Recession as a catalyst for gold

According to the latest assessment by Bloomberg Intelligence, the U.S. economy will slide into recession. The reason is the Fed’s still aggressive stance. Even though there were strong economic data at the beginning of the year, the markets are still suffering from stubborn inflation. Even though the gold price went down in February, it is still in an intact bull market. Higher gold prices are bound to happen, according to Bloomberg Intelligence. Investment research house BCA Research also sees higher prices in the precious metal, as geopolitical tensions are also on the rise. A war economy is beginning to take hold in the West, they say, and gold should cost around $2,000 per troy ounce by the end of the year. On the one hand, it is the political relations between the U.S. and China that have deteriorated. The U.S. had pulled a suspected Chinese spy balloon out of the sky. On the other hand, escalations in the Russia-Ukraine war are feared, as China may support Russia.

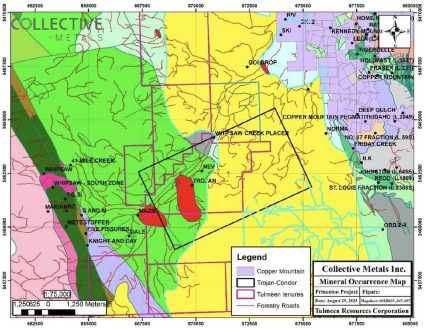

Geopolitical uncertainties coupled with a further deterioration in economic conditions could therefore have a favorable impact on gold prices. One argument for continued high inflation is that the war in Ukraine will continue to affect commodity prices in the near future. And the efforts of Western nations on climate change and defense spending will also keep inflation high. Time therefore for gold investments, for example in the stocks of Condor Gold or Skeena Resources.

Condor Gold – https://www.commodity-tv.com/ondemand/companies/profil/condor-gold-plc/ – is achieving excellent gold grades in drilling at its flagship La India project in Nicaragua.

Skeena Resources – https://www.commodity-tv.com/ondemand/companies/profil/skeena-resources-ltd/ – is bringing the formerly producing Eskay Creek gold-silver mine in British Columbia back to life.

Current corporate information and press releases from Skeena Resources (- https://www.resource-capital.ch/en/companies/skeena-resources-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()