Karora Announces Strong Increases in Beta Hunt Gold Mineral Resources, Grades and Gold Mineral Reserves

Highlights:

At Beta Hunt:

– Gold Measured and Indicated Mineral Resources increased by 18% to 1.6 million ounces

– Measured and Indicated Mineral Resource grade at Western Flanks, Beta Hunt’s largest zone, increased by 12% from 2.6 g/t to 2.9 g/t (1.1 million ounces)

– Gold Proven and Probable Mineral Reserve increased by 6% to 573,000 ounces

Consolidated Gold Measured and Indicated Mineral Resource inventory increased by 9% to 3.2 million ounces net of mining depletion

At Higginsville:

-Maiden Probable Mineral Reserve produced for the Spargos deposit comprising 437,000 tonnes grading 4.6 g/t for 64,00 ounces

– The expanded Mineral Resource and Reserves further support extending mine life at Karora’s flagship Beta Hunt mine

Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) ("Karora" or the "Corporation" – https://www.commodity-tv.com/play/karora-resources-stable-growth-in-gold-production-with-strong-nickel-upside-in-the-future/) is pleased to announce significant increases to its Gold Measured and Indicated (“M&I”) Mineral Resource at its flagship Beta Hunt Mine (increase of 18%) and Consolidated M&I Resources at Beta Hunt and Higginsville (increase of 9%), both net of mining depletion. Beta Hunt’s Western Flanks zone highlighted the update with improved grades (12% higher) and a net addition of 143,000 ounces in M&I Resources. Nickel M&I Resources also showed improved grade along with the addition of 1,200 tonnes of contained nickel.

Paul Andre Huet, Chairman & CEO, commented: "Our 2023 drilling campaign at Beta Hunt was focused primarily on expanding our Measured and Indicated Resource base and upgrading a significant portion of our Inferred Resource. I am extremely pleased to announce our success in this objective, net of mining depletion, culminating in a 249,000 ounce increase (or 18%) to gold M&I Resources. I am also very encouraged by improvements in M&I Resource grade – an increase of 8%.

Western Flanks is the engine room of Beta Hunt, providing the bulk of our mined tonnes and ounces as our largest mineralized shear zone. In 2023, we continued to significantly upgrade this zone, resulting in a 16% increase (143,000 ounces) in M&I Resources, net of mining depletion. A terrific result.

I am also very pleased to announce a 7% increase to the Beta Hunt Gold Proven and Probable Reserve and an 8% grade improvement (to 2.7 g/t from 2.5 g/t). Our new Reserve adds 35,000 ounces, net of mining depletion, compared to our prior estimate. We believe our new increased total of 573,000 ounces of Proven and Probable Mineral Reserves positions us well for many years of mining ahead. As is the case with underground operations, we will continue to expand our resource base to feed a rolling, and expanding, multi-year reserve base.

Beta Hunt is a very large system comprised of extensive, wide and continuous mineralized shear zones which have been extended by drilling both along strike and at depth. Karora has also discovered numerous parallel shear zones over the last several years, adding maiden Mineral Resources at Larkin, Mason and Cowcill, with Fletcher set to be the next exciting addition. Given the tremendous drill results at Fletcher to date (highlighted by 46.5 g/t over 7.0 metres in hole BL1730-04AE – see Karora news release dated April 13, 2023), we are certainly looking forward to its inclusion in our resource update in 2024.

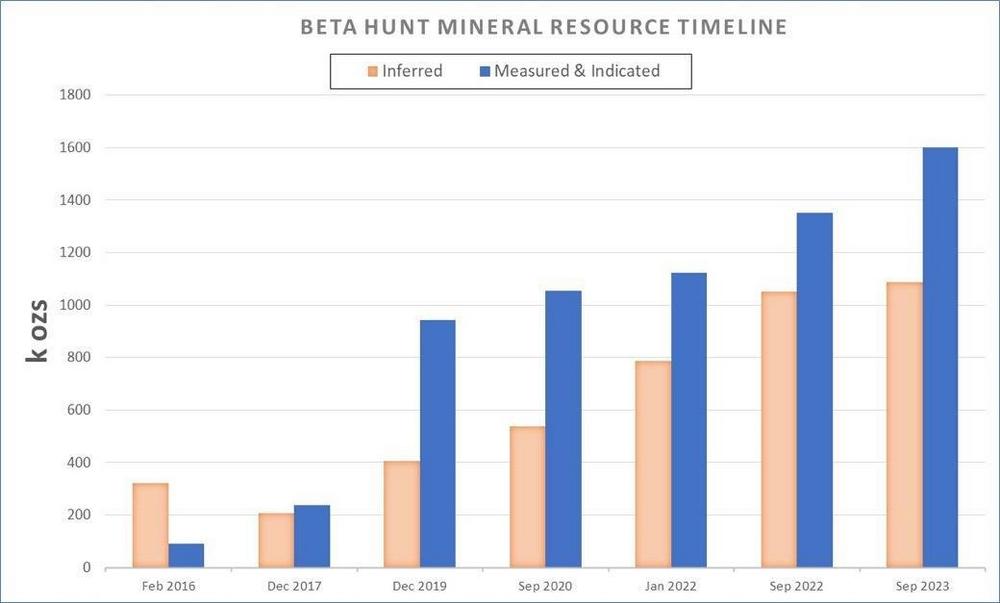

As can be seen in Figure 1, we have built a consistent and successful track record of resource growth via the drill bit at Beta Hunt, with inventories rising by more than 550% since 2016. This is a direct result of our aggressive underground drilling program leveraging the +400km of extensive infrastructure already in place and enabled by significant reductions made to onerous royalty burdens in 2020. As we continue with our program in 2024, we look forward to potential new shear zone discoveries and extensions of our existing zones.

Our success in the continued expansion of the Beta Hunt Mineral Resource is a critical step enabling mine life extensions as we increase production rates. Once the expanded Beta Hunt mining capacity is fully ramped up to its targeted capacity of 2 Mtpa, we expect that approximately 80% of our mill feed will come from our flagship Beta Hunt mine.

On the nickel front, drilling aimed at upgrading our high grade (~3.0% Ni) East Alpha Zone was successful. In 2024, we intend to complete additional drilling and exploration work in the Gamma block south of the Gamma Fault where our large 50C resource is located. With a current 22,300 contained nickel tonnes in M&I Mineral Resources and an additional 13,400 contained nickel tonnes in Inferred Mineral Resources at Beta Hunt, the nickel growth story is becoming an increasingly important part of Beta Hunt’s future production profile.

On a consolidated basis, our gold M&I Resource grew by 9% to 3.2 million ounces and Inferred Resources grew by 4% to 1.5 million ounces, net of mining depletion. While drilling at Higginsville was focused primarily on production drilling, highlights include reserve growth at Spargos as we prepare to begin underground operations in 2024.”

Beta Hunt Gold Mineral Resource

The updated Gold Mineral Resource is effective as of September 30, 2023 and represents an update to the previously released Beta Hunt Mineral Resource that was effective as of September 30, 2022 (see Karora news release dated February 13, 2023). The updated Measured & Indicated Gold Mineral Resource totals 1.6 million ounces, an increase of 18% (249,000 ounces). The updated Inferred Gold Mineral Resource now totals 1.1 million ounces, representing a 3% (34,000 ounces) increase. M&I grades increased by 8%, from 2.5 g/t to 2.7 g/t.

The updated Beta Hunt Mineral Resource estimate is net of mine production depletion of 1.2 million tonnes grading 2.6 g/t for 101,000 ounces over the period October 1, 2022 to September 30, 2023. The result continues the multi-year trend of significantly increasing Mineral Resources (Figure 1) in support of Karora’s growth plan.

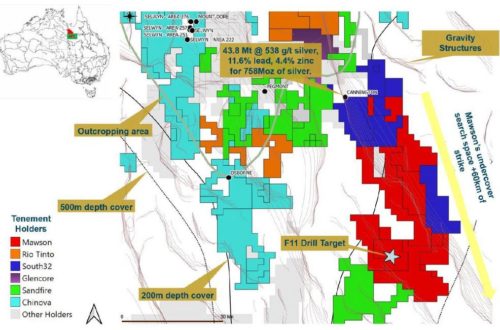

The new Mineral Resource reflects the results from new drilling designed to extend and upgrade the September 30, 2022 Mineral Resource in support of the Karora Growth Plan, which is underpinned by an expansion to 2.0 Mtpa for mine production from Beta Hunt (see Karora news release dated June 28, 2021). The Mineral Resource comprises the previously reported Western Flanks, A Zone and Larkin. The latter previously included the Cowcill Zone which is now reported as a separate Mineral Resource. In addition, a maiden Mason Zone Mineral Resource was added to the Beta Hunt Mineral Resource Inventory for the first time. The location of all five resource areas is shown in Figure 2.

Western Flanks: Resource definition and exploration drilling focused on upgrading the northern and southern down-dip positions of the existing Mineral Resource, up to 900 metres below surface. This work resulted in an upgrade to the previously reported Inferred Mineral Resource. Drilling also identified an offset to the Main Shear mineralization from approximately 750 metres below surface. The offset Main Shear mineralization remains open at depth (see Karora news release dated September 18, 2023).

The Western Flanks M&I Resource increased by 16% (143,000 ounces) with the Inferred Resource decreasing by 24% (-188,000 ounces), the latter the result of the 2023 drilling focus on resource conversion. Significantly, overall M&I Resource grade increased 12% (+0.3 g/t) reflecting results from new drilling and domaining refinements to the hangingwall mineralization to the Main Shear.

A Zone: Drilling in this zone concentrated on upgrading the northern margin and down-dip central position of the existing resource. This work resulted in the A Zone M&I Resource increasing by 16% (49,000 ounces) and the Inferred Resource increasing by 46% (93,000 ounces). M&I Resource grades at A zone increased by 4%.

Larkin: Drilling focused on upgrading the northern margin of the existing Mineral Resource adjacent the Alpha Island Fault. Previous work had identified this area as suitable for additional drilling to drive resource conversion. The additional drilling increased confidence in the continuity of the mineralization supporting a revised geological interpretation of the north-end of the Larkin mineralization resulting in a significant resource upgrade compared to the previously reported September 30, 2022 Mineral Resource. The Larkin M&I Resource increased by 50% (56,000 ounces) and an increase of 88% (62,000 ounces) was reported for Inferred Resources.

Cowcill: Previously included as part of the Larkin Mineral Resource and now reported as a separate Mineral Resource, the Cowcill Mineral Resource is offset mineralization on the eastern side of the Larkin Mineral Resource and is interpreted as a separate structural domain to Larkin. No new drilling was completed since the previous resource update (as part of Larkin) and the Mineral Resource remains unchanged.

Mason: Results from exploration drilling targeting the Mason Zone in 2023 provided enough drill data at the north end of the Zone to show continuity of mineralization to support the production of the first-ever Mason Mineral Resource. Mason represents mineralized hangingwall shear zones with similar albite-biotite rich alteration to the adjacent Larkin Mineral Resource. Mason remains open at depth and along strike to the south (see Karora news release dated September 18, 2023).

Beta Hunt Gold Mineral Reserve Summary

The updated Gold Mineral Reserve is effective as of September 30, 2023, and represents an update to the previously released Beta Hunt Mineral Reserve as of September 30, 2022 (see Karora news release dated February 13, 2023).

The updated Gold Proven and Probable Mineral Reserve now totals 573,000 ounces, representing a 6% (35,000 ounces) increase from the, September 30, 2022 Proven and Probable Mineral Reserve estimate. The Beta Hunt Mineral Reserve is net of mine production depletion of 1.2 million tonnes grading 2.6 g/t for 101,000 ounces over the period October 1st, 2022, to September 30, 2023.

Grade improvements of 8% (from 2.5 g/t to 2.7 g/t) were recorded for the updated Proven and Probable Mineral Reserve.

The 2023 Beta Hunt Reserve additions were greater than the proceeding year’s mine production with drilling improving confidence and adding Mineral Reserves in A Zone, Western Flanks and Larkin.

2024 Drilling Program

For 2024, gold drilling will continue to focus on upgrading Inferred Resources to Indicated status, providing the opportunity for increased Mineral Reserves. Exploration drilling is also planned, targeting previously defined mineralized zones (Figure 4).

In the Hunt Block, exploration drilling is planned to extend and infill significant gold mineralization (see KRR news release, September 12, 2023) identified as part of the Fletcher Zone with the aim of producing a maiden Mineral Resource for this Zone. During 2023, drilling in the southern end of the Fletcher Zone was highlighted by intersections of 46.5 g/t over 7.0 metres, 6.5 g/t over 26.0 metres and 15.9 g/t over 6.0 metres.

In the Beta Block, drilling will be aimed at infilling and extending the new Mason Mineral Resource. Recent drill results, including 12.2 g/t over 6.0 metres and 14.7 g/t over 4.0 metres (See Karora news release dated September 18, 2023), highlight the potential to grow this new mineral resource.

In the Gamma Block, drilling will be focused on upgrading and extending the existing 50C nickel Mineral Resource. In addition, drilling will target gold mineralization below the 50C using the analogy of the A Zone and Western Flanks geological model where gold mineralization is found directly below nickel mineralization. Previous drilling below the 50C intersected 40.5 g/t over 4.0 metres in drillhole G50-22-007NE (see Karora news release dated November 15, 2021).

Beta Hunt Nickel Mineral Resource

The new Nickel Mineral Resource incorporates an update to the East Alpha Mineral Resource to take into account additional drilling aimed at upgrading the Kappa and Delta lenses, which are part of East Alpha (Figure 5). East Alpha represents the eastern-most nickel resource, on the east side of the Kambalda Dome. The new East Alpha Nickel Mineral Resource comprises a M&I Mineral Resource of 307,000 tonnes grading 3.2% Ni for 9,900 nickel tonnes and an Inferred Mineral Resource of 98,000 tonnes grading 2.9% Ni for 2,900 nickel tonnes. East Alpha is part of the Beta Block Mineral Resource. The Beta Hunt Mineral Resource estimate is net of mine production depletion of 23,800 tonnes grading 2.1% Ni for 500 nickel tonnes over the period October 1, 2022 to September 30, 2023. Mining over this period was completed in the 25C, 30C, East Alpha and 4C positions.

As at September 30, 2023, M&I Mineral Resources totaled 776,000 tonnes grading 2.9% for 22,300 nickel tonnes. This marks an increase of 1,200 nickel tonnes, or 6% compared to the September 30, 2022, Measured and Indicated Mineral Resource estimate (see Karora news release dated March 7, 2023). The change reflects an upgrade based on new infill drilling in the Kappa and Delta nickel lenses, part of the East Alpha Mineral Resource. The September 30, 2023 Inferred Mineral Resources totals 500,000 tonnes grading 2.7% for 13,400 nickel tonnes. This result represents no change compared to the September 30, 2022 Inferred Mineral Resource estimate.

Higginsville Gold Mineral Resource

The updated Gold Mineral Resource is effective as of September 30, 2023 and represents an update to the previously released Higginsville Mineral Resource as of January 31, 2022 (see Karora news release dated April 7, 2022). The updated M&I Gold Mineral Resource totals 1.6 million ounces, with no significant change in total ounces. The updated Inferred Gold Mineral Resource now totals 0.45 million ounces, representing a 5% (23,000 ounces) increase (Table 5). The Higginsville Mineral Resource estimate is net of mine production depletion of 770,000 tonnes grading 3.4 g/t for 85,000 ounces over the period February 1, 2022 to September 30, 2023 period.

Reporting for the Higginsville Mineral Resource inventory is split into two main areas – Higginsville Central and Higginsville Greater (Figure 6). The former covers Mineral Resources within an area approximately 10 kilometres from the Higginsville mill while Higginsville Greater covers all Mineral Resources that fall outside the Higginsville Central area.

HGO Central: Drilling in 2022 and 2023 concentrated on infilling and extending existing resources at Pioneer and Aquarius. Mine production accounted for depletions at Aquarius, Two Boys, Hidden Secret and most recently, Pioneer. The updated M&I Resource increased by 10% (39,000 ounces) and the Inferred Resource increased by 4% (7,000 ounces) compared to the previously reported Mineral Resource effective January 31, 2022.

HGO Greater: Drilling focused on extending existing resources at Mousehollow and Spargos (see KRR news release, September 18, 2023). Mine production accounted for depletions at Spargos. The updated M&I Resource decreased by 2% (21,000 ounces) and the Inferred Resource increased by 7% (17,000 ounces) compared to the previously reported Mineral Resource effective January 31, 2022.

Stockpiles: Total M&I Resources in stockpiles decreased by 28% (16,000 ounces) compared to the previously reported Mineral Resource effective January 31, 2022. The decrease reflects stockpile depletion over the reporting period as part of the objective to fill the increased milling capacity provided by the addition Lakewood in August 2022 to the existing Higginsville mill while Beta Hunt’s infrastructure expansion to 2MTPA is undertaken.

Higginsville Gold Mineral Reserve

The updated Higginsville Gold Mineral Reserve is effective as of September 30, 2023 and represents an update to the previously released Mineral Reserve that was effective as of September 30, 2020 (see KRR release, December 16, 2020). The Higginsville Mineral Reserve estimate of 705,000 ounces is net of mine production depletion of 1.9 million tonnes grading 2.4 g/t for 142,000 ounces over the period October 1, 2020 to September 30, 2023.

HGO Central: Depletions in Mineral Reserve exist at Pioneer, Fairplay, Hidden Secret and Mousehollow and Two Boys.

HGO Greater: Depletions at Baloo were offset by the addition of the maiden underground Mineral Reserve for Spargos, a Probable Mineral Reserve of 437,000 tonnes at 4.6 g/t for 64,000 ounces.

Consolidated Mineral Resource and Reserve Summary

Gold

The updated consolidated M&I Gold Mineral Resource totals 3.2 million ounces, an increase of 9% over previously reported September 30, 2022 estimate for Beta Hunt (see Karora news release dated February 13, 2023) and the previously reported January 2022 estimate for Higginsville (see Karora news release dated April 7, 2022). The Consolidated Inferred Gold Mineral Resource now totals 1.5 million ounces, representing a 4% increase.

The updated consolidated Proven and Probable Gold Mineral Reserve totals 1.3 million ounces, including a 7% increase at Beta Hunt, and an overall decrease of 8% over previously reported September 30, 2022 estimate for Beta Hunt and the previously reported September, 2020 estimate for Higginsville. Drilling to convert Mineral Resources to Mineral Reserves has been concentrated on upgrading the flagship Beta Hunt Mine since the Company’s last Mineral Reserve update.

Technical Report

The Beta Hunt Mineral Resource and Reserve estimate and the Higginsville Mineral Resource and Reserve estimate will be detailed in two separate technical reports prepared in accordance with NI 43-101 to be filed under the Corporation’s SEDAR profile at sedar.com within 45 days of the date of this news release.

Compliance Statement (JORC 2012 and NI 43-101)

Mr. Stephen Devlin is Group Geologist for Karora, a full-time employee of Karora and a Fellow of the AusIMM. Mr Devlin has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr Devlin has reviewed and approved the disclosure of the technical information for the Higginsville Gold Mineral Resource (excluding Mt Henry) and the Beta Hunt Nickel Mineral Resource included in this news release.

Mr. Graham de la Mare is Principal Resource Geologist for Karora, a full-time employee of Karora and a Fellow of the AIG. Mr de la Mare has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr de la Mare has reviewed and approved the disclosure of the technical information for the Beta Hunt Gold Mineral Resource included in this news release.

Mr. Ian Glacken is a geologist and geostatistician and a Fellow and Chartered Professional Geologist of the AusIMM. Mr Glacken is an employee of Snowden Optiro of Perth, Western Australia, and was employed by Karora to compile the Gold Mineral Resource estimates for the Mt Henry Project. Mr Glacken has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and also fulfills the requirements of a "Qualified Person" for the purposes of NI 43-101. Mr Glacken has reviewed and approved the disclosure of the scientific and technical information for the Mt Henry Gold Mineral Resource in this news release. The Mt Henry Gold Mineral Resource is part of the Higginsville Greater Mineral Resource estimate.

Mr Peter Ganza is Chief Operating Officer – Australia for Karora, a full-time employee of Karora, a mining engineer and a Chartered Professional Member of the AusIMM. Mr Ganza has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr Ganza has reviewed and approved the disclosure of the technical information for the Consolidated Mineral Reserves included in this news release.

The "JORC Code" means the Australasian Code for Reporting of Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Mineral Council of Australia. There are no material differences between the definitions of Mineral Resources under the applicable definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM Definition Standards") and the corresponding equivalent definitions in the JORC Code for Mineral Resources.

Detailed Footnotes relating to Mineral Resource Estimates as at September 30,2023

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

- The Measured and Indicated Mineral Resources are inclusive of those Mineral Resources modified to produce Mineral Reserves.

- The Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is also no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves once economic considerations are applied.

- The Gold Mineral Resource is estimated using a long term gold price of US$1,700/oz with a US:AUD exchange rate of 0.70.

- The Gold Mineral Resource for Higginsville deposits is reported using a 0.5g/t Au cut-off for open pits (0.4g/t Au cut-off for Mt Henry Project) and a 1.3g/t Au cut-off grade for underground (1.6g/t Au for Spargos underground). The Gold Mineral Resource for Beta Hunt underground is reported using a 1.4g/t Au cut-off.

- The Nickel Mineral Resource is reported within proximity to underground development and nominal 1% Ni lower cut-off grade for the nickel sulphide mineralization.

- The Mineral Resource is depleted for all mining to September 30, 2023

- The Nickel Mineral Resource assumes an underground mining scenario and a high level of selectivity.

- To best represent "reasonable prospects of eventual economic extraction" the mineral resource for open pits has been reported within optimized pit shells at A$2,429(US$1,700) and, for underground resources, areas considered sterilized by historical mining are depleted from the Mineral Resource.

- Mineral Resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

Detailed Footnotes relating to Mineral Reserve Estimates as at September 30, 2023

- The Mineral Reserve is estimated using a long-term gold price of US$1,500/oz and a long term nickel price of US$17,500/t with a US:AUD exchange rate of 0.70.

- At Beta Hunt, Underground Gold Mineral Reserves are reported at a 1.8 g/t cut-off grade while Nickel Mineral Reserves are reported at a 2% cut-off grade. At Higginsville, Underground Mineral Reserves cut-off grades vary between 1.6g/t to 2.0g/t. The cut-off grade considers Operating Mining, Processing/Haulage and G&A costs, excluding capital.

- At Higginsville, Open Pit cut-off grades vary between 0.8 g/t to 1.0g/t. The cut-off grade considers dilution, mine recovery, mining and processing/haulage costs. Dilution and recovery factors varied by deposit.

- The Mineral Reserve is depleted for all mining to September 30, 2023.

About Karora Resources

Karora is focused on increasing gold production at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. In July 2022, Karora acquired the 1.0 Mtpa Lakewood Mill in Western Australia. At Beta Hunt, a robust gold Mineral Resource and Reserve are hosted in multiple gold shears, with gold intersections along a 5 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,900 square kilometers. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the liquidity and capital resources of Karora, production guidance, timing and anticipated results of the 2024 resource and reserve update, consolidated production guidance and the production and development potential of the Beta Hunt Mine, Higginsville Gold Operation, the Spargos Gold Mine, the Lakewood Mill, and the completion of the second Beta Hunt decline system.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedarplus.ca.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()