Which country has the highest incentives for electric cars in 2023?

Netherlands provides the highest level of incentives, followed by France and Germany

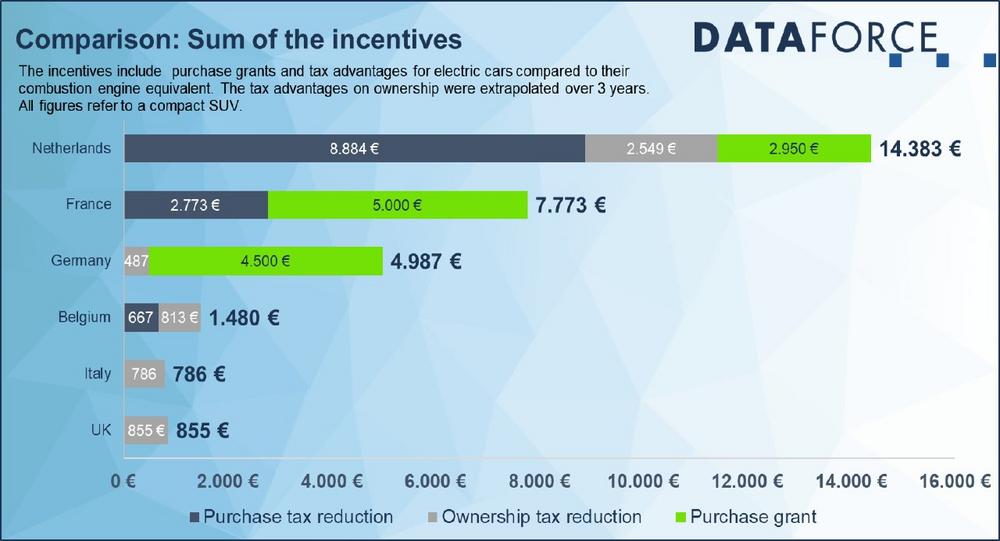

To calculate the incentives, Dataforce examined and compared the incentives in the countries. To quantify the individual rulesets, a compact SUV was taken as the standard, since most customers in the private market today opt for this segment (22.6% market share in 2022, EU 27+EFTA+UK).

Purchase grants are probably the best-known type of incentive for electric cars. They directly reduce the price from the buyers’ point of view. In Germany and France, they account for the largest share of the total subsidy. It can also be seen that countries without purchase premiums are far behind in the ranking of incentives for private car buyers.

However, many private buyers underestimate the additional influence of tax benefits, which can quickly amount to several thousand Euros. In the Netherlands, the large tax savings even ensure that the total subsidy is almost twice as high as in France.

The incentives in detail

Out of our scope, for countries leverage additional registration taxed, but BEVs are currently exempt (tax advantage on purchase). In addition, BEVs do not pay road tax anywhere (tax advantage on ownership). Insofar, the countries are similar.

However, when it comes to the amount of the advantages, the differences are drastic. In the Netherlands and France, quite high CO2-related taxes are already incurred when registering a typical compact SUV with an internal combustion engine. Likewise, ICE vehicle tax is also a costly matter in the Netherlands.

There are also significant differences in the purchase grants. France has the highest aid with 5,000 Euros, followed by Germany with 4,500 Euros and the Netherlands with 2,950 Euros. In Italy, a typical electric compact SUV is too expensive to be eligible for the purchase grant. Belgium and the United Kingdom no longer provide purchase grants.

High subsidies encourage faster switch to electric vehicles

The level of subsidies varies greatly between the individual countries. Likewise, the market shares of BEVs also differ. Consequently, BEVs are particularly attractive where high taxes can be avoided, or the purchase price is reduced by grants.

This is exactly what Dataforce sees in the Netherlands, Germany, and France. The three countries with the highest subsidies also have the highest BEV shares. The market share in the private market here is well above the EU average of 15.4%. Countries with comparably low subsidies such as the UK, Belgium and Italy are below average. In the case of the last two, even significantly.

What are the incentives in the fleet market?

However, the situation is completely different in the fleet market. In many countries, such as Belgium, Austria, or the UK, it is only in this channel where tax advantages for all-electric vehicles really come into play. For example, there are significant incentives for the "benefit-in-kind".

The Car Taxation Guide

Dataforce compiled detailed information on taxation and electric car subsidies in the 11 most important European markets in the Car Taxation Guide. It also includes projections of possible savings for BEVs and PHEVs for each country. The Car Taxation Guide will be available from Dataforce from March 2023 at a net price of 1,950 euros.

DATAFORCE – Wir zählen Autos.

As a leading market research company, we bring transparency to the European automotive market. Independent – with over 25 years of experience – we set standards and make markets comparable.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930382

E-Mail: julian.litzinger@dataforce.de

![]()