per ounce”, “Pan operating income” and “Pan operating cash flow” are intended to provide additional information only and do not have any standardized definition under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The measures are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate the measure differently.

“Average realized price” is a financial measure with no standard meaning under IFRS. Management uses this measure to better understand the price realized in each reporting period for gold sales. Average realized price excludes from revenues unrealized gains and losses, if applicable, on non-hedge derivative contracts. The average realized price is intended to provide additional information only and does not have any standardized definition under IFRS; it should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Other companies may calculate this measure differently.

Cautionary Note Regarding Forward Looking Statements

This news release contains “forward-looking statements” and “forward looking information” (as defined under applicable securities laws), based on management’s best estimates, assumptions and current expectations. Such statements include but are not limited to, statements with respect to future operations at the Pan Mine, expected production, expected costs, expected mining rates, strip ratios, all cost, all 2020 production and cost guidance, estimates of mineral resources and reserves, expectations that the Company will add additional resources and reserves through drilling, timing of a resource and mine plan update for the Pan Mine, effectiveness of protocols in response to the COVID-19 pandemic, all of the future planned development, Gold Rock development plan, operations and production described in the Gold Rock PEA, Gold Rock drilling and metallurgical testing, Gold Rock Feasibility, future development, operations and production described in the Golden Eagle resource, future financial performance, company outlook, goal to become a 150,000 ounce producer, goal to acquire additional production or near production assets, and other statements, estimates or expectations. Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects” and similar expressions (including negative variations) which by their nature refer to future events. By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond Fiore Gold’s control. These statements should not be read as guarantees of future performance or results. Forward looking statements are based on the opinions and estimates of management at the date the statements are made, as well as a number of assumptions made by, and information currently available to, the Company concerning, among other things, anticipated geological formations, potential mineralization, future plans for exploration and/or development, potential future production, ability to obtain permits for future operations, drilling exposure, and exploration budgets and timing of expenditures, all of which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievement of Fiore Gold to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause actual results to vary materially from results anticipated by such forward looking statements include, but not limited to, risks related to the Pan Mine performance; risks related to the COVID-19 pandemic, including government restrictions impacting our operations, risks the pandemic poses to our work-force, impacts the virus may have on ability to obtain services and materials from our suppliers and contractors; risks related to the company’s limited operating history; risks related to international operations; risks related to general economic conditions, actual results of current or future exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates; increases in market prices of mining consumables; possible variations in ore reserves, grade or recovery rates; uncertainties involved in the interpretation of drilling results, test results and the estimation of gold resources and reserves; failure of plant, equipment or processes to operate as anticipated; the possibility that capital and operating costs may be higher than currently estimated; the possibility of cost overruns or unanticipated expenses in the work programs; availability of financing; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of exploration, development or construction activities; the possibility that required permits may not be obtained on a timely manner or at all; changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Fiore Gold operates, and other factors identified in Fiore Gold’s filings with Canadian securities authorities under its profile at www.sedar.com respecting the risks affecting Fiore and its business. Although Fiore has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements and forward-looking information are made as of the date hereof and are qualified in their entirety by this cautionary statement. Fiore disclaims any obligation to revise or update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements or forward-looking information contained herein to reflect future results, events or developments, except as require by law. Accordingly, readers should not place undue reliance on forward-looking statements and information.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()