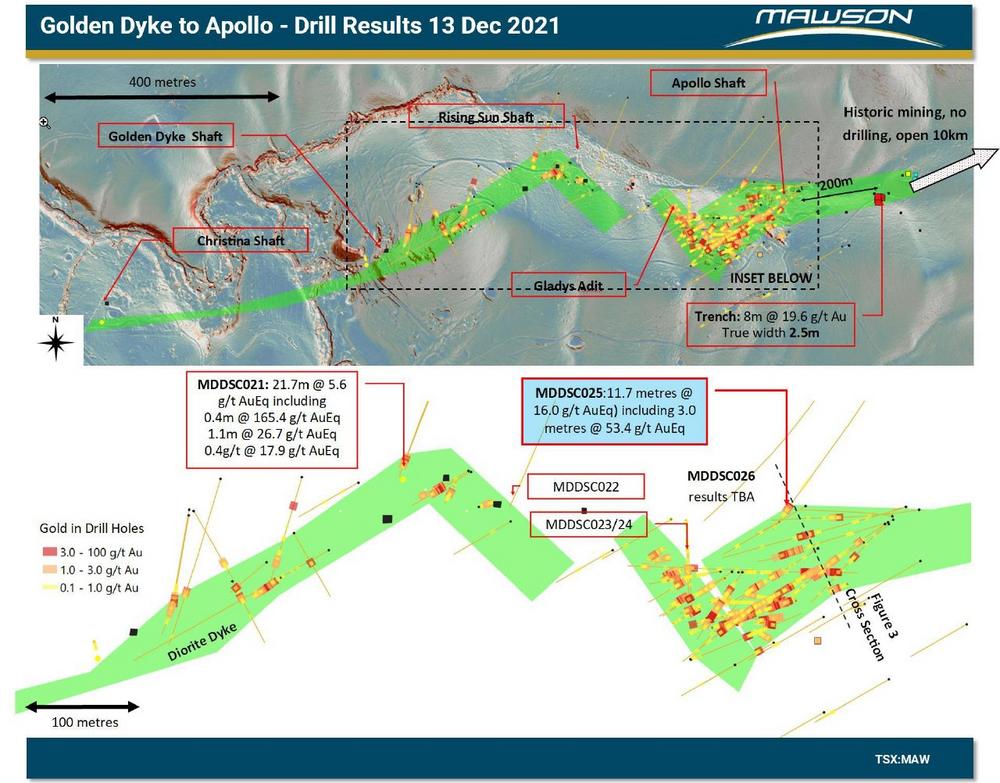

Mawson Drills 3.0 M @ 41.4 G/T Gold and 12.0 % Antimony within 11.7m @ 12.4 G/T Gold and 3.6 % Antimony in Deepest Hole at Sunday Creek, Victoria, Australia

Highlights:

– 11.7 metres @ 12.4 g/t Au and 3.6 % Sb (16.0 g/t AuEq) from 362.0 metres in hole MDDSC025, including:

- 3.0 metres @ 41.4 g/t Au and 12.0 % Sb (53.4 g/t AuEq) from 364.0 metres;

- 0.5 metres @ 14.3 g/t Au and 4.4 % Sb (18.7 g/t AuEq) from 370.8 metres;

– MDDSC025 is the deepest drill hole drilled at Sunday Creek (320 metres vertical depth), and highest-grade gold-stibnite mineralization to date on the project (Tables 1-3, Figures 1-3)

– The proposed spin-out of Mawson’s Australian assets onto the Australian Stock Exchange (“ASX”) is progressing well, with Mawson recently receiving ASX’s positive reply for Southern Cross Gold’s In-principle Advice submission to support Southern Cross Gold’s suitability for admission to the official list of the ASX. Southern Cross Gold is now moving to the pre-IPO private placement financing stage to fund continued exploration, drilling, working capital and IPO expenses in Australia.

Michael Hudson, Executive Chairman, states: “Sunday Creek is one of the best discoveries to be made in the modern renaissance of the Victorian goldfields. With bolder and larger step-outs the project continues to deliver. Our deepest hole at the project to date has intersected the highest grades and widths we have seen. This is the eighth intersection exceeding 100 “grade (g/t) x width (m)” on the project. Mineralization remains open at depth and the system continues 10 kilometres to the east covering historic mines, without a single drill hole test.”

MDDSC025 is a large step-out, located 380 metres east of MDDSC021 (Figure 1), the previous deepest intersection drilled at the project (21.7 metres @ 4.7 g/t Au and 1.0 % Sb (5.6 g/t AuEq from 274.7 metres) (Figure 2). MDDSC025 (Figure 3) intersected:

– 7 metres @ 12.4 g/t Au and 3.6 % Sb (16.0 g/t AuEq) from 362.0 metres in hole MDDSC025, including:

- 0 metres @ 41.4 g/t Au and 12.0 % Sb (53.4 g/t AuEq) from 364.0 metres or 6.5 metres @ 20.6 g/t Au and 6.0 % Sb (26.6 g/t AuEq) from 362.5 metres;

- 5 metres @ 14.3 g/t Au and 4.4 % Sb (18.7 g/t AuEq) from 370.8 metres;

MDDSC024 metres at Gladys, drilled 180 metres SW of MDDSC025 intersected:

- 0 metres @ 1.1 g/t Au and 0.3 % Sb (1.5 g/t AuEq) from 195.0 metres;

MDDSC022 at Rising Sun and MDDSC023 at Gladys did not intersect significant mineralization (Figure 1).

Mawson has now completed twenty-six drill holes (MDDSC001-026) for 6,447.8 metres at the Sunday Creek gold-antimony project since mid-2021 (Figures 1 and 2). Assays from 25 out of the 26 finalized holes have been released. The drill rig will return to Sunday Creek in January 2022 after completing two diamond drill holes at the Whroo JV project. Geophysical surveys (3D induced polarization and ground magnetics) and detailed LiDAR surveys have been completed. Mawson has also completed a 1,200-point soil sampling program at Sunday Creek extending east-northeast from the drilling area to test the 11-kilometre trend of historically mined epizonal dyke-hosted mineralization within Mawson’s tenured areas. The integration of the LiDAR, soil sampling data, rock chips and geophysics is key to the expansion of the project along strike.

The previously announced spin-out Mawson’s Australian assets into a new entity, Southern Cross Gold Pty Ltd. ("Southern Cross Gold") via an Initial Public Offering (“IPO”) for admission to the official list of ASX Limited (“ASX” or “Australian Stock Exchange”) is progressing well. ASX’s positive reply has now been received for Southern Cross Gold’s In-principle Advice submission to support Southern Cross Gold’s suitability for admission to the official list of the ASX. Southern Cross Gold will now move to the pre-IPO private placement financing stage to fund continued exploration, drilling, working capital and IPO expenses in Australia from sophisticated and professional (“accredited”) investors.

Technical and Environmental Background: Tables 1–3 provide collar and assay data. The true thickness of the mineralized interval is interpreted to be approximately 60 % of the sampled thickness. All drill results quoted have a lower cut of 0.3 g/t Au cut over a 2.0 metre width, with higher grades reported with a 5 g/t Au cut over 1.0 metre applied unless otherwise stated. Lab duplicates and quarter core field duplicates demonstrate that mineralization is homogenous with a low nugget effect evident. A diamond drill rig from contractor Starwest Pty Ltd was used in the program. Core diameter is HQ (63.5 mm) and oriented with excellent core recoveries averaging close to 100% in both oxidized and fresh rock. After photographing and logging in Mawson’s core logging facilities in Nagambie, intervals were diamond sawn in half by Mawson personnel. Half core is retained for verification and reference purposes. Analytical samples are transported to On Site Laboratory Services’ Bendigo facility which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 gram charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of Mawson consists of the systematic insertion of certified standards of known gold content, quarter core duplicates and blanks within interpreted mineralized rock. In addition, On Site inserts blanks and standards into the analytical process.

Gold Equivalent Calculation: It is the opinion of Mawson that all the elements included in the metal equivalent calculation have a reasonable potential to be recovered. The gold equivalent (AuEq) was calculated based on commodity prices as 21 March 2021. The AuEq formula is as follows: AuEq(g/t) = (Aug/t) + (XX * Sb%), where XX = (US$5,600/100) / (US$1,750/31.1035) and the gold price = US$1,750/oz and antimony price = US$5,600/tonne.

Qualified Person: Dr Nick Cook (FAusMM), Chief Geologist for the Company, is a qualified person as defined by National Instrument 43-101 – Standards of Disclosure or Mineral Projects and has prepared or reviewed the preparation of the scientific and technical information in this press release.

About Mawson Gold Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Gold Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic Arctic exploration company with a focus on the flagship Rajapalot gold-cobalt project in Finland. Mawson also owns or is joint venturing into three high-grade, historic epizonal goldfields covering 470 square kilometres in Victoria, Australia and is well placed to add to its already significant gold-cobalt resource in Finland.

On behalf of the Board,

"Michael Hudson"

Michael Hudson, Executive Chairman

In Europe:

Swiss Resource Capital AG

Jochen Staiger

Further Information

1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7

Mariana Bermudez (Canada), Corporate Secretary, +1 (604) 685 9316, info@mawsongold.com

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to, timing and successful completion of exploration and drill programs planned at Sunday Creek and the Whroo Project, timing and successful completion of Southern Cross Gold’s Pre-IPO Private Placement, IPO and listing of Southern Cross Gold’s common shares on ASX, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, the potential impact of epidemics, pandemics or other public health crises, including the current pandemic known as COVID-19 on the Company’s business, risks related to negative publicity with respect to the Company or the mining industry in general; planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson’s most recent Annual Information Form filed on www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()