USCM Enters into Exploration and Option Agreement on McDermitt Lithium East Project

Positions USCM with exposure to two leading lithium basins in Nevada (Clayton Valley and McDermitt Basin). Nevada is the only lithium producing state in the US.[1]

McDermitt Caldera includes Thacker Pass, a construction stage project that is positioned to be the first lithium clay producing asset in the US[2]. McDermitt Caldera is potentially the largest source of lithium clays in the world.

McDermitt Lithium East Project spans 6,508 acres of Bureau of Land Management claims with a preliminary surface sample of 1,907ppm lithium.

Occupies a geologically strategic position on the margin of the McDermitt caldera similar to that occupied by the Thacker Pass project1, which is 19 kilometers to west.

Provides USCM additional project optionality with minimal initial cash outlay and earn-in expenditures over time to advance the project. Team positioned to fast-track field studies required to refine and permit targets.

US Critical Metals Corp. (CSE: USCM) (OTCQB: USCMF) (FSE: 0IU0) (“USCM” or the “Company”) – https://www.commodity-tv.com/ondemand/companies/profil/us-critical-metals-corp/ – is pleased to announce that it has, along with its wholly-owned subsidiary, US Energy Metals Corp. (“USEM”), entered into an Exploration and Option to Enter Joint Venture Agreement dated September 15, 2023 (the “Option Agreement”) with respect to the McDermitt Lithium Project in Nevada (the “Project” or “MLEP”) with Live Energy Minerals Corp. (“LIVE”), a public British Columbia company listed on the Canadian Securities Exchange (the “CSE”) and its wholly-owned Nevada subsidiary, Lithium Valley Holdings Corp. (“LVH”), providing the Company with the option to acquire up to a 50% interest in the Project and a further option to acquire an additional 25% interest for an aggregate total of 75% interest in the Project (the “Transaction”).

Transaction Highlights

Upon the Earn-In Right (as defined herein) being obtained by USEM, this Transaction further advances USCM’s business model to explore a portfolio of unique assets within the US. Subject to the completion of this Transaction, USCM will have exposure to two of the most advanced lithium basins in the US. This includes the Clayton Valley, the only lithium producing basin in the US and the McDermitt Basin, the first potential basin to produce lithium from clay in the US. MLEP is located east of Thacker Pass, which is the largest known lithium deposit in the US and one of the largest in the world with 3.7 million tonnes of lithium carbonate equivalent reserves at 3,160 ppm lithium1. As Thacker Pass advances towards production, USCM believes that a significant derisking and revaluation of lithium clay projects will occur.

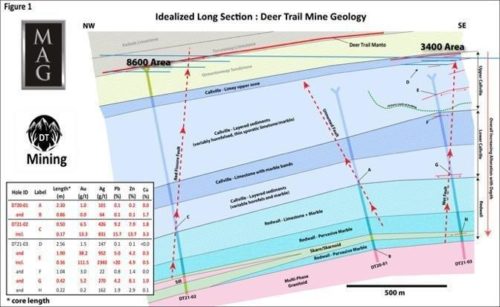

The map below outlines the location of MLEP in relation to Tacker Pass project2.

USCM intends to immediately commence with the geologic mapping, geochemical sampling and permitting with the BLM to position the Project as fully drill ready. LIVE’s preliminary sampling program involved surface claystone (rock) from a historic, shallow trench (1907 ppm Li) and two soil samples (30 and 32 ppm Li). Recognizing that the area is under sampled, the high lithium value is from intra-caldera lake sediments along the margin of the McDermitt Caldera which has prompted USCM to move aggressively in securing this unique opportunity. USCM will work closely with LIVE to further advance any and all activities leading to a maiden drill program.

The Transaction is at arms-length and closing is subject to acceptance of the Option Agreement by the CSE and satisfaction of other customary closing conditions.

Project Overview

The Project spans 6,508 acres of BLM claims and is located within the McDermitt Caldera, an extinct 40×30 km super-volcano formed approximately 16.3 million years ago (Ma) as part of a hotspot currently underneath the Yellowstone Plateau. Following an initial eruption and concurrent collapse of the McDermitt Caldera, a large lake formed in the caldera basin. This lake water was extremely enriched in lithium and resulted in the accumulation of lithium-rich clays.

Late volcanic activity uplifted the caldera, draining the lake and bringing the lithium-rich moat sediments to the surface resulting in the near-surface lithium present on the Project. The McDermitt Caldera is potentially one of the largest sources of lithium clays in the world and hosts some of the largest lithium deposits in the USA including the Tacker Pass project in the south portion of the Caldera.

LIVE completed a technical report in accordance with National Instrument 43-101 on the Project entitled “43-101 Technical Report on McDermitt Lithium East Property prepared by John Michael William Collins, P. Geo.,” effective date December 16, 2022” (the “Technical Report”) which indicates high potential for the project to host large amounts of lithium bearing sediments. The Technical Report can be found on SEDAR+ at www.sedarplus.ca.

Transaction Terms

Pursuant to the terms of the Option Agreement, LVH has granted USEM an exclusive irrevocable right to prospect, explore for and develop minerals within the Project, to earn and vest an undivided 50% interest in the Project and to form a joint venture for the management, operation and ownership of the Project (collectively the “Earn-in Right”). In consideration for the Earn-in Right, USEM has agreed to incur an initial CAD$1,500,000 in exploration expenditures on or before the second anniversary of the date of the Option Agreement (the “Second Year Deadline”) and an additional CAD$3,000,000 in exploration expenditures on or before the sixth anniversary of the Option Agreement, for a total of CAD$4,500,000 (the “Exploration Expenditures”).

In addition to the Exploration Expenditures, USEM has agreed to make the following payments in cash (“Cash Payments”) and in common shares of USCM (the “Shares”, collectively with the Exploration Expenditures and Cash Payments, the “Earn-in Obligation”) to LVH:

- Reimbursement of BLM fees for the Property for the September 2023 to August 2024 period;

- CAD$50,000 within 5 business days after the CSE’s acceptance of the Option Agreement;

- if USEM elects to continue the Option Agreement in effect after the Second Year Deadline, CAD$100,000 within 10 business days after the Second Year Deadline;

- Shares having a value of CAD$100,000 on the CSE’s acceptance of the Option Agreement; and

- if USEM elects to continue the Option Agreement in effect after the Second Year Deadline, Shares having a value of CAD$200,000 within 10 business days after the Second Year Deadline.

Upon exercise of the option following the completion of the Earn-in Obligation by the Company, a joint venture will be formed between the parties to advance the Project, with each party having an initial interest of 50%.

USEM will have the option to increase its participating interest in the joint venture by an additional 25% to an aggregate participation right of 75% by: (i) incurring and paying additional exploration expenditures in the amount of CAD$5,000,000 on or before the sixth anniversary of the effective date of the Operating Agreement (the “Additional Earn-in Deadline”); and (ii) by issuing Shares having a value of CAD$1,000,000 within 10 business days after the Additional Earn-in Deadline.

If at any time LVH’s participating interest in the joint venture is diluted to below 10%, LVH’s interest will be deemed to have been withdrawn and been converted into a 3.0% net smelter returns mineral production royalty. USEM will then have the option and right, exercisable at any time, to purchase one-third of the royalty for the purchase price of CAD$5,000,000.

QP Statement

Robert J. Johansing, BSc (geology), MSc (economic geology), who is a qualified person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (the “QP”), has reviewed and approved the scientific and technical information contained in this news release. Robert J. Johansing is a consultant for the Company.

About US Critical Metals Corp.

USCM is focused on mining projects that will further secure the US supply of critical metals and rare earth elements, which are essential to fueling the new age economy. Pursuant to option agreements with private Canadian and American companies, USCM’s assets consist of three agreements, each providing USCM with the right to acquire interests in four discovery focused projects in the US. These projects include the Clayton Ridge Lithium Property located in Nevada, the Haynes Cobalt Property located in Idaho, the Sheep Creek located in Montana, and Lemhi Pass located in Idaho. A significant percentage of the world’s critical metal and rare earth supply comes from nations with interests that are contrary to those of the US. USCM intends to explore and develop critical metals and rare earth assets with near- and long-term strategic value to the advancement of US interests.

For further information please contact:

Darren Collins

Chief Executive Officer & Director

Telephone: +1 (786) 633-1756

Email: dcollins@uscmcorp.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

This news release contains certain information that may be deemed “forward-looking information” with respect to USCM within the meaning of applicable securities laws. Such forward-looking information involves known and unknown risks, uncertainties and other factors that may cause USCM’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking information. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Forward-looking information contained in this press release may include, without limitation, the expectation that the Company will close the option agreement and fulfil its obligations under the Option Agreement; exploration plans and expected exploration and drilling results at the Project, results of operations, and the expected financial performance of the Company.

Although USCM believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by its nature, forward-looking information involves assumptions and known and unknown risks, uncertainties and other factors which may cause our actual results, level of activity, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; the Covid-19 pandemic; adverse industry events; the receipt of required regulatory approvals and the timing of such approvals; that USCM maintains good relationships with the communities in which it operates or proposes to operate; future legislative and regulatory developments in the mining sector; USCM’s ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of USCM to implement its business strategies; competition; the risk that any of the assumptions prove not to be valid or reliable, which could result in delays, or cessation in planned work; risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits; the possibility that results will not be consistent with USCM’s expectations; as well as other assumptions, risks and uncertainties applicable to mineral exploration and development activities and to USCM, including as set forth in the USCM’s public disclosure documents filed on the SEDAR website at www.sedar.com.

The forward-looking information contained in this press release represents the expectations of USCM as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While USCM may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

[1] https://www.mdpi.com/2075-163X/10/1/68.

[2] The comparable information about other issuers was obtained from public sources and has not been verified by the Company. Comparable means information that compares an issuer to other issuers. The information is a summary of certain relevant operational attributes of certain mining and resource companies and has been included to provide an overview of the performance of what are expected to be comparable issuers. The comparables are considered to be an appropriate basis for comparison with the Company based on their industry, commodity mix, jurisdiction, and additional criteria. The comparable issuers face different risks from those applicable to the Company. Relevant material concerning any adjacent or comparable properties included in this press release is limited to information publicly disclosed by the owner or operator for such adjacent or comparable property. The Company has relied on the Qualified Persons responsible for such information and has not independently verified such information. The Company cautions that past production, mineral reserves, resources or occurrences on adjacent or comparable properties are not indicative of the mineralization on the Company’s properties. Readers are cautioned that the past performance of comparables is not indicative of future performance and that the performance of the Company may be materially different from the comparable issuers. You should not place undue reliance on the comparable information provided in this press release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()