OCEANAGOLD DELIVERS POSITIVE PRELIMINARY ECONOMIC ASSESSMENT RESULTS FOR WAIHI DISTRICT

The PEA is being disclosed in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). An NI 43-101 Technical Report of the PEA will be finalised and filed on SEDAR within the next 45 days. Readers are cautioned that the PEA is preliminary in nature. It includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realised. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

PEA Results Summary

BASE CASE (@$1,500/oz gold price)

- Initial after-tax IRR of 51%

- Initial after-tax net present value (“NPV”) at 5% discount rate of US$665 million

- Life of Mine (“LOM”) after-tax free cash flow of US$1.1 billion

- LOM All-in sustaining costs (“AISC”) of US$627 per ounce

- LOM cash costs of US$557 per ounce

- Initial mine life to 2036 from multiple sources of mill feed

- Total growth capital investment of approximately US$447 million over eight years for four distinct deposits

- Increased resource for Martha Open Pit – now 260,000 gold ounces in the Indicated category and 290,000 ounces in the Inferred category

Michael Holmes, President and CEO of OceanaGold said, “We are very pleased to share the positive results of the Waihi District Study that represents the initial value creating potential of the district opportunities. The PEA indicates the potential for a robust project with an extended mine life for Waihi to 2036 from Martha Underground, Wharekirauponga Underground (“WKP”), Gladstone open pit and a cutback of the existing Martha open pit.”

“Using our base case assumptions, the significant exploration potential recognised at Martha Underground and WKP, combined with the existing infrastructure and skilled workforce, the results of the study give us confidence to move forward in the Waihi District opportunities and as a result, we will continue advancing each forward. Additionally, we see potential for further significant growth through resource additions particularly at Martha Underground and WKP deposits. Resource expansion has the potential for sustained high levels of annual gold production and mine life extension.”

“Leveraging exploration potential through aggressive drill campaigns has been the key to our success since acquiring the Waihi asset in late 2015. This year, we have over 25,000 metres of exploration drilling planned and underway at Martha Underground where our focus is on resource conversion. At WKP, we have an additional 5,000 metres of drilling underway as we continue to drill the high-grade East Graben vein and related foot-wall and hanging wall structures. We expect to update the WKP resource mid-2021.”

“The critical path for success is expected to be resource consenting of WKP and surface projects including the Martha Open Pit Phase 5 and additional tailings storage capacity. The Company has successfully permitted projects in New Zealand over the past 30 years. Through our understanding of the regulatory regime, strong reputation as a responsible miner, demonstration of 30 years of responsible mining and rehabilitation and support from local communities, we are confident to advance these projects through the permitting phase.”

“The results of the Waihi District Study also show significant socio-economic benefits for the rural communities in the Coromandel region and for New Zealand that can play a critical role in the post-COVID-19 economic recovery. With the potential to extend the mine life out to 2036, we can invest an estimated $1.4 billion in-country while adding 300 new jobs to our existing 700-person countrywide workforce. OceanaGold has operated responsibly for over 30 years and has already delivered significant benefits to New Zealand over that time.”

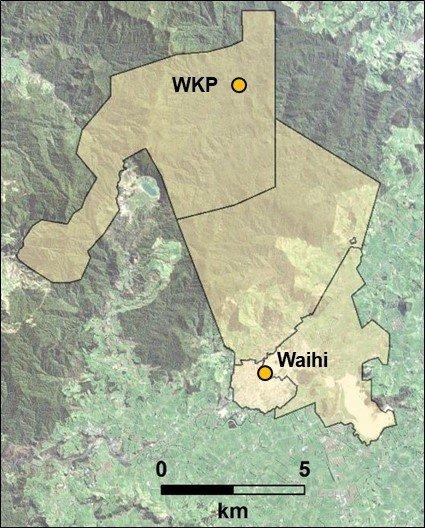

Overview

The Waihi District on the North Island, New Zealand includes the town of Waihi and surrounding areas and lies approximately 140 kilometres southeast of Auckland. The mining projects included in the PEA for the Waihi district include Martha Underground (“MUG”), Wharekirauponga Underground (“WKP”), Martha Open Pit Phase 5 Cutback (“MOP5”) and Gladstone Open Pit (“Gladstone”) (Figure 1). WKP is located 10 kilometres north of Waihi. The forecast financial and operating metrics reflect the inclusion of the four projects as they progressively contribute to production, commencing with MUG in the second quarter of 2021.

Mineral Resource

Since 2017, the Company has completed nearly 100,000 metres of drilling from surface and underground at Martha and approximately 35,000 metres of drilling at WKP that underpins the existing Indicated and Inferred Resources (no Measured Resource currently exists at MUG or WKP) (Table 1).

The PEA is based upon the resource estimates reported in the Company’s 2019 annual reserve and resource statement (see release March 31, 2020) with optimisation of the mine design resulting in the following modifications to reported resources:

- the Martha Phase 4 open pit has been superseded by MOP5, resulting in the merging of the Martha Phase 4 resource into the larger MOP5 open pit resource

- the Martha Phase 4 open pit mineral reserve of 77,000 ounces has been declassified for inclusion in the larger open pit mineral resource

- the MOP5 design utilises approximately 140,000 ounces from the upper portion of the Martha underground mineral resource resulting in a mineral resource reduction to the latter

- a review of cut-off grade applicable to the Gladstone project resulting in an increase in both Indicated and Inferred Resource

In combination with the release of the PEA, the Company is pleased to announce an increase in the resource for the Martha Open Pit which now totals 260,000 ounces of gold in the Indicated category and 290,000 ounces of gold in the Inferred category. Meanwhile, the Indicated Resource at Gladstone has increased to 140,000 ounces of gold (from 100,000 ounces) while the Inferred Resource has increased to 20,000 ounces of gold (from 10,000 ounces). The net result of these changes is an increase of 140,000 and 240,000 ounces of gold in the Indicated and Inferred categories, respectively from the updated December 2019 Resource and Reserve statement.

The Company also notes that the Martha Underground resource used for the purposes of the PEA totals 706,000 gold ounces, approximately half of the reported total Indicated and Inferred ounces pending future studies around the extraction of the remnant Martha and Royal veins in historical mine working areas.

Assumptions such as mine dilution and mining rates have been applied to the reported resources for the purposes of the study.

Project Economics

The base case after-tax financial model yielded an IRR of 51% and an NPV5% of $665 million (Table 2). The spot case scenario assumes gold prices and exchange rates that closer reflects the current operating environment, including a gold price of $1,750 per ounce. At these assumptions, the after-tax financial model resulted in an IRR of 75% and an NPV5% of $917 million. Cash flows have been discounted to January 1, 2020 assuming production commences with Martha Underground in the second quarter of 2021.

Mining and Milling

The PEA assumes an initial 2.2 million ounces of gold produced, after application of metallurgical recoveries averaging 90% over the LOM from the four deposits: MUG, WKP, Gladstone and MOP5.

Average annual gold production is based on the total production expected over the initial mine life and includes the ramp-up period; thus, total gold production from the start of production until depletion of the mineral resources is assumed. Steady-state production assumes average production rates following ramp-up of mining operations. The Company will continue to drill both the Martha and WKP underground deposits with the aim of increasing the size of both resources.

Initial estimated mill feed used in the PEA, including initial grades and mining rates, are listed in Table 4. Mill feed grade reflects dilution factors applied to the resource. The Company expects varying timelines to ramp-up to peak mining rates for the different deposits. Total contained gold in mill feed at MUG reflects only half of the reported resources due to mine planning restrictions that reflect the exclusion of areas that prevents optimal design and requires additional resource and geotechnical drilling.

The PEA assumes underground mining at MUG and WKP and conventional open pit mining at MOP5 and Gladstone. MUG is expected to produce 35,000 to 45,000 gold ounces in 2021 with production beginning in the second quarter utilising modified Avoca and remnant mining methods.

WKP is located 10-kilometres north of the existing Waihi process plant within New Zealand Department of Conservation (“DOC”) land. The PEA assumes underground mining of the WKP deposit utilising a decline from private land with several access locations currently under consideration. The material mined would be transported underground via a decline to a portal then via surface to the existing Waihi process plant. The PEA assumes first production from WKP in 2026 using a modified Avoca mining method.

Open pit mining at Gladstone, beginning in 2024, would provide early mill feed as well as rock for underground mine backfill over the LOM and construction of TSFs. Mining of MOP5, beginning in 2027, assumes an additional cutback to the previously permitted Phase 4 cutback and would require some relocation/replacement of surface infrastructure, acquisition of a mining fleet and pre-stripping of overburden.

The PEA includes the use of the existing Waihi process plant that currently has a throughput capacity of 1.0 to 1.3 million tonnes per annum (“Mtpa”) and assumes modest growth capital investment to increase plant capacity to 1.6 Mtpa. The throughput rate of the plant will be achieved through upgrades to the crushing, milling, and carbon-in-pulp circuits (Figure 3). Options are available with increased capital to further increase the capacity of the plant to accommodate potential expansion of existing resources and production levels over the life of mine.

Preliminary metallurgical test work demonstrates average recoveries of 90% over the LOM from the existing processing circuit. Annual gold production ranges from 35,000 to 45,000 ounces in 2021 to approximately 300,000 gold ounces in 2028 with a significant contribution from WKP along with MUG and MOP5.

Options for future tailings storage facilities (“TSFs”) include two upper lifts on the existing TSFs, the construction of a new (third) TSF, and the potential conversion of Gladstone open pit to a TSF when mining is completed there.

Capital Investment

The total growth capital investment for the Waihi District is estimated to be $447 million spread principally over eight years (Table 5). Growth capital expenditures include MUG development and construction, portal facilities and decline access to WKP, WKP underground development, surface infrastructure related to Gladstone and MOP5, expansion of the process plant, lifts to the existing TSFs and construction of an additional (third) TSF.

Total sustaining capital cost is estimated to be approximately $155 million over the LOM and is inclusive of $49 million estimated for site reclamation and closure costs.

Operating Costs

The life of mine All-in Sustaining Cost is expected to be $627 per ounce while life of mine cash costs is expected to be $557 per ounce including estimated royalties.

Next Steps

The Company is committed to advancing the permitting (consenting) process under New Zealand’s Resource Management Act and progressing technical studies for the Waihi District as outlined in the PEA. The Company expects to complete a feasibility study for MUG in the first quarter of 2021 and complete a prefeasibility study for WKP in the second half of 2021 with the intent to convert existing resources to reserves. The Company also expects to complete a feasibility study for Gladstone, MOP5 and the additional TSF in 2022.

The Company intends to complete the consenting process for all the projects as soon as possible to facilitate the development of the Waihi District, prioritising the development of WKP. The consenting process includes extensive technical, environmental and cultural assessments as well as significant social engagement beyond the initial geological work that established the Mineral Resource. The consenting process is expected to commence in the second half of 2020.

For the remainder of 2020, the Company expects to drill an additional 5,000 metres at WKP on the high-grade East Graben structures. At MUG, the Company has completed approximately 10,000 metres of drilling in the first half of 2020 and expects to complete an additional 15,000 metres of drilling during the remainder of the year with a focus on resource conversion to Indicated category. In addition to the current reported resource at MUG, the Company has an identified exploration target with the potential of 6 to 8 million tonnes grading 4 to 6 g/t Au that represents future opportunity for resource addition.

It is important to note that the exploration target at MUG is exclusive of the reported resource and relates to the portion of the deposit that has not yet been adequately drill tested. This exploration target is based on the assessment of surface and underground drill data collected by the Company in addition to the significant amount of historical and archived geological and mine data from over a century of mining activity at Waihi. The exploration target is conceptual in nature and insufficient exploration has been undertaken in the areas that the exploration target relates to estimate a Mineral Resource. It is uncertain if further exploration will result in the estimation of a Mineral Resource.

Conference Call

The Company will host a conference call / webcast to discuss the positive PEA results for the Waihi District at 7:30 am on Thursday July 16, 2020 (Melbourne, Australian Eastern Standard Time) / 5:30 pm on Wednesday July 15, 2020 (Toronto, Eastern Daylight Time).

Webcast Participants

To register, please copy and paste the link below into your browser:

https://produceredition.webcasts.com/starthere.jsp?ei=1340758&tp_key=3dddf93ae1

Teleconference Participants (required for those who wish to ask questions)

Local (toll free) dial in numbers are:

Local (toll free) dial in numbers are:

North America: 1 888 390 0546

Australia: 1 800 076 068

United Kingdom: 0 800 652 2435

Switzerland: 0 800 312 635

All other countries (toll): + 1 416 764 8688

Playback of Webcast

If you are unable to attend the call, a recording will be available for viewing on the Company’s website.

The NI 43-101 Technical Report in respect of the PEA will be filed on SEDAR and the Company’s website within 45 days of this announcement.

About OceanaGold

OceanaGold Corporation is a mid-tier, high-margin, multinational gold producer with assets located in the Philippines, New Zealand and the United States. The Company’s assets encompass the Didipio Gold-Copper Mine located on the island of Luzon in the Philippines. On the North Island of New Zealand, the Company operates the high-grade Waihi Gold Mine while on the South Island of New Zealand, the Company operates the largest gold mine in the country at the Macraes Goldfield which is made up of a series of open pit mines and the Frasers underground mine. In the United States, the Company operates the Haile Gold Mine, a top-tier, long-life, high-margin asset located in South Carolina. OceanaGold also has a significant pipeline of organic growth and exploration opportunities in the Americas and Asia-Pacific regions.

OceanaGold has operated sustainably since 1990 with a proven track-record for environmental management and community and social engagement. The Company has a strong social license to operate and works collaboratively with its valued stakeholders to identify and invest in social programs that are designed to build capacity and not dependency.

For 2020, and subject to the cautionary statement below, the Company expects to produce between 360,000 and 380,000 ounces of gold from Haile, Waihi and Macraes combined at a consolidated All-In Sustaining Costs ranging from $1,075 to $1,125 per ounce sold.

Qualified Persons and Technical Information

The PEA is a preliminary technical and economic study of the potential technical and economic viability for a series of four projects located in the Waihi District. The PEA includes Inferred Mineral Resources that are considered too geologically speculative to have economic considerations applied to them in order to be categorized as Mineral Reserves. Further drilling, evaluation and studies are required to provide any assurance of an economic development case. The potential economic outcomes referred to in the PEA are based on 51% Indicated Mineral Resources and 49% Inferred Mineral Resources. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further drilling will convert these to Indicated Mineral Resources.

The reader is advised that the PEA is preliminary in nature and is intended to provide only an initial, high-level review of the Waihi District potential, design options and potential economic outcomes. Readers are encouraged to read the Technical Report in its entirety, including all qualifications and assumptions. The PEA Technical Report is intended to be read, and sections should not be read or relied upon out of context. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Resources. Inferred Resources are too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves and to be used in an economic analysis except as permitted by NI 43-101 for a PEA level study. There is no guarantee that the PEA mine plan and economic model will be realized, or that Inferred Resources can be converted to Indicated or Measured Resources. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. As such, there is no guarantee the potential project economics described herein will be realised.

The updated Mineral Resources described herein have been verified, reviewed and approved by P. Church. Any information regarding metallurgy or mineral processing has been verified, reviewed and approved by D. Carr. Technical and scientific information related to mine designs and schedules for Waihi have been verified, reviewed and approved by, or are based upon information prepared by or under the supervision of, T. Maton. Each of the foregoing individuals is a qualified person within the meaning of NI 43-101.

The estimates of Mineral Resources contained in this public release are based on, and fairly represent, information and supporting documentation prepared by the named qualified and competent persons in the form and context in which it appears.

Messrs, Church and Maton are full-time employees of the Company’s subsidiary, OceanaGold (New Zealand) Limited. Mr Carr is a full-time employee of the Company’s subsidiary, OceanaGold Management Pty Limited.

Messrs Carr, Church and Maton are Members and Chartered Professionals with the Australasian Institute of Mining.

Messrs Carr, Church and Maton consent to inclusion in this public release of the matters based on their information in the form and context in which it appears. The estimates of Mineral Resources contained in this public release are based on, and fairly represent, information and supporting documentation prepared by the named qualified and competent persons in the form and context in which it appears.

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed “forward-looking” within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company’s expectations regarding the generation of free cash flow, achievement of guidance, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements.

In particular, all of the results of the PEA for the Waihi District constitute forward-looking statements or information, and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs and the size and timing of phased development of the projects and the Waihi District. Furthermore, the Company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include: (i) the adequacy of infrastructure; (ii) geological characteristics; (iii) metallurgical characteristics of the mineralization; (iv) the ability to develop adequate processing capacity; (v) the price of gold; (vi) the cost of consumables and mining and processing equipment; (vii) unforeseen technological and engineering problems; (viii) changes in regulations; (ix) the regulation of the mining industry by various governmental agencies; and (x) changes in project scope or design, among others.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the outbreak of an infectious disease, the accuracy of mineral reserve and resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company’s most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR at www.sedar.com under the Company’s name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward-looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company’s control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()