The i-virus – dangerous for purchasing power

The latest figures make economists and serious central bankers, such as the still head of the German Bundesbank Jens Weidmann, probably shudder. If a wave of such high rates of monetary devaluation comes, the guardians of the currency, as the central banks are also called, should react. No, even more so. Since they are experts in financial markets and economic models, they should actually act. Moreover, as the highest authorities in monetary policy, the central banks should also have the necessary sources of information to see, recognise and classify warning signals at an early stage.

So, there can be no excuses when "suddenly" consumer prices in Germany shoot up by 4.6 percent year-on-year in October. For November, Jens Weidmann even fears up to six percent. Moreover, this will not remain a one-off monthly effect, as producer prices also exploded by 18 percent in October and will probably be passed on to customers in the near future. Even if the pressure in the production sector were to decrease again, be it due to lower commodity prices, as is the case with oil these days, or rationalisation, the price increases for customers would hardly be reversed.

Especially before Christmas, one might start to wonder about adequate gifts in this environment. A gold coin, which is likely to retain its value in the long term, or a silver bar, for which VAT has to be paid, but which makes quite an impression from its shine and weight alone, should at least be included in the considerations. If you are willing to take risks, you can also put shares of companies that own the precious metal in the ground into your portfolio, even in the gold and silver sector.

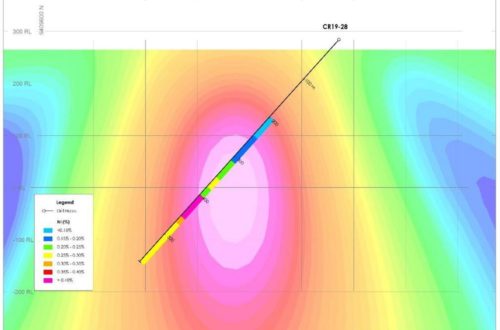

Ridgeline Minerals – https://www.youtube.com/watch?v=ZMT6gNJXDz4 -, for example, owns four projects in Nevada with gold and silver. Exploration is in full swing.

Vizsla Silver – https://www.youtube.com/watch?v=4iftwdjuCAU – is working on its high-grade Panuco gold and silver project in Mexico.

In Colombia, Gran Colombia Gold – – is producing gold and silver at its Segovia mine.

British Columbia and the Golden Triangle is home to Tudor Gold’s – https://www.youtube.com/watch?v=yHazC4ybcxQ&t=1s – Treaty Creek project. Here, Eric Sprott is on board.

Current company information and press releases from Vizsla Silver (- https://www.resource-capital.ch/en/companies/vizsla-silver-corp/ -) and Gran Colombia Gold (- https://www.resource-capital.ch/en/companies/gcm-mining-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()