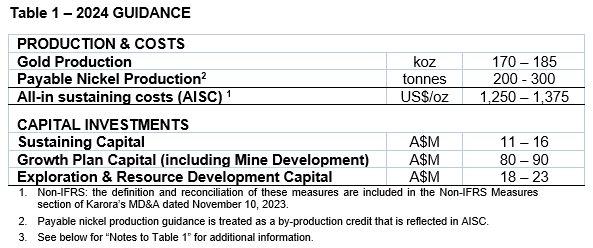

Karora Announces Consolidated 2024 Gold Production Guidance of 170,000 – 185,000 ounces at AISC of US$1,250 – US$1,375 per ounce sold

Karora’s updated guidance incorporates optimized 2024 mine and development plans across its operations. At Beta Hunt, this includes planned mine development required to bring the mine to 2.0Mtpa as well as accessing the new Fletcher zone by the end of the year. The guidance also includes further equipment additions, processing plant upgrades at both Higginsville and Lakewood, tailings storage expansions and other growth-related expenditures. By the end of 2024, Karora’s three-year growth plan will have been executed to deliver a 2.0Mtpa operation at Beta Hunt feeding two upgraded mills alongside contributions from Higginsville Gold Operations.

Paul Andre Huet, Chairman & CEO, commented: "Following our record full year gold production of 160,492 ounces in 2023, gold production in 2024 is projected to be another significant increase to between 170,000 – 185,000 ounces. Our updated guidance incorporates our ramp up to an annualized 2.0Mtpa production rate at Beta Hunt by end of year as well as contributions from Pioneer, Two Boys and stockpiles. The minor (5%) trim to the top end of our gold production guidance reflects a focus on prioritizing higher margin Beta Hunt ounces over slightly lower margin smaller open pit options at Higginsville.

Given increased cost pressures experienced across the industry since our last update in March 2023, we have adjusted our AISC guidance for 2024 to reflect the current operating environment and lower planned nickel by-product credits.

At Beta Hunt we are in a position of unique operational flexibility with respect to mining nickel. The mine leverages shared infrastructure for both gold and nickel mining, driving a very competitive cost structure per nickel tonne. However, with the global pressure on spot nickel prices, we have made the decision to reduce higher cost hand-held nickel mining to focus on mechanized mining in our currently developed areas, trimming forecast payable nickel production in 2024 to a range of 200-300 nickel tonnes. With significant dual-purpose infrastructure in place, an enviable feature of our operations is the ability to significantly ramp up the new 50C/Gamma nickel blocks as market conditions warrant.

Capital guidance for our final year of the Beta Hunt 2.0Mtpa growth plan, involves mine development, equipment additions and growing the workforce to accommodate the higher production rates. The 10% increase in midpoint capital guidance reflects, among other things, the decision to move more aggressively in advancing the compelling Fletcher Zone, an impressive new area proximal to our Western Flanks and Larkin mining areas.

We look forward to continuing to deliver on our plan and extend the Beta Hunt mine life via the drill bit. With the current mining areas of Western Flanks and A Zone still growing, the Fletcher Zone is poised to be the next exciting new gold production target area joining Larkin, Mason and Cowcill. As we have stated before, the exploration and resource expansion potential at Beta Hunt remains wide open, which we look forward to drilling aggressively via another A$18 – $A23M exploration and resource development budget this year.

Overall, we are proud of the progress made to date on our growth plan which has delivered an aggressive organic expansion schedule through a challenging cost environment for the entire sector, taking Karora from a production level of just 99k oz in 2020 to the targeted 170,000 – 185,000 oz in 2024.”

Notes to Table 1

- 2024 guidance, which was announced in March 2023 (see Karora news release dated March 23, 2023), is updated as detailed above in Table 1.

- The Corporation’s guidance assumes targeted mining rates and costs, availability of personnel, contractors, equipment and supplies, the receipt on a timely basis of required permits and licenses, cash availability for capital investments from cash balances, cash flow from operations, or from a third-party debt financing source on terms acceptable to the Corporation, no significant events which impact operations, an A$ to US$ exchange rate of 0.67 and A$ to C$ exchange rate of 0.90. Assumptions used for the purposes of guidance may prove to be incorrect and actual results may differ from those anticipated. See below “Cautionary Statement Concerning Forward-Looking Statements”.

- Exploration expenditures include capital expenditures related to infill drilling for Mineral Resource conversion, capital expenditures for extension drilling outside of existing Mineral Resources and expensed exploration. Exploration expenditures also includes capital expenditures for the development of exploration drifts.

- Capital expenditures exclude capitalized depreciation and leased equipment.

- AISC calculations are for the Australian operations only, and exclude non-cash share-based payments expense, derivative settlements, and net realizable value adjustments to prior period stockpiles. The Company acquired the Lakewood mill in 2022 and embarked on an expansion program to grow the Beta Hunt gold mine to 2Mtpa mining rate during 2024. Mine development for projects with greater than 1 year mine life and equipment acquisition are being attributed to growth capital during this growth phase

- See “Risk Factors” described in the Corporation’s MD&A dated November 10, 2023.

About Karora Resources

Karora is focused on increasing gold production at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations in Western Australia. Ore is processed at two centralized plants: the 1.6 Mtpa Higginsville mill and the 1.0 Mtpa Lakewood mill, both located near our mining operations. At Beta Hunt, a robust gold Mineral Resource and Reserve is hosted in multiple gold shears, with gold intersections along a 5 km strike length remaining open in multiple directions. Higginsville has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,900 square kilometers. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the liquidity and capital resources of Karora, production guidance, full year consolidated 2024 production guidance and the potential of the Beta Hunt Mine and Higginsville Gold Operation, upgrades and expansions at the Lakewood Mill, and Karora’s future plans.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedarplus.ca.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

For more information, please contact:

Rob Buchanan

Director, Investor Relations

T: (416) 363-0649

www.karoraresources.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()