Gold continues its long-term upward trend

The mood in the precious metals sector is excellent. Silver is performing well, and many are betting on gold reaching the US$4,000 mark. From a technical perspective, the current resistance level for the gold price is US$3,500 per troy ounce. Even if the new US consumer prices put pressure on the gold price this week, this would be a buying opportunity and would not change the long-term upward trend. In 2024, the price of the precious metal rose by around 44 per cent, which is certainly good news for investors. Gold secures financial existence, and gold coins and bars can already be considered indispensable asset protection. Gold has proven itself, especially in crises and geopolitical upheavals, and the next crisis is sure to come. Gold is a stable asset and a must-have for portfolio diversification. In physical form, it functions as a portable store of value. Investors who want greater leverage on the price of gold are adding gold mining companies to their portfolios. Looking at the total cost of gold production, this is around US$1,400 to US$1,500 per ounce. Gold companies can therefore look forward to significantly higher margins.

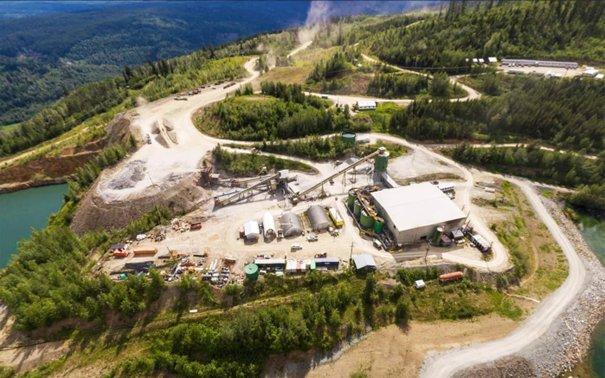

It is therefore worth taking a look at the stocks of gold companies such as Osisko Development – https://www.commodity-tv.com/ondemand/companies/profil/osisko-development-corp/ -. The company owns the Cariboo (Canada), San Antonio (Mexico), and Tintic (USA) projects. Production at Cariboo (approximately 190,000 ounces of gold per year over ten years) is scheduled to start in 2027.

Fortuna Mining – https://www.commodity-tv.com/ondemand/companies/profil/fortuna-mining-inc/ – is a successful gold and silver producer with mines in West Africa and Latin America. In the second quarter of 2025, more than 71,600 ounces of gold were produced.

Current company information and press releases from Fortuna Mining (- https://www.resource-capital.ch/en/companies/fortuna-mining-corp/ -) and Osisko Development (- https://www.resource-capital.ch/en/companies/osisko-development-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()