Kuya Silver Acquires 800 Hectare Mineral Concessions Including Artisanal Mine Near Bethania

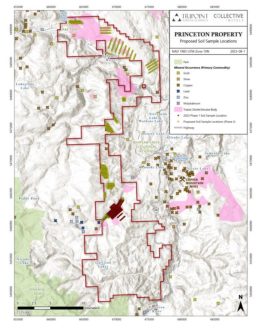

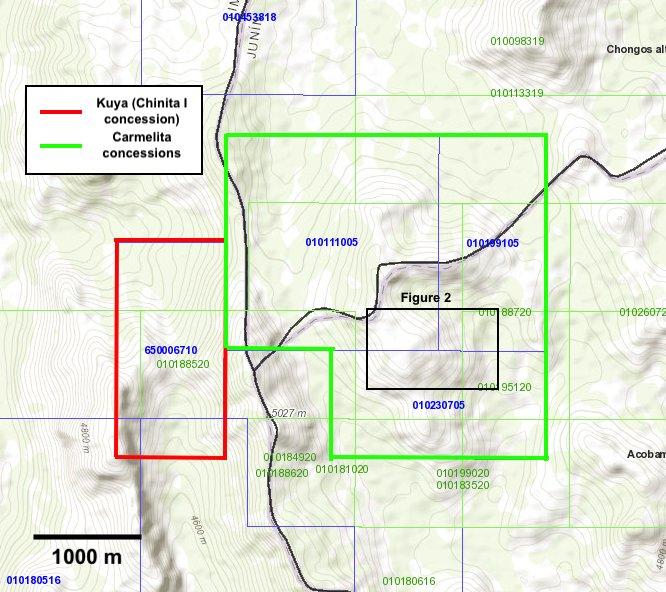

The three properties total 800 hectares and are strategically located less than three kilometers west of Kuya’s Bethania Mine. The Project provides the Company with additional high-priority exploration targets, including a potential strike extension of the high-grade silver-polymetallic vein system that has been identified at Bethania. Located on the land package is the Carmelita Mine, an artisanal mine approximately 3.6 kilometers west of the Bethania Mine. The Project also borders Kuya’s Chinita I concession to the west (see figure 1). With this acquisition, Kuya now holds 2,545 hectares of mineral concessions in the Bethania district.

Kuya’s President and CEO, David Stein stated, “We are very pleased to acquire this exciting Project, located along strike from the Bethania vein system and only a short distance to the mine. Apart from Bethania, we feel that Carmelita is the most advanced prospect in the district, and the veins here bear a striking similarity to mineralization that has been produced from the Bethania mine. It is our intention that if economic mineralization is discovered at Carmelita, it would be run as a satellite mining operation feeding the Bethania mill.”

Carmelita Mine

Kuya recently conducted due diligence on the Project where review focused on the Carmelita Mine area, which has experienced recent small-scale production, targeting silver-polymetallic veins. During the Company’s visit, Kuya geologists observed five veins outcropping on surface and took several samples of the near surface vein system, that can be traced in outcrop over one kilometer in strike length (see figure 2). Access to the Carmelita mine includes three separate adits corresponding to three different veins.

Highlights of Kuya’s sampling included:

- 75 oz/t silver (490 g/t), 8.2% lead and 0.9% zinc (22.8 oz/t silver eq.*) from Veta Victoria

- 30 oz/t silver (196 g/t), 2.6% lead and 1.7% zinc (10.0 oz/t silver eq.*) from Veta Esperanza

- 58 oz/t silver (81 g/t), 2.4% lead and 6.2% zinc (10.8 oz/t silver eq.*) from a stockpile at the Esperanza adit

*Silver equivalent calculated using $27.00/oz silver price, $2,800/t zinc price and $2,000/t lead price.

A total of 6 rock chip samples were collected. The coordinates of the locations of each sample were recorded, and the samples dispatched to the SGS laboratory in Lima for geochemical analysis. The analyses were carried out using the following methods: FA313 – Fire Assay for gold, ICP40B – ICP-AES Multi-acid digestion for 36 elements, and AAS41B – Atomic Absorption, multi-acid digestion for Ag, Pb, Zn over detection limit. SGS Laboratories in Lima has international certifications OHSAS 18001, ISO 14001 and ISO 9001 and is accredited by INACAL under the NTP-ISO / IEC 17025.

Terms of Agreement

Kuya has agreed to pay, subject to Canadian Securities Exchange (the “Exchange”) approval, USD$200,000 on signing of the Agreement; USD$250,000 on the 12-month anniversary of signing the Agreement; and on the 18-month anniversary of signing the Agreement, the value of USD$400,000 in common shares in the capital of the Company (each a “Common Share”). The Common Shares will be issued at a deemed price per Common Share equal to the 10-day average closing price of the Common Shares on the Exchange, ending on the day prior to issuance. The Common Shares will be subject to a hold period expiring four months and one day from the date of issuance.

National Instrument 43-101 Disclosure

The technical content of this news release has been reviewed and approved by Dr. Quinton Hennigh, P.Geo., Chairman of Kuya and a Qualified Person as defined by National Instrument 43-101.

About Kuya Silver Corporation

Kuya is a Canadian‐based silver‐focused mining company that owns the Bethania Project, which includes the Bethania mine, located in Central Peru. The Bethania mine was in production until 2016, toll‐milling its ore at various other concentrate plants in the region, the Company’s plan is to implement an expansion and construct a concentrate plant at site before restarting operations. The Bethania mine produced silver‐lead and zinc concentrates from the run of mine material, until being placed on care and maintenance due to market conditions and lack of working capital.

For more information, please contact the Company at:

Kuya Silver Corporation

Telephone: (604) 398‐4493

info@kuyasilver.com

www.kuyasilver.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Reader Advisory

This news release may contain statements which constitute “forward-looking information”, including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities and involve risks and uncertainties, and that the Company’s future business activities may differ materially from those in the forward-looking statements as a result of various factors, including, but not limited to, fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing and general economic, market or business conditions. There can be no assurances that such information will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither the Canadian Securities Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()