Precious metals are gaining in importance

Idaho has recently abolished the state income tax on silver and other precious metals, and Florida is now doing the same.

In addition to a tax reduction in Idaho, the exemption from taxes on precious metals has been added. Gold, silver, platinum and palladium are affected, in the form of coins or bars. The savings on income tax associated with the sale of precious metals will thus be extended. The attitude towards precious metals in general is therefore becoming more optimistic once again. The main consumer country China, always of interest, is busy importing gold from Hong Kong. Chinese demand for gold therefore appears to be increasing despite the high prices. It is probably investors rather than jewelry lovers who are stocking up and betting on gold as a safe haven.

China wants to increase its recoverable gold reserves by 2027. An important psychological aspect is likely to be the loss of confidence in fiat currencies. Precious metals are in high season. And so money is flowing into gold and also into silver, whereby a price explosion could be all the greater due to the small size of the silver market in this precious metal sector. Nowadays, investing savings in paper money involves risks. Government budget deficits are increasing, as are the necessary interest expenses, and precious metals are a good way for investors to escape the unrestrained printing of money and thus the destruction of value.

One important aspect is the counterparty risk. If there were liquidity problems on the US government bond market, there would be unpleasant problems. Investors cannot protect themselves against counterparty risk with paper money. The situation is different with precious metals. In order to avoid the risks of conventional gold mining, equity investors can fall back on royalty companies. Royalty and streaming companies are broadly diversified and largely exempt from the general mining risk (rising operating costs, etc.).

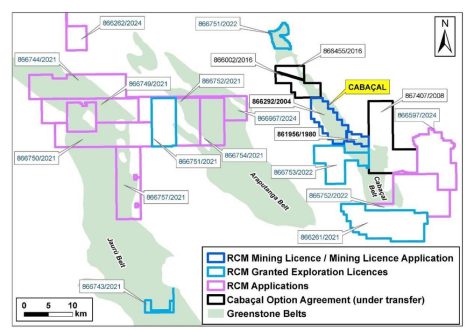

OR Royalties – https://www.commodity-tv.com/ondemand/companies/profil/osisko-gold-royalties-ltd/ -, active in North America, has license agreements and interests in the gold and copper sector, including the Malartic property, one of Canada’s largest mines.

Gold Royalty – https://www.commodity-tv.com/ondemand/companies/profil/gold-royalty-corp/ – looks after gold properties in North and South America. Both companies benefit from the high precious metal prices.

Current company information and press releases from OR Royalties (- https://www.resource-capital.ch/en/companies/or-royalties-inc/ -) and Gold Royalty (- https://www.resource-capital.ch/en/companies/gold-royalty-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()