If the gold price rises, the gold mine operators follow

As a rule, in a gold bull market, the large gold mine operators rise first, followed by the gold royalty and streaming companies and then the junior and project developer companies. And the more the first two categories rise in value, the more the latter also gain momentum. This means that now could be a good time to invest in mining stocks. Because even a possible recession in the USA is not yet off the table. Past experience shows that gold stocks have risen between 30 and 187 percent during recessions. And in the recessions in which gold stocks fell, the decline was only two to five percent. Although the pause in most tariffs now announced by US President Donald Trump is a glimmer of hope, the future remains uncertain. On the relatively accurate forecasting platform Polymarket, the probability of recession is 39%.

Ongoing economic uncertainties and geopolitical disputes are weighing on the markets and increasing the appeal of gold as a safe haven. The high gold price should also ensure that more investors are interested in gold companies. Another point is the Fed’s interest rate decisions. Because if interest rates fall, this increases the attractiveness of gold. In April, the inflation rate in the US was 2.3%, the lowest level since February 2021, making interest rate cuts by the US Federal Reserve more likely again. And if the gold price weakens, this is likely to attract more participants back into the gold market and could bring an end to price corrections. In any case, solid gold mining stocks are an enrichment to the portfolio. GoldMining or Tudor Gold would come into consideration.

In British Columbia in the Golden Triangle, Tudor Gold – https://www.commodity-tv.com/ondemand/companies/profil/tudor-gold-corp/ – owns the prospective Treaty Creek project. Recent flotation tests consistently returned a high-grade copper concentrate with 30.3% copper, 36.5 grams of gold per tonne of rock and 99.8 grams of silver per tonne of rock.

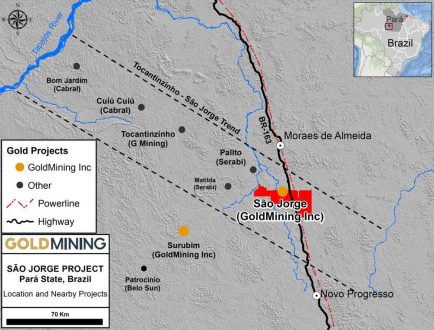

GoldMining – https://www.commodity-tv.com/ondemand/companies/profil/goldmining-inc/ – has gold and copper projects in North and South America, shares in Gold Royalty, U.S. GoldMining and NevGold. The Crucero project in Peru contains gold and antimony.

Current company information and press releases from GoldMining (- https://www.resource-capital.ch/en/companies/goldmining-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()