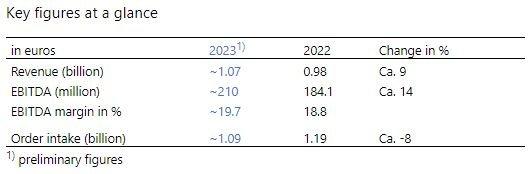

Jenoptik achieves strong revenue and earnings growth in fiscal year 2023

- Strong organic growth; revenue up around 9 percent to approx. 1.07 billion euros

- EBITDA grew again overproportionately to approx. 210 million euros; EBITDA margin at around 19.7 percent

- Order intake remains at high level

- Further profitable growth expected for 2024

“Despite an increasingly challenging economic environment, 2023 was a very successful year for Jenoptik. We achieved our revenue goals and earnings targets which we had increased in the course of the year. The expansion of our production capacities is proceeding as planned and we significantly reduced our leverage ratio. Jenoptik has strong growth platforms in its three core markets: Semiconductor & Electronics, Life Science & Medical Technology, and Smart Mobility. Accordingly, we expect to continue growing profitably in the current fiscal year and are on track to achieve our goals for 2025,” says Stefan Traeger, President & CEO of JENOPTIK AG.

Significant growth in revenue and earnings

The Jenoptik photonics group continued on its course of profitable growth in the past fiscal year. Revenue, based on preliminary figures, increased by around 9 percent to approx. 1.07 billion euros (prior year: 0.98 billion euros). The main growth driver was the Advanced Photonic Solutions division, particularly due to strong demand from the semiconductor equipment industry.

The Group’s EBITDA once again grew at a faster rate than revenue, by about 14 percent to approximately 210 million euros (prior year: 184.1 million euros). The corresponding EBITDA margin increased to around 19.7 percent, compared to 18.8 percent in the prior year.

Key balance sheet and financial ratios further improved

Jenoptik’s balance sheet and financial position remain very strong. The equity ratio improved to around 54 percent (31/12/2022: 50.4 percent). The free cash flow before interest and taxes increased from 82.7 million euros to approximately 127 million euros, despite high capital expenditure. In addition to very good operating performance, the free cash flow benefited from the sale of real estate assets within the Non-Photonic Portfolio Companies. The company’s leverage, i.e., net debt in relation to EBITDA, was around 2.0 at the end of fiscal year 2023 compared to 2.6 in the prior year. Jenoptik thus continues to have very solid financial and balance sheet ratios.

Demand remained at good level

As expected, the Group’s order intake of approximately 1.09 billion euros in fiscal year 2023 was around 8 percent below the very high prior-year figure of 1.19 billion euros. The book-to-bill ratio was 1.02 (prior year: 1.21). Accordingly, the overall high order backlog increased slightly to around 745 million euros (31/12/2022: 733.7 million euros).

Further profitable growth expected for 2024

Based on the high order backlog, and good ongoing developments in the core photonics businesses, especially in the semiconductor equipment sector, the Executive Board of JENOPTIK AG is optimistic that it will achieve further profitable organic growth in the fiscal year 2024.

The final audited figures for 2023 and the 2023 Annual Report will be published on March 27, 2024.

This press release may contain statements relating to the future which are based on current assumptions and forecasts made by the corporate management of the Jenoptik Group. A variety of known and unknown risks, uncertainties, and other factors may cause the actual results, the financial situation, the development, or the performance of the company to diverge significantly from the information provided here. Such factors may include geopolitical conflicts, changes in currency exchange rates and interest rates, pandemics, the introduction of competing products, or a change in business strategy. The company does not assume any obligation to update such forward-looking statements in the light of future developments.

Optical technologies form the basis of our business. Jenoptik is a global photonics group and comprises the two divisions Advanced Photonic Solutions and Smart Mobility Solutions. Non-photonic activities, particularly for the automotive market, are operated as independent brands within the Non-Photonic Portfolio Companies. Our key markets primarily include semiconductor & electronics, life science & medical technology as well as smart mobility. Approximately 4,600 people worldwide work for the Jenoptik Group, which is headquartered in Jena (Germany). JENOPTIK AG is listed on the German Stock Exchange in Frankfurt and traded on the MDax and TecDax. In fiscal year 2023, Jenoptik generated revenue of approx. 1.07 billion euros, based on preliminary figures.

JENOPTIK-KONZERN

Carl-Zeiß-Straße 1

07743 Jena

Telefon: +49 (3641) 65-0

Telefax: +49 (3641) 424514

http://www.jenoptik.com

Investor Relations

Telefon: +49 (3641) 65-2156

Fax: +49 (3641) 424514

E-Mail: ir@jenoptik.com

Head of Investor Relations

Telefon: +49 (3641) 65-2291

E-Mail: andreas.theisen@jenoptik.com

![]()