Sibanye-Stillwater off-market takeover offer for New Century Resources Limited at A$1.10 per share

Today we have launched an off-market takeover offer for all of the shares in New Century that we do not already own, in accordance with Australian takeovers requirements (Takeover). The proposed Takeover is in line with our strategy to invest in the circular economy and be a global leader in tailings retreatment and recycling.

The offer price implies an equity value for New Century of US$103 million (A$149 million)[1] on a fully diluted basis. In the event that Sibanye-Stillwater acquires all of the securities in New Century that it does not already own, Sibanye-Stillwater will pay up to US$83 million (A$120 million)1 under the transaction.

For further information on the transaction please refer to the Bidder’s Statement and announcement released on the Australian Securities Exchange today, available on Sibanye-Stillwater’s website at https://www.sibanyestillwater.com/business/new-century-resources-australia/.

Ends.

About New Century

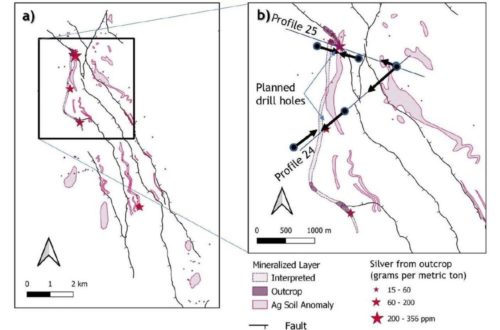

New Century is an Australian base metal producer with significant zinc assets and a brownfield copper development project. New Century is a top-15 global and top-five domestic zinc producer, operating Australia’s largest hydraulic mine at the Century Mine in Queensland; extracting, processing and marketing zinc recovered from historical tailings. New Century is actively progressing life extension opportunities at Century and studying the potential to restart copper production at the historically significant Mt Lyell Copper Mine in Tasmania. New Century is also pursuing opportunities with industry peers to reprocess and rehabilitate contemporary and historical mineralised waste assets at operational and legacy mine sites.

About Sibanye-Stillwater

Sibanye-Stillwater is a multinational mining and metals processing Group with a diverse portfolio of mining and processing operations, projects and investments across five continents. The Group is also one of the foremost global recyclers of PGM autocatalysts and has interests in leading mine tailings retreatment operations.

Sibanye-Stillwater has established itself as one of the world’s largest primary producers of platinum, palladium, and rhodium and is also a top tier gold producer. It produces and refines iridium and ruthenium, nickel, chrome, copper and cobalt. The Group has recently begun to build and diversify its asset portfolio into battery metals mining and processing and is increasing its presence in the circular economy by growing and diversifying its recycling and tailings reprocessing operations globally. For more information refer to www.sibanyestillwater.com.

Investor Relations

James Wellsted, Head of Investor Relations and Corporate Affairs

Sibanye-Stillwater

Email: ir@sibanyestillwater.com

Tel: +27 (0) 83 453 4014

Media Enquiries

Mark Hawthorne

Director

Civic Financial Communications

Email: Mark.hawthorne@civicfinancial.com.au

Tel: +61 (0) 418 999 894

Sponsor: J.P. Morgan Equities South Africa Proprietary Limited

FORWARD LOOKING STATEMENTS

The information in this announcement may contain forward-looking statements within the meaning of the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements, including, among others, those relating to Sibanye Stillwater Limited’s (“Sibanye-Stillwater” or the “Group”) financial positions, business strategies, plans and objectives of management for future operations, are necessarily estimates reflecting the best judgment of the senior management and directors of Sibanye-Stillwater.

All statements other than statements of historical facts included in this announcement may be forward-looking statements. Forward-looking statements also often use words such as “will”, “forecast”, “potential”, “estimate”, “expect” and words of similar meaning. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances and should be considered in light of various important factors, including those set forth in this disclaimer. Readers are cautioned not to place undue reliance on such statements.

The important factors that could cause Sibanye-Stillwater’s actual results, performance or achievements to differ materially from those in the forward-looking statements include, among others, our future business prospects; financial positions; debt position and our ability to reduce debt leverage; business, political and social conditions in the United States, South Africa, Zimbabwe and elsewhere; plans and objectives of management for future operations; our ability to obtain the benefits of any streaming arrangements or pipeline financing; our ability to service our bond instruments; changes in assumptions underlying Sibanye-Stillwater’s estimation of their current mineral reserves and resources; the ability to achieve anticipated efficiencies and other cost savings in connection with past, ongoing and future acquisitions, as well as at existing operations; our ability to achieve steady state production at the Blitz project; the success of Sibanye-Stillwater’s business strategy; exploration and development activities; the ability of Sibanye-Stillwater to comply with requirements that they operate in a sustainable manner; changes in the market price of gold, PGMs and/or uranium; the occurrence of hazards associated with underground and surface gold, PGMs and uranium mining; the occurrence of labour disruptions and industrial action; the availability, terms and deployment of capital or credit; changes in relevant government regulations, particularly environmental, tax, health and safety regulations and new legislation affecting water, mining, mineral rights and business ownership, including any interpretations thereof which may be subject to dispute; the outcome and consequence of any potential or pending litigation or regulatory proceedings or other environmental, health and safety issues; power disruptions, constraints and cost increases; supply chain shortages and increases in the price of production inputs; fluctuations in exchange rates, currency devaluations, inflation and other macro-economic monetary policies; the occurrence of temporary stoppages of mines for safety incidents and unplanned maintenance; the ability to hire and retain senior management or sufficient technically skilled employees, as well as their ability to achieve sufficient representation of historically disadvantaged South Africans in management positions; failure of information technology and communications systems; the adequacy of insurance coverage;

any social unrest, sickness or natural or man-made disaster at informal settlements in the vicinity of some of Sibanye-Stillwater’s operations; and the impact of HIV, tuberculosis

and the spread of other contagious diseases, such as coronavirus (“COVID-19”). Further details of potential risks and uncertainties affecting Sibanye-Stillwater are described in Sibanye-Stillwater’s filings with the Johannesburg Stock Exchange and the United States Securities and Exchange Commission, including the Integrated Annual Report and the Annual Report on Form 20-F.

These forward-looking statements speak only as of the date of the content. Sibanye-Stillwater expressly disclaims any obligation or undertaking to update or revise any forward-looking statement (except to the extent legally required).

NON-IFRS MEASURES

The information contained in this announcement may contain certain non-IFRS measures, including adjusted EBITDA, AISC and AIC. These measures may not be comparable to similarly titled measures used by other companies and are not measures of Sibanye-Stillwater’s financial performance under IFRS. These measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Sibanye-Stillwater is not providing a reconciliation of the forecast non-IFRS financial information presented in this report because it is unable to provide this reconciliation without unreasonable effort.

WEBSITES

References in this announcement to information on websites (and/or social media sites) are included as an aid to their location and such information is not incorporated in, and does not form part of, this announcement.

[1] AUD/USD: 0.69.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()