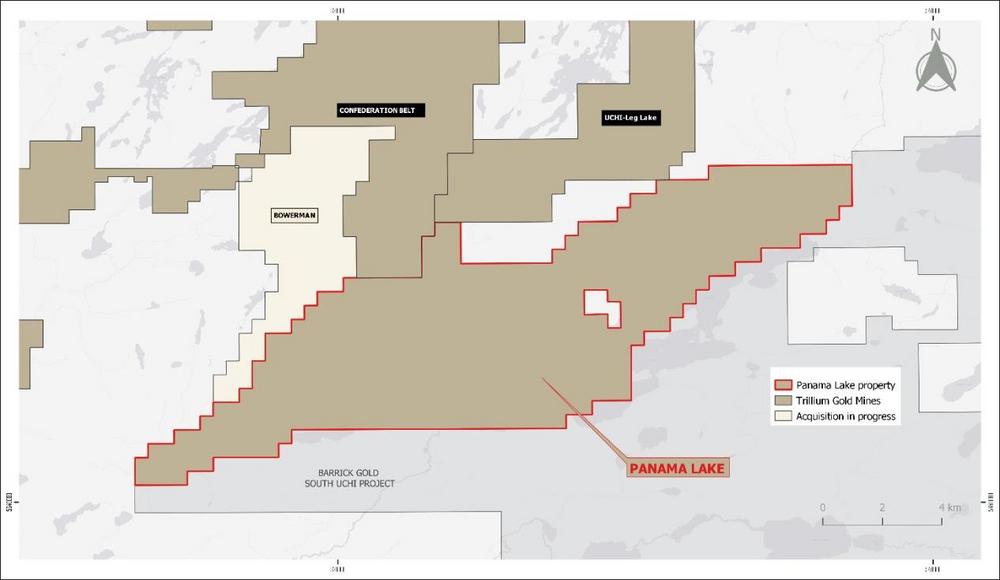

Trillium Gold Closes Panama Lake Acquisition Extends Dominant Foothold by 9,882 Hectares on Trend with Kinross‘ LP Fault Zone in Red Lake, Ontario

The Panama Lake Gold Project is located approximately 80km from, and on the same structural trend as Kinross Gold’s LP Fault Zone and effectively extends Trillium Gold’s dominant contiguous foothold along the Confederation belt by 9,882 hectares (see Figure 1).

Pursuant to the Assignment and Assumption Agreement entered into following the closing of the Purchase Agreement (the “Assignment Agreement” together with the Original Option Agreement, the “Option Agreement”), among Trillium Gold and St. Anthony Gold, St. Anthony Gold has assigned all of its rights and obligations under the Original Option Agreement to Trillium Gold. In addition, pursuant to the Assignment Agreement, Benton Resources Inc. (“Benton Resources”) has agreed to register 100% of the Property’s title to Trillium Gold while retaining its 50% ownership interest in the Property until such time as Trillium Gold fulfils its option to earn 100% interest.

“With the recently completed acquisition of the Eastern Vision properties, the Panama Lake acquisition brings Trillium Gold’s consolidated land package along the Confederation Belt to over 58,400 hectares, bound by the Red Lake and LP Fault structures, positioning it as one of the most prospective exploration projects in the heart of the Red Lake mining district,” commented Russell Starr, President & CEO of Trillium Gold.

Trillium’s geological team has commenced early exploration work while permit applications for drilling and trenching are underway and are expected to be received in early summer 2022. The Company has planned an initial 6,000 metres of drilling throughout the Project area on targets that have been systematically researched, prioritized and deemed drill ready.

Terms of the Panama Lake Agreement

Pursuant to the terms of the Purchase Agreement which has since been amended following the news release that was disseminated on June 1, 2022, Trillium Gold paid St. Anthony Gold, Cdn $500,000 in cash and issued 1,000,000 common shares in the capital of Trillium Gold (the “Common Shares”). In the event Trillium Gold acquires a 100% interest in the Property, St. Anthony Gold may cause Trillium Gold to exercise its Buy-Back Right under the Option Agreement (as further discussed below) to repurchase from Benton Resources one-half of the 2.0% Net Smelter Royalty (“NSR”) on the Property and convey such repurchased 1.0% NSR to St. Anthony Gold in exchange for a cash payment by St. Anthony Gold to Trillium Gold of $1,000,000.

Pursuant to the terms of the Option Agreement, in order for Trillium Gold to earn a 70% interest in the Property, it will pay to Benton Resources Cdn $100,000 in cash by October 24, 2022, and complete Cdn $250,000 in exploration expenditures on the Project by April 24, 2023. Trillium Gold has the option to earn 100% ownership of the Property by paying Benton Resources a further Cdn $300,000 in cash and complete Cdn $300,000 in exploration expenditures on the Project in each case by October 24, 2023. Benton Resources has the right to retain a 2.0% NSR on the Project, subject to the option of Trillium Gold to buy back one-half of such royalty (being 1.0%) for Cdn $1,000,000 (the “Buy Back Right”). In the event that Trillium Gold completes a NI 43-101 compliant resource estimate for the Property, Trillium Gold will pay Benton Resources a cash payment that is determined based on the number of ounces of gold in the NI 43-101 report multiplied by $0.50.

The Common Shares of Trillium Gold issued under the Purchase Agreement are subject to a four-month holding period from the closing date. The Purchase Agreement is subject to the approval of the TSXV and other applicable regulatory authorities.

About the Panama Lake Property

A long history of exploration activity has occurred on the Panama Lake Gold Project since the late 1960s. Recent diamond drilling completed by Benton Resources and St. Anthony Gold have continued to intercept anomalous gold values from the Panama Zone and north of a highly anomalous gold grain till sample collected by the Geological Survey of Canada (GSC Open File 3038). Recently completed interpretation of newly acquired airborne geophysics have identified several linear magnetic trends that appear coincident with the Panama Zone and other gold occurrences found on the Panama Lake Gold Project. This new geophysical interpretation and recently obtained anomalous gold values from 2019-2022 diamond drill programs will allow future exploration programs to be focused on areas of high mineral potential.

The technical information presented in this news release has been reviewed and approved by William Paterson QP, P.Geo, Vice President of Exploration of Trillium Gold Mines, as defined by NI 43-101.

On behalf of the Board of Directors,

Trillium Gold Mines Inc.

Russell Starr

Interim Chairman, President & CEO

For further information, please contact Donna Yoshimatsu, VP Corporate Development and Investor Relations at dyoshimatsu@trilliumgold.com, (416) 722-2456, or info@trilliumgold.com.

Visit our website at www.trilliumgold.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

About Trillium Gold Mines Inc.

Trillium Gold Mines Inc. is a growth focused company engaged in the business of acquisition, exploration and development of mineral properties located in the Red Lake Mining District of Northern Ontario. As part of its regional-scale consolidation strategy, the Company has assembled one of the largest prospective land packages in and around the Red Lake mining district in proximity to major mines and deposits, as well as the Confederation Lake and Birch-Uchi greenstone belts. Recently, the Company signed a definitive agreement for control over a significant portion of the Confederation Lake greenstone belt to more than 100km in length. In addition, the Company has interests in highly prospective properties in Larder Lake, Ontario.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This news release contains forward-looking information, which involves known and unknown risks, uncertainties and other factors that may cause actual events to differ materially from current expectations.

Forward-looking information is based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Such factors, among others, include: impacts arising from the global disruption caused by the Covid-19 coronavirus outbreak, business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company disclaims any intention or obligation, except to the extent required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()