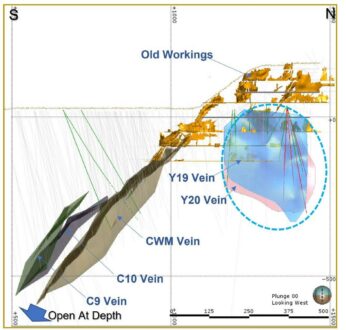

Karora Resources Drills 6.0 g/t Au over 13.0 metres in New Mason Zone and Provides Beta Hunt Development Update

- Mason: 6.0 g/t Au over 13.0 metres (BM1890-25AE)

- Cowcill: 2.4 g/t Au over 5.0 metres (BC1704-009AE)

- Interval lengths are downhole widths. Estimated true widths cannot be determined with available information.

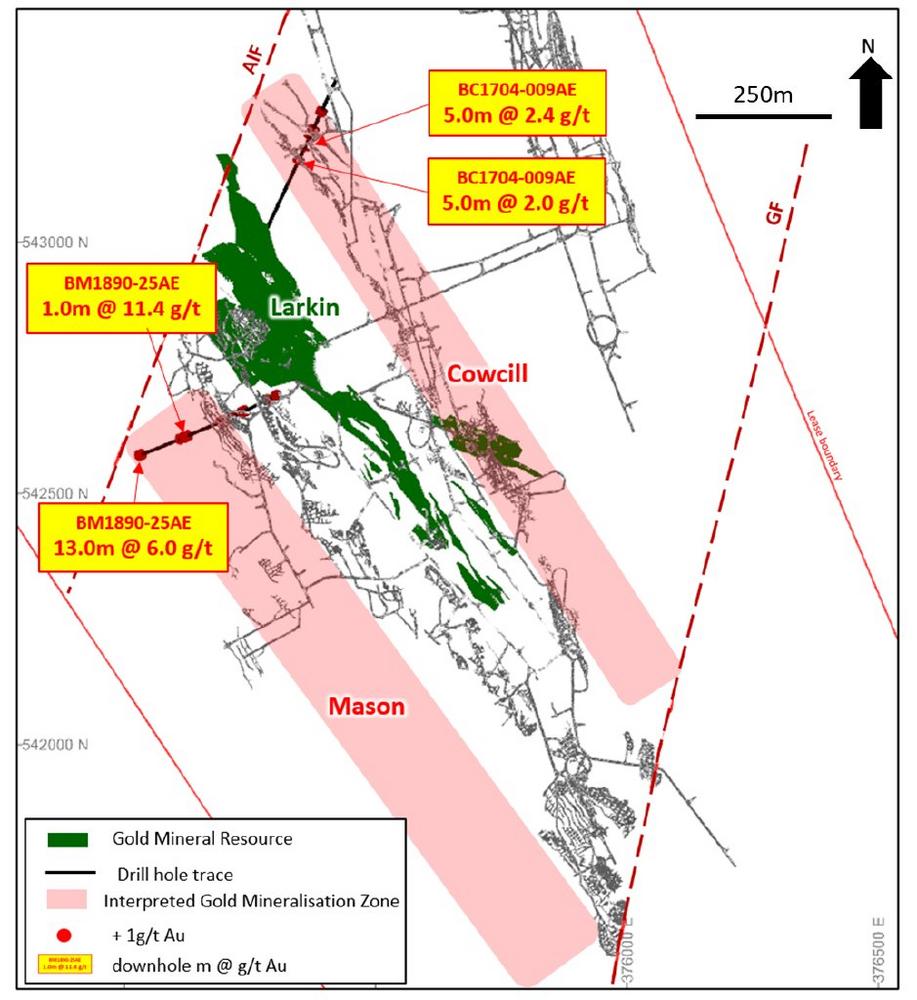

Additionally, Karora is pleased to announce that construction activities to install the second decline at the Beta Hunt Mine are approximately 67% complete and the Corporation remains on track and on budget to complete construction in the first quarter of 2023 (as previously announced, ahead of the original complete target date of mid-year 2023). Work on the vent raise is scheduled to begin at the end of the month, with the expectation that the decline will be functioning in the second quarter of 2023.

Paul Andre Huet, Chairman & CEO, commented: “I am encouraged by the first set of new gold drill results from the Mason and Cowcill shear zones. The results support our previous interpretation of these gold mineralized systems that run parallel to the Larkin Zone on both sides. I am particularly excited that the first two holes of our 24-hole program in this area both returned excellent results including 6.0 g/t over 13.0 metres (see figure 1). Today’s results are another great example of the Mineral Resource growth potential that exists at Beta Hunt, considering both Mason and Cowcill are outside the existing Mineral Resource.

Our flagship Beta Hunt Mine is a literal beehive of mining, drilling, development, and expansion activities. In addition to our recent exploration and resource definition drilling results, completing the second decline and vent raise installations at Beta Hunt are also critical tasks to position us to achieve our growth plan targets and I am very pleased that both are proceeding more rapidly than originally forecast. We have poured the vent pad and are scheduled to commence work on the vent raise beginning at the end of August. We currently expect that the second decline will be functioning by the end of the second quarter of 2023. Our team, along with our contractors, have been doing a great job executing on the plan. Overall, we expect to finish the project significantly ahead of our original schedule and under our original budget.”

Gold Drilling Update

Results for the first two holes drilled this year to test for the Mason and Cowcill Zones were received. Mason and Cowcill are interpreted parallel gold mineralized shear zones to the Larkin Zone. The drill targets are supported by overlying nickel mineralization trends and historical gold intersections in the footwall to the nickel. A section of the Cowcill Zone has also been mined historically for gold. The potential of the Mason Zone was realized late last year where drill hole EL-EA2-004AE intersected the widest ever mineralized interval drilled by Karora at Beta Hunt – 1.5 g/t Au over 90 metres including 50.9 g/t Au over 0.4 metres – approximately 250 metres west of the Larkin Zone (Karora news release dated November 15, 2021).

Significant results were received in both holes (Figure 1) and are listed below:

- Mason: BM1890-25AE – 6.0 g/t Au over 13.0 metres

- Cowcill: BC1704-009AE – 2.4g/t Au over 5.0 metres

The Mason intersection of 6.0 g/t Au over 13.0 metres occurs 250 metres west of Larkin, 160 metres below the ultramafic contact and offset from the 90 metre intersection in drill hole EL-EA2-004AE, 80 metres to the north. Mineralization is associated with weakly sheared, biotite-pyrite altered basalt and both shear and extensional quartz veining. The Cowcill intersection occurs 90 metres below gold and nickel mineralization on the ultramafic/basalt contact. Mineralization is associated with strong shearing, quartz shear veinlets and intense biotite-pyrite +/- albite alteration. Both intersections are deep (> 90m below the contact) which provides encouragement for the delineation of a strong and extensive mineralized system with further drilling.

An additional nine holes of the twenty-four hole program have been completed to test for the Cowcill and Mason Zones along strike of the two holes the subject of this release. Results are expected to be received for these additional holes before the end of the third quarter.

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

At Beta Hunt all drill core sampling is conducted by Karora personnel. Samples for gold analysis are shipped to SGS Mineral Services of Kalgoorlie for preparation and assaying by 50 gram fire assay analytical method. All gold diamond drilling samples submitted for assay include at least one blank and one Certified Reference Material ("CRM") per batch, plus one CRM or blank every 20 samples. In samples with observed visible gold mineralization, a coarse blank is inserted after the visible gold mineralization to serve as both a coarse flush to prevent contamination of subsequent samples and a test for gold smearing from one sample to the next which may have resulted from inadequate cleaning of the crusher and pulveriser. The lab is also required to undertake a minimum of 1 in 20 wet screens on pulverised samples to ensure a minimum 90% passing at -75µm. Samples for nickel analysis are shipped to SGS Australia Mineral Services of Kalgoorlie for preparation. Pulps are then shipped to Perth for assaying. The analytical technique is ICP41Q, a four acid digest ICP-AES package. Assays recorded above the upper detection limit (25,000ppm Ni) are re-analyzed using the same technique with a greater dilution (ICP43B). All samples submitted for nickel assay include at least one Certified Reference Material (CRM) per batch, with a minimum of one CRM per 20 samples. Where problems have been identified in QAQC checks, Karora personnel and the SGS laboratory staff have actively pursued and corrected the issues as standard procedure.

About Karora Resources

Karora is focused on increasing gold production to a targeted range of 185,000-205,000 ounces by 2024 at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. Karora recently acquired the 1.0 Mtpa Lakewood Mill in Western Australia. At Beta Hunt, a robust gold Mineral Resource and Reserve are hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,900 square kilometers. The Corporation also owns the high grade Spargos Reward project, which came into production in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the liquidity and capital resources of Karora, production guidance, growth plan strategy to deliver increased gold production, the expected timing to complete the construction and development activities at the Beta Hunt Mine, the potential of the Beta Hunt Mine, Higginsville Gold Operation, the Aquarius Project, the Spargos Gold Project, the commencement of mining at the Spargos Gold Mine, the Lakewood Mill, and the completion of the resource estimate.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()