IsoEnergy announces closing of $36.6 million private placement of Subscription Receipts

The Offering was conducted by a syndicate of agents co-led by Canaccord Genuity Corp., TD Securities Inc. and Eight Capital, and including Haywood Securities Inc., Red Cloud Securities, Cormark Securities Inc., Paradigm Capital, PI Financial Corp., Raymond James Ltd. and SCP Resource Finance LP (collectively, the “Agents”).

Each Subscription Receipt will entitle the holder thereof to receive, for no additional consideration and without further action on part of the holder thereof, one common share of IsoEnergy, on or about the date that IsoEnergy’s previously announced share-for-share merger with Consolidated Uranium Inc. by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario) (the “Arrangement”) is completed.

The net proceeds of the Offering will be used for the Arrangement, exploration and development of the Company’s uranium assets, as well as for working capital and general corporate purposes. The net proceeds of the Offering will be held in escrow pending satisfaction of the escrow release conditions, including the satisfaction of the conditions to the closing of the Arrangement and certain other customary conditions.

Pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”), the Offering constitutes a “related party transaction” as NexGen Energy Ltd. (“NexGen”) has subscribed for Subscription Receipts. These transactions are exempt from the formal valuation and minority shareholder approval requirements of MI 61-101, as the fair market value of the Subscription Receipts subscribed for NexGen pursuant to the Offering does not exceed 25% of the Company’s market capitalization.

In connection with the Offering, the Agents are entitled to a cash commission equal to 6.0% of the aggregate gross proceeds raised from the sale of Subscription Receipts (reduced to 3.0% or nil for subscriptions made by certain specified purchasers of Subscription Receipts, as agreed by the Agents and the Company). At closing of the Offering, the Agents received a cash commission of $293,257.13, representing 50% of the total cash commission payable. The balance of the Agents’ cash commission shall be held in escrow pending satisfaction or waiver of the escrow release conditions and is payable upon satisfaction of such escrow release conditions.

The Subscription Receipts were offered by way of private placement pursuant to applicable exemptions from prospectus requirements in each of the provinces of Canada and in such other jurisdictions as may be mutually agreed between the Company and the Agents. The securities issued under the Offering are subject to a four month hold period under applicable Canadian securities laws.

The securities offered pursuant to the Offering have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Qualified Person Statement

The scientific and technical information contained in this news release with respect to IsoEnergy was prepared by Dr Darryl Clark, P.Geo., IsoEnergy Vice President, Exploration, who is a “Qualified Person” (as defined in NI 43-101 – Standards of Disclosure for Mineral Projects). Dr Clark has verified the data disclosed. For additional information regarding the Company’s Larocque East Project, including its quality assurance, quality control procedures and other details of the mineral resource estimate contained herein, please see the Technical Report dated effective July 8, 2022, on the Company’s profile on SEDAR+ at www.sedarplus.ca.

About IsoEnergy

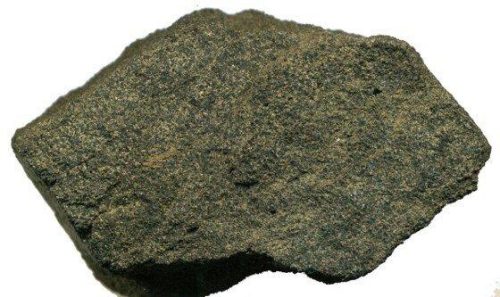

IsoEnergy Ltd. (TSXV: ISO) (OTCQX: ISENF) is a well-funded uranium exploration and development company with a portfolio of prospective projects in the infrastructure-rich eastern Athabasca Basin in Saskatchewan, Canada. In 2018, IsoEnergy discovered the high-grade Hurricane Deposit on its 100% owned Larocque East property in the eastern Athabasca Basin. The Hurricane Deposit has indicated mineral resources of 48.61 M lbs U3O8 based on 63,800 tonnes grading 34.5% U3O8 and inferred mineral resources of 2.66 M lbs U3O8 based on 54,300 tonnes grading 2.2% U3O8 (July 8, 2022). The Hurricane Deposit is 100% owned by IsoEnergy and is unencumbered from any royalties. IsoEnergy is led by a board and management team with a track record of success in uranium exploration, development, and operations. IsoEnergy was founded and is supported by the team at its major shareholder, NexGen Energy Ltd.

Tim Gabruch

Chief Executive Officer

IsoEnergy Ltd.

+1 306-261-6284

info@isoenergy.ca

www.isoenergy.ca

Investor Relations

Kin Communications

+1 604 684 6730

iso@kincommunications.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

The information contained herein contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. These forward-looking statements or information may relate to the Offering, including, without limitation, statements with respect to the use of proceeds from the Offering; the closing of the Arrangement (including the receipt and timing of required regulatory, shareholder and court approvals, stock exchange (including the TSX Venture Exchange) and other approvals in respect thereof); and the conversion of the Subscription Receipts (and the related release of funds from the Offering from escrow to the Company).

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the price of uranium, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, the limited operating history of the Company, the influence of a large shareholder, alternative sources of energy and uranium prices, aboriginal title and consultation issues, reliance on key management and other personnel, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, availability of third party contractors, availability of equipment and supplies, failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

NOT FOR DISTRIBUTION TO THE U.S. NEWSWIRE OR FOR DISSEMINATION IN THE UNITED STATES

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()