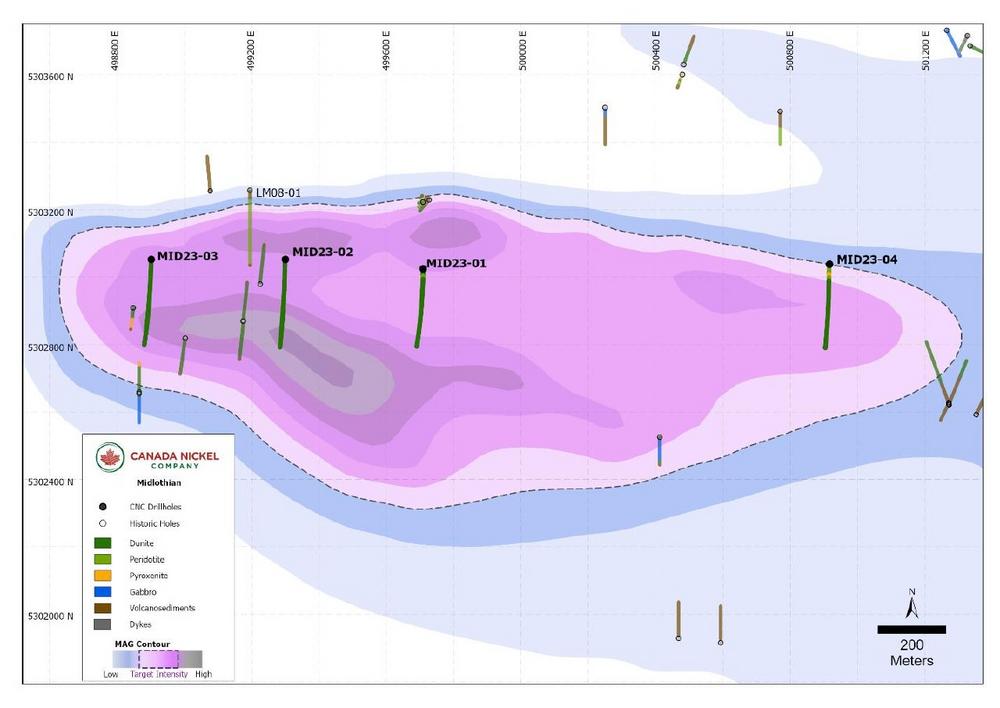

Canada Nickel Announces New Nickel Discovery at Midlothian Property with Larger Potential Footprint than Flagship Crawford Property

- First four holes intersected multi-hundred metre intervals of mineralized dunite across a strike length of two kilometres

- Near-surface mineralization – overburden less than five metres thick

- Preliminary mineralogy samples from first two holes confirm:

– mineralization dominated by awaruite, a recoverable nickel-iron alloy mineral

– more than triple Crawford’s content of brucite, which is highly reactive for carbon sequestration, in hole MID23-02

Canada Nickel Company Inc. ("Canada Nickel" or the "Company") (TSXV: CNC) (OTCQX: CNIKF – https://www.commodity-tv.com/ondemand/companies/profil/canada-nickel-company-inc/) announces positive preliminary drill results from the first four holes on the Midlothian Property (the “Property” or “Midlothian”), located 70 kilometres south-southeast of Timmins, Ontario.

The Company has drilled four holes totaling 1,548 metres to complete its initial phase of testing a large geophysical target 2.7 kilometres along strike by up to 800 metres thick and open at depth.

Mark Selby, CEO of Canada Nickel Company, said, “This is the latest in a string of regional exploration successes – Reid, Deloro, Sothman, Texmont, and now Midlothian – as we unlock the potential of the Timmins Nickel District. Midlothian is one of our ten targets with a geophysical footprint larger than Crawford. While we are waiting for assays, we are very excited by the preliminary mineralogy results which included the presence of heazlewoodite and significant amounts of awaruite, a nickel-iron alloy, and significant amounts of brucite, the most highly reactive mineral for carbon sequestration, at more than triple the average amount at Crawford. Each success with our geophysical targeting increases the probability of success with the balance of the portfolio and we look forward to further successes across our regional exploration program in 2023.”

Midlothian Property

Access to Midlothian is via an all-weather gravel road west from the town of Matachewan. Midlothian is an option agreement between Canada Nickel, Canadian Gold Miner Corp. (70%) and Laurion Mineral Exploration Inc. (30%) whereby Canada Nickel can earn a 100% undivided interest to fifty (50) mining claims covering the Property through a combination of cash payments, share issuances, and exploration expenditures over four years which was outlined in our news release of November 22, 2021.

Historically, a total of 30 holes were drilled over the last 50 years by various operators with 23 holes intersecting serpentinized peridotite/dunite and 17 holes ending while still in the ultramafics. Six drillholes, each intersected over 100 metres of continuous, uninterrupted dunite/ultramafic, with LM08-01 intersecting 263.8 metres to the end of hole. Seven holes had nickel assays, with the best interval in hole LM08-01 which yielded 0.24% nickel across core length of 345 metres with the final 42 metres grading 0.30% nickel. Nickel sampling was not continuous down most drillholes.

(see release dated November 22, 2021 for further details)

Current Drill Results

Four holes were drilled along a strike length of two kilometres, all oriented to the south with an inclination of -50o and maximum length of 400 metres. Overburden in the area varied between 2.0 and 7.7 metres in downhole length (less than 5 metres thick).

MID23-01 was collared toward the centre of the intrusion and intersected 343 metres of highly serpentinized dunite starting at 2.0 metres and ending at 345 metres. Selected samples were taken for metallurgical testing (QEMSCAN) that confirmed the samples were well-serpentinized with varying amounts of heazlewoodite and awaruite. The hole encountered two narrow (~0.5 metres) dikes.

MID23-02 was collared approximately 400 metres west of MID23-01 and intersected a continuous unit of serpentinized dunite below 7.7 metres of overburden to the end of hole at 401 metres. Selected samples were taken for metallurgical testing (QEMSCAN) which confirmed the samples were well-serpentenized and contained awaruite from 0.35% awaruite to 0.49% awaruite. These samples also indicated brucite content of 8.7 to 10.9% more than triple the content at Crawford.

MID23-03 was collared approximately 400 metres west of MID23-02, and within 300 metres of the western margin of the ultramafic target. The hole intersected a continuous unit of serpentinized dunite below 5.0 metres of overburden until the end of hole at 401 metres, interrupted only by a 5.5 metre dike.

MID23-04 was collared approximately two kilometres east of MID23-03 and within 400 metres of the eastern margin of the ultramafic target. The hole intersected a sequence of pyroxenite, peridotite and dunite starting at 4.0 metres downhole. This sequence is typically found on the contact of these ultramafic sills. A continuous unit was logged from 80.0 – 401.0 metres as a strongly serpentinized dunite.

Assays, Quality Assurance/Quality Control and Drilling and Assay

Edwin Escarraga, MSc, P.Geo., a "qualified person" as defined by National Instrument 43-101, is responsible for the on-going drilling and sampling program, including quality assurance (QA) and quality control (QC). The core is collected from the drill in sealed core trays and transported to the core logging facility. The core is marked and sampled at 1.5 metre lengths and cut with a diamond blade saw. One set of samples is transported in secured bags directly from the Canada Nickel core shack to Actlabs Timmins, while a second set of samples is securely shipped to SGS Lakefield for preparation, with analysis performed at SGS Burnaby or SGS Callao (Peru). All are ISO/IEC 17025 accredited labs. Analysis for precious metals (gold, platinum, and palladium) are completed by Fire Assay while analysis for nickel, cobalt, sulphur and other elements are performed using a peroxide fusion and ICP-OES analysis. Certified standards and blanks are inserted at a rate of 3 QA/QC samples per 20 core samples making a batch of 60 samples that are submitted for analysis.

Qualified Person and Data Verification

Stephen J. Balch P.Geo. (ON), VP Exploration of Canada Nickel and a "qualified person" as is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Canada Nickel Company Inc.

The magnetic images shown in this press release were created from Canada Nickel’s interpretation of datasets provided by the Ontario Geological Survey.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless-steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero NickelTM, NetZero CobaltTM, NetZero IronTM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel-Cobalt Sulphide Project in the heart of the prolific Timmins-Cochrane mining camp. For more information, please visit www.canadanickel.com.

For further information, please contact:

Mark Selby

CEO

Phone: 647-256-1954

Email: info@canadanickel.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Cautionary Statement Concerning Forward-Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, the carbon capture approach could allow production of Net Zero nickel and generation of an additional tonnes of CO2 credits per tonne of nickel produced after offsetting all emissions, the potential to turn nickel mine into a generator of carbon credits rather than generator of carbon emissions, the production of estimated average of 710,000 tonnes of carbon credits annually and 18 million total tonnes of CO2 of credits over expected life of mine at Crawford, the ability to monetize carbon credits, the ability to quantify carbon capture, emission estimates, the brucite content of the deposit, the scalability of the process, the metallurgical results, the timing and results of the feasibility study including the viability of the inclusion of the IPT Carbonation Process and related facilities as part of the project, the results of Crawford’s PEA, including statements relating to net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs, timing for permitting and environmental assessments, realization of mineral resource estimates, capital and operating cost estimates, project and life of mine estimates, ability to obtain permitting by the time targeted, size and ranking of project upon achieving production, economic return estimates, the timing and amount of estimated future production and capital, operating and exploration expenditures and potential upside and alternatives. Readers should not place undue reliance on forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Canada Nickel to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The PEA results are estimates only and are based on a number of assumptions, any of which, if incorrect, could materially change the projected outcome. There are no assurances that Crawford will be placed into production. Factors that could affect the outcome include, among others: the actual results of development activities; project delays; inability to raise the funds necessary to complete development; general business, economic, competitive, political and social uncertainties; future prices of metals or project costs could differ substantially and make any commercialization uneconomic; availability of alternative nickel sources or substitutes; actual nickel recovery; conclusions of economic evaluations; changes in applicable laws; changes in project parameters as plans continue to be refined; accidents, labour disputes, the availability and productivity of skilled labour and other risks of the mining industry; political instability, terrorism, insurrection or war; delays in obtaining governmental approvals, necessary permitting or in the completion of development or construction activities; mineral resource estimates relating to Crawford could prove to be inaccurate for any reason whatsoever; additional but currently unforeseen work may be required to advance to the feasibility stage; and even if Crawford goes into production, there is no assurance that operations will be profitable.

Although Canada Nickel has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Canada Nickel disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()