Results for the six months ended 30 June 2025 – Short form announcement

SALIENT FEATURES FOR THE SIX MONTHS ENDED 30 JUNE 2025

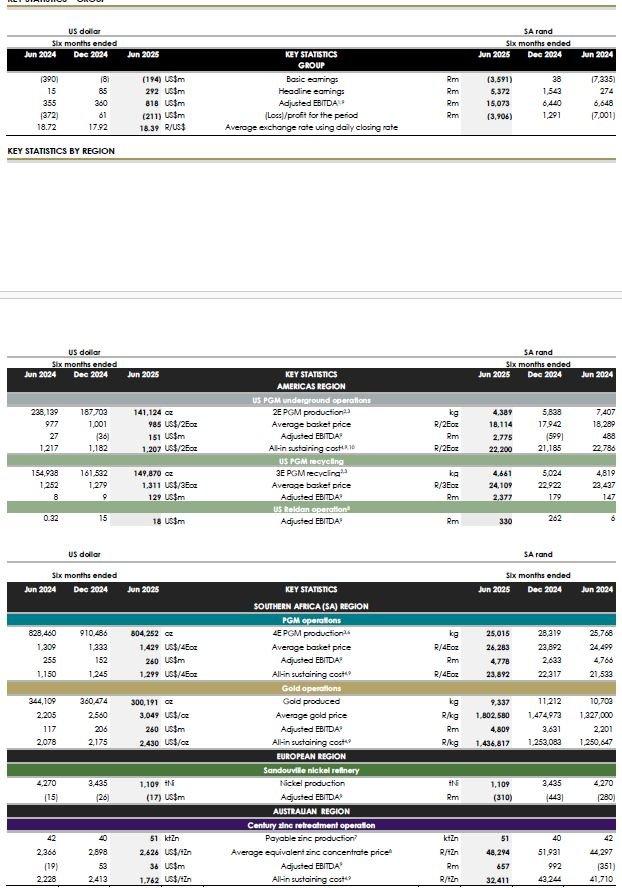

• R3.7bn (US$196m) reduction in basic loss to R3.6bn (US$194m). Headline earnings of R5.4bn (US$292m), 19 fold higher than H1 2024

– Difference between headline earnings and basic loss primarily due to impairments of R9.7bn (US$526m)

• R5.1bn (US$285m) S45X10 credit and restructuring of US PGM operations main factors reducing cost of sales and boosting earnings

• Including S45X10 credits, Group adjusted EBITDA1 increased to R15.1bn (US$818m), a 127% increase year-on-year

• Balance sheet reinforcement measures effective: Net debt:adjusted EBITDA1 of 0.89x at 30 June 2025, from 1.79x at 31 December 2024

• Positive earnings and cash flow outlook

• All Group operations improved and on track to achieve annual guidance, other than SA gold operations

– SA PGM operations: Steady, safe production and good cost management ensures ongoing profitability

– US PGM operations: Stabilised operations and improved profitability post restructuring

◦ Benefitted from US$159m (R2.8bn) in total S45X10 credits

– SA gold operations

◦ Adjusted EBITDA1 increased by 118% to R4.8bn (US$260m)

◦ Production 13% lower, primarily due to challenges at Kloof, which is under review

– US recycling operations contributed strongly to Group profit, including US$126m (R2.2bn) S45X10 credit for US PGM recycling operation

– Keliber lithium project nearing completion of construction phase, project capex to conclude in H1 2026

◦ Currently assessing options for a responsible start-up schedule given ongoing lithium surpluses markets and depressed prices

1. The Group reports adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) based on the formula included in the facility agreements for compliance with the debt covenant. Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Adjusted EBITDA is not a measure of performance under IFRS and should be considered in addition to and not as a substitute for any other measure of financial performance and liquidity. For a reconciliation of profit before royalties and tax to adjusted EBITDA, see note 11.1 of the consolidated interim financial statements

2. The US PGM operations’ underground production is converted to metric tonnes and kilograms, and financial performance is translated to SA rand (rand). In addition to the US PGM operations’ underground production, the operation treats various recycling material which is excluded from the 2E PGM production, average basket price and All-in sustaining cost statistics shown. PGM recycling represents palladium, platinum and rhodium ounces fed to the furnace

3. The Platinum Group Metals (PGM) production in the SA operations is principally platinum, palladium, rhodium and gold, referred to as 4E (3PGM+Au) and measured at the concentrator, and in the US underground operations is principally platinum and palladium, referred to as 2E (2PGM) and US PGM recycling is principally platinum, palladium and rhodium referred to as 3E (3PGM)

4. See “Salient features and cost benchmarks – Six months ” for the definition of All-in sustaining cost (AISC). The SA PGM All-in sustaining cost excludes the production and costs associated with the purchase of concentrate (PoC) from third parties

5. The acquisition of the Reldan Group of Companies (Reldan) was concluded on 15 March 2024. The six months ended 30 June 2024 only includes the results since acquisition

6. The SA PGM production excludes the production associated with the PoC from third parties. For a reconciliation of the production and third party PoC, refer to the "Reconciliation of operating cost excluding third party PoC for Total SA PGM operations and Marikana – Six months"

7. Payable Zinc production is the payable quantity of zinc metal produced after applying smelter content deductions

8. Average equivalent zinc concentrate price is the total zinc sales revenue recognised at the price expected to be received excluding the fair value adjustments divided by the payable zinc metal sold

9. Adjusted EBITDA and AISC are not measures of performance under IFRS and should not be considered in isolation or as substitutes for measures of financial performance prepared in accordance with IFRS. See "Non-IFRS measures" for more information on the Non-IFRS metrics presented by Sibanye-Stillwater

10. The US PGM operations’ All-in sustaining cost for the six months ended 31 December 2024 and 30 June 2024 were adjusted to include the Section 45X (S45X) Advance Manufacturing Production Credits. During the six months ended 30 June 2025 the US PGM operations recognised R699 million (US$39 million) and R563 million (US$30 million) which related to mining costs for the six months ended 31 December 2024 and 30 June 2024, respectively The non-IFRS measures presented in this short form announcement are considered to be pro forma financial information in terms of the JSE Listings Requirements and have been prepared for illustration purposes only and are the responsibility of the board of directors of Sibanye-Stillwater. Because of their nature, they may not fairly present the Company’s financial position, changes in equity, results of operations or cash flows.

OVERVIEW OF THE RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2025

The Group operating and financial performance for H1 2025 was pleasing, with safe production and costs from the operations consistent, and largely in line with the intended outcomes of the operational restructuring undertaken from mid-2023.

Greater operational stability and good cost control at most Group operations, combined with leveraged exposure of the SA gold operations to the rand gold price has notably improved Group profitability for H1 2025.

The positive financial outcomes from solid operational management and decisive restructuring, were amplified by the incorporation of Section 45X credits in terms of the Inflation Reduction Act (IRA), following agreements reached with third party refiners of our PGMs. A total S45X credit of R5.1 billion (US$285 million) (comprising combined estimated credits for 2023, 2024 and H1 2025), has been recognised in cost of sales for the US PGM mining and recycling operations for the period, benefiting cost and boosting profitability for H1 2025, with associated cash payments expected in 2026.

Improved operational profitability and cash flow, together with effective balance sheet management and reinforcement measures implemented during 2024, has enhanced the Group financial position, and I am satisfied that the Group is well positioned to thrive under multiple scenarios and to create ongoing shared value for stakeholders.

SAFE PRODUCTION AND OPERATIONAL EXCELLENCE

I am particularly pleased with the continued improvement in most of the Group’s key safety statistics and performance, especially while navigating a challenging environment and through a disruptive period of restructuring and change.

The Group Total Recordable Injury Frequency Rate (TRIFR) of 3.90 per million hours worked for H1 2025 was 12% lower than for H1 2024 and was the lowest level reached for TRIFR since we began tracking it in 2020. Group Serious Injury Frequency Rate (SIFR) and TRIFR have both shown favourable compound annual declines of 14% and 16% respectively over the past 3 1/2 years. The Group Fatal Injury Frequency Rate (FIFR) for H1 2025 of 0.038 improved by 5% year-on-year (H1 2024 of 0.04) and was 24% lower than the 3-year trailing FIFR, representing a sustained improvement in safety across the Group since 2022.

Despite the general reduction in the Group lagging indicators, the loss of three colleagues from the SA region during H1 2025 (H1 2024: 3) is an ongoing reminder that we still have a challenging journey to achieve our goal of zero harm. We mourn the tragic loss of these employees and will continue to focus on the implementation of our fatal elimination strategy to maintain our safe production focus.

OPERATIONAL EXCELLENCE AND OPTIMISING PROFITABILITY

All Group operations other than the SA gold operations are on track to deliver safe production and unit costs within annual guidance ranges for 2025, as well as improved profitability. Only the SA gold operations fell short of planned production and cost levels, but continued to benefit from leverage to the increasing gold price during H1 2025, delivering a significantly improved financial contribution.

The SA PGM operations continued to deliver steady and reliable results, as they have done consistently since they were acquired and integrated into the Group. Since 2016, the SA PGM operations have met or exceeded annual guidance every year, other than in 2022, when unanticipated stage 6 load shedding by Eskom from September 2022 severely disrupted the entire SA mining industry.

Production from the SA PGM operations (including attributable production from Mimosa and purchase of concentrates (PoC)) for H1 2025 was 4% lower year-on-year due to surface production declining by 30% year-on-year, primarily due to heavy rainfall during Q1 2025 which disrupted PGM production throughout the SA PGM industry. Underground production was flat year-on-year.

Adjusted EBITDA from the SA PGM operations of R4.8 billion (US$260 million) for H1 2025 was in line with H1 2024, despite 151,863 4Eoz (16%) less 4E PGM sold year-on-year. A 7% higher average basket price received for H1 2025 offset lower metal sales. The inventory built-up during H1 2025, is expected to be processed and sold in H2 2025. Compared with H2 2024, adjusted EBITDA for H1 2025 was 81% higher, primarily driven by a 10% increase in the average 4E basket price.

The restructuring of the US PGM operations during Q4 2024 was successfully implemented, with production and cost for H1 2025 ahead of planned restructuring levels and, on an annualised basis, better than 2025 guidance.

The profitability of the US PGM operations also improved despite lower metal sales due to a build-up of inventory during the smelter transition in Q2 2025 and an average 2E PGM basket price for H1 2025, that was less than 1% higher than for H1 2024. On a like-for-like basis, adjusted EBITDA (excluding S45X credits) for H1 2025 improved by US$8 million (R273 million) to a loss of US$9 million (R51 million), compared with an adjusted EBITDA loss of US$16 million (R324 million) for H1 2024 (excluding the once off US$43 million (R812 million) insurance payment during Q1 2024, related to the mid-2022 flooding event).

The average 2E PGM basket price for Q3 2025 to date is US$1,229/2Eoz. This is 25% higher than the average for H1 2025 of US$985/oz and 9% below AISC (excluding S45X credits) of US$1,351/oz. Similarly to the SA PGM operations, if higher PGM prices persist, the profitability of the US PGM operations should increase substantially.

During Q2 2025, agreement was reached with the contract refiner with both parties signing certification statements reflecting this agreement. Consequently, total S45X credits of US$159 million (R2.8 billion) for the PGM underground operations, were recognised during Q2 2025, comprising a credit against cost of US$20 million (R360 million)) for H1 2025 and full year credits of US$70 million (R1.2 billion) and US$69 million (R1.2 billion) for 2023 and 2024 respectively, significantly benefiting cost and profitability for the US PGM operations for the period.

Adjusted EBITDA for the US PGM operations including just the H1 2025 S45X credit of US$20 million (R360 million), would have increased to US$11 million (R309 million). Combined with the full S45X credits for 2023 and 2024, adjusted EBITDA for the US PGM operations increased substantially to US$151 million (R2.8 billion) for H1 2025, 457% higher than for H1 2024.

The SA gold operations are highly leveraged to the dollar gold price and rand:dollar exchange rate. Despite operational challenges which reduced production by 13% year-on-year, adjusted EBITDA for H1 2025 increased by 118% to R4.8 billion (US$260 million) from R2.2 billion (US$117 million) for H1 2024, driven by a 36% year-on-year increase in the average received gold price to R1,802,580/kg (US$3,049/oz). This is the highest adjusted EBITDA from the SA gold operations since H2 2020, and accordingly, the contribution from the SA gold operations to Group adjusted EBITDA for H1 2025 (excluding total S45X credits) increased to 48% from 33% for H1 2024, confirming the strategic importance of the SA gold assets in the diversified Group portfolio.

Gold production from the managed SA gold operations (excluding DRDGOLD) decreased by 14% primarily due to ongoing challenges at the Kloof operation, with AISC for H1 2025, increasing by 17% due to 21% lower gold sold year-on-year.

The average gold price received by the SA managed operations for H1 2025 (including gold hedges), increased by 33% to R1,756,996/kg (US$2,972/oz), significantly enhancing operational profitability. Adjusted EBITDA (excluding DRDGOLD) increased by 166% to R3.0 billion (US$160 million) compared to R1.1 billion (US$59 million) in H1 2024.

The Century zinc retreatment operations in the Australian region also performed strongly, with production 22% higher year-on-year and AISC 22% lower. Adjusted EBITDA of R657 million (US$36 million) for H1 2025 was a substantial turnaround from the adjusted EBITDA loss for H1 2024 of R351 million (US$19 million), reflecting an all-round good performance and greater operational stability through measures implemented to sustain production through the wet season that had affected production in previous years.

The US PGM recycling operation was stable year-on-year, with recycling constrained by low automobile scrappage rates. The average 3E PGM recycling basket price of US$1,311/3Eoz (R24,109/3Eoz) for H1 2025 was 5% higher than for H1 2024, partially offsetting 14% lower 3E PGM ounces sold due to a build up of inventory during the smelter transition.

As a result of lower 3E sales (and build up in inventory), on a like-for like basis, adjusted EBITDA (excluding S45X credits) of US$4 million (R150 million) was 55% lower year-on-year. Excess inventory is expected to be processed and sold during H2 2025 and, benefiting from higher average PGM prices for Q3 2025 to date, boosting revenue for the coming period.

The US PGM recycling operations also qualify for S45X credits, which boosted adjusted EBITDA for H1 2025 by US$121 million (R2.2 billion) to US$129 million (R2.4 billion). The total credits of US$126 million (R2.2 billion) comprised US$16 million (R289 million) for H1 2025, US$40 million (R711 million) for 2024 and US$69 million (R1.2 billion) for 2023.

The Reldan recycling operation generated adjusted EBITDA of US$18 million (R330 million) for H1 2025, 20% higher than for H2 2024, the previous full 6-month period since it was incorporated into the Group in March 2024. Revenues benefited from higher gold and silver prices during the period.

In our EU region, the ramp down of the Sandouville refinery is nearing completion and preparation for the care and maintenance phase is ongoing. Production of nickel cathode and nickel salts from nickel matte was stopped by end of Q2 and only some areas of the down stream process remain open to allow for recycling and recovery of nickel from the effluents. Adjusted EBITDA losses of R310 million (US$17 million) for H1 2025 are expected to reduce once the operations are on care and maintenance.

The GalliCam project prefeasibility study is expected to be completed around year end.

The Keliber lithium project remains on track for completion of the construction phase during H1 2026. 2025 marks the peak of project capital expenditure, with capital commitments forecast to decline significantly from H1 2026.

The Keliber lithium project remains the most advanced, fully integrated lithium hydroxide project in the EU region, offering a significant competitive advantage for value realisation in a more supportive price environment. In light of revisions to medium term lithium market fundamentals and price forecasts, we are currently assessing various scenarios to ensure that a decision on the full commissioning and production build up, is adequately informed and responsible, with a primary focus on timing of market entry to optimise value.

FINANCIAL HEALTH

The Group is in a sound financial position. Balance sheet ratios are healthy, secured by capital reinforcement and disciplined capital allocation during 2024, underpinned by improving operational profitability and cash flows. With precious metals prices well supported, the projected outlook for key financial health indicators is positive.

Greater operational stability and good cost control from most Group operations, combined with the leveraged exposure of our SA gold operations to the increasing gold price, have notably improved Group profitability.

Importantly, this upward trend in Group profitability reflects the benefits of repositioning and restructuring of operations which stabilised production and cost from most Group operations, which underpinned a 51% increase in Group adjusted EBITDA (excluding all S45X credits) to R10.0 billion (US$533 million) for H1 2025 from adjusted EBITDA of R6.6 billion (US$355 million) for H1 2024.

The financial turnaround for H1 2025 was significantly amplified by the incorporation of Advance Manufacturing Production credits in terms of Section 45X of the Inflation Reduction Act (IRA), which have been secured for the US PGM operations following agreement reached with the US PGM third party refiner.

S45X credits for both the US underground and recycling operations for FY2023, FY2024 and H1 2025 totalling R5.1 billion (US$285 million) were recognised during Q2 2025, boosting Group adjusted EBITDA (including S45X credits) to R15.1 billion (US$818 million), 127% higher than adjusted EBITDA of R6.6 billion (US$355 million) for H1 2024, albeit not directly comparable year-on-year.

The same positive trend was reflected in Group adjusted free cash flow (FCF), which improved by R12.4 billion (US$610 million) to positive FCF of R4.5 billion (US$243 million) for H1 2025, from a free cash outflow of R6.9 billion (US$367 million) for H1 2024.

Group FCF was boosted by the R9.2 billion (US$500 million) proceeds from the Franco Nevada streaming transaction, concluded in February 2025. Excluding the streaming proceeds would have resulted in a R4.7 billion (US$258 million) FCF outflow for the Group for H1 2025. This is still substantially improved compared with H1 2024, despite the substantial buildup of inventory at the gold and PGM operations which reduced metal sales and FCF from these operations during H1 2025. This inventory is expected to be processed during H2 2025, enhancing cash flow for the period.

The Group’s cash balance (excluding Burnstone) increased by 31% from 31 December 2024 to R21.0 billion (US$1.1 billion) at 30 June 2025, primarily due to the streaming proceeds.

Gross debt (excluding Burnstone) increased by 2% to R40.2 billion (US$2.3 billion) at 30 June 2025, primarily due to project capital expenditure at the Keliber Lithium project.

Net debt decreased by R4.2 billion (US169 million) to R19.2 billion (US$1.1 million) at 30 June 2025, which together with the a 64% increase in the 12 month trailing adjusted EBITDA to R21.5 billion (US$1.2 billion), resulted in the Group’s net debt to adjusted EBITDA reducing to 0.89x, which is pleasing considering substantial capital investment in key projects through the price cycle.

The Group financial position is robust, with sufficient balance sheet liquidity headroom of R46.9bn (US$2.6bn), debt maturities which are well structured and undemanding, Group net debt:adjusted EBITDA which is within comfort levels and well below debt covenant levels. SA gold and SA PGM operations are expected to deliver improved operating results during H2 2025. Metal sales for the period are likely to be enhanced by a release of inventory built up during H1 2025. The US PGM operations are similarly expected to benefit from a release of inventory and higher metal sales for H2 2025.

The SA gold operations and SA and US PGM operations are highly leveraged to metal prices as is evident from the sharp increase in profitability for H1 2025, despite relatively modest metal price increases. Gold and PGM prices have rallied further during Q3 2025 (for Q3 2025 to date, averaging R1,934,171/kg (+5%), R31,328/4Eoz (+19%) and US$1,229/2Eoz (+25%)), which suggests significant upside for earnings and cash flow should higher prices be maintained.

The Group cash position will be further enhanced in 2026, by the expected R4,404 million (US$248.5 million) S45X credits cash payment to the US PGM operations.

Losses from the Sandouville refinery are also anticipated to decline when the facility is placed on planned care and maintenance at year end.

Furthermore, as detailed in the Q1 2025 operating results, Group cash flow is expected to benefit from substantially reduced annual project capital expenditure for the Keliber lithium project (from capital guidance of €300 million (R5.9 billion) for 2025), following the forecast completion of the construction/development phase of the Keliber lithium project, scheduled for H1 2026.

The Marikana K4 shaft is also nearing completion of the project phase, with project capital expected to decline from current levels of R309 million (US$17 million) for H1 2025, and its contribution to revenue from the Marikana operation, increasing as production continues to ramp up.

As such, there is a high probability that cash flow for H2 2025 and FY2026 could increase substantially, supporting a reduction in Gross debt, which will further strengthen the Group financial position, and provide for increased dividends to shareholders.

STRATEGIC POSITIONING

I am confident that the proactive and decisive actions taken over the past 2 years to optimise operational profitability and secure the financial sustainability of the Group through an extended trough in commodity prices, have successfully managed risk and aided in preserving value.

The decisions we took and actions we implemented were not taken lightly, but were deeply considered and measured, avoiding knee-jerk responses to the deteriorating environment, before being decisively implemented.

We approached the restructuring in a phased and considered manner, focusing on high-cost mines to restore profitability and ensure their survival, and closing shafts which were at, or close to, the end of their operating lives, or unable to restructure effectively.

Our strategic positioning in the US, European and Australian ecosystems has been guided by our recognition in 2021 that the global trade model was unsustainable and that there would be a shift towards establishment of regional value chains, which we called multipolarity. We anticipated that achieving greater trade independence would require significant financial support and investment from regional governments, which would benefit strategically positioned businesses.

This led to us keeping the US PGM operations in production at reduced scale despite sentiment from some analysts and investors that they should be shut down. I am pleased to say this appears to be the right decision by the Group. The US PGM operations are the only source of primary PGM supply in the US and are of strategic importance not just for Sibanye-Stillwater, but for the US. The phased repositioning and restructuring we implemented at these operations since 2022, together with the S45X credits, which will provide critical financial support for the next 8 years, has already enhanced their potential sustainability.

The Group filed anti-dumping and countervailing duty petitions on unwrought Palladium from Russia on 30 July 2025, following significant engagement with the US Treasury. The petition was filed together with the United Steelworkers Union and with support from over 70% of US Palladium value chain participants.

The purpose of US anti-dumping and countervailing duty law is to ensure that domestic producers can compete on a level playing field by addressing market distortions caused by unfair trade practices. Parallel investigations by the US Department of Commerce and the US International Trade Commission will take about 13 months although preliminary duties may be imposed within five months of the filing.

The rationale for our application is to protect a strategic asset for the US and protect our US PGM operations from uneven trade practices, for the benefit of stakeholders including employees and communities in Montana.

Our projects in the European region, the Keliber lithium project and GalliCam project, have both been granted ‘strategic project’ status under the EU critical raw materials act (CRMA), with the GalliCam project having been awarded a conditional grant of €144 million from the European Innovation Fund.

While taking decisive action to improve operational profitability and reinforce our Balance sheet, and despite the trough in prices, we continued to invest in key projects that were approved and were under development, such as the Marikana K4 project and the Keliber lithium project. Both of these projects are well advanced, with the K4 project in the production buildup phase, with project capital expenditure reducing, and the Keliber lithium project nearing completion of the construction phase.

The K4 project at Marikana operations is a world class PGM project with a LOM of more than 30 years that was substantially developed with capital invested by Lonmin before it was put on care and maintenance in 2015/16. Sibanye-Stillwater resumed project development in 2021 and it has significantly advanced, with the ramp up of production to full production of 250,000 4Eoz underway for three years already, steadily increasing its contribution to Marikana production and reducing unit costs.

The Keliber lithium project remains the most advanced, fully integrated lithium hydroxide project in the EU region, offering a significant competitive advantage for value realisation by supplying locally mined and beneficiated critical metals to the European battery ecosystem.

The lithium market has been in surplus since 2023, which has continued to weigh on lithium prices during H1 2025. Despite lithium prices falling well into the industry cost curve, there has been limited response from producers. Absent any material supply response, the lithium market is forecast to remain in surplus for longer, extending the trough in prices. Despite a slowdown in forecast battery electric vehicles (BEV) sales growth, lithium demand is expected to continue to increase steadily, albeit at a reduced rate than previously projected by the market. Our fundamental long-term outlook for the lithium market therefore remains unchanged, however these factors have contributed to a more extended period of oversupply and low prices, than previously forecast.

We successfully funded these projects through peak capex phases, while maintaining our financial integrity, contrary to expectations of many market commentators. Project capital requirements for these projects are forecast to decrease significantly during 2026, enhancing cash flow. Further to investing in these key projects through the cycle, opportunities to optimise the potential of the SA PGM operations continue to be assessed.

The acquisition of Valterra’s 50% share in the Kroondal PSA and full consolidation of Kroondal into the Rustenburg operation during H2 2024, allows opportunities for further synergies and value unlock, in addition to the cross boundary mining already taking place. During Q2 2025, the Board approved the Bambanani-Siphumelele project as the next step in realising value from this acquisition. This brownfield project involves the extension of the Bambanani decline allowing extraction of Siphumelele UG2 reserves from low cost mechanised Bambanani infrastructure. The Siphumelele vertical shaft provides more efficient man and materials logistics resulting in significant cost benefits for both operations. This logical, relatively low capital intensity project, is expected to deliver extend the life of both the Siphumelele and Bambanani mines, and forecast to deliver quick payback of invested capital, thereby ensuring high returns for the Group and unlocking of shared value for all stakeholders.

Low capital intensity,brownfields projects such as this are a logical continuation of the consolidation of our SA PGM assets which began in 2016 and offer significant potential to maintain higher production from these assets over a longer LOM than currently planned, through the realisation of further operational and cost synergies. There is also significant potential to reprocess extensive surface resources, which is currently being assessed and is expected to extend the life of the surface operations significantly.

The agreement announced on 19 February 2025 regarding the Glencore/Merafe JV is expected to significantly increase chrome yields and production from the SA PGM operations, and accelerate completion of delivery of contracted chrome volumes agreed in 2011 between Lonmin and the Glencore/Merafe JV Venture, by approximately 20 years. Thereafter, Sibanye-Stillwater’s attributable share of value from chrome production from the Marikana CRPs is expected to be significantly enhanced from greater exposure to chrome prices, and anticipated future chrome production growth. The improved economics of Sibanye-Stillwater’s chrome production are expected to enhance the inherent value and commercial viability of development and extension brownfields projects at the SA PGM operations, which are currently being assessed.

DIVIDEND DECLARATION

Despite normalised earnings of R1,832 million for the six months ended 30 June 2025, the Board has decided to maintain a more prudent and conservative approach considering the uncertain global economic and geo-political backdrop and resolved not to declare an interim dividend for 2025. A decision on an appropriate full year dividend for 2025, will instead be made by the Board of Directors after assessing the financial results for the year ending 31 December 2025 together with the prevailing operating context. No dividends were declared for 2024.

This short-form announcement is the responsibility of the board of directors of the Company (Board). The information disclosed is only a summary and does not contain full or complete details. Any investment decisions by investors and/or shareholders should be based on a consideration of the full financial results for the six months ended 30 June 2025 (results booklet) as a whole and shareholders are encouraged to review the results booklet, which is available for viewing on the Company’s website at https://www.sibanyestillwater.com/… and via the JSE at https://senspdf.jse.co.za/….

Contact:

Email: ir@sibanyestillwater.com

James Wellsted

Executive Vice President: Investor Relations and Corporate Affairs

+27(0)83 453 4014

Website: www.sibanyestillwater.com

In Europe

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Sponsor: J.P. Morgan Equities South Africa Proprietary Limited

DISCLAIMER FORWARD LOOKING STATEMENTS

The information in this report may contain forward-looking statements within the meaning of the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements, including, among others, those relating to Sibanye Stillwater Limited’s (Sibanye-Stillwater or the Group) financial positions, business strategies, business prospects, industry forecasts, production and operational guidance, climate and ESG-related targets and metrics, plans and objectives of management for future operations, are necessarily estimates reflecting the best judgment of the senior management and directors of Sibanye-Stillwater and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward-looking statements should be considered in light of various important factors, including those set forth in this report.

All statements other than statements of historical facts included in this report may be forward-looking statements. Forward-looking statements also often use words such as “will”, “would”, “expect”, “forecast”, “potential”, “may”, “could”, “believe”, “aim”, “anticipate”, “target”, “estimate” and words of similar meaning. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances and should be considered in light of various important factors, including those set forth in this disclaimer. Readers are cautioned not to place undue reliance on such statements.

The important factors that could cause Sibanye-Stillwater’s actual results, performance or achievements to differ materially from estimates or projections contained in the forward-looking statements include, without limitation, Sibanye-Stillwater’s future financial position, plans, strategies, objectives, capital expenditures, projected costs and anticipated cost savings, financing plans, debt position and ability to reduce debt leverage; economic, business, political and social conditions in South Africa, Zimbabwe, the United States, Europe and elsewhere; plans and objectives of management for future operations; Sibanye-Stillwater’s ability to obtain the benefits of any streaming arrangements or pipeline financing; the ability of Sibanye-Stillwater to comply with loan and other covenants and restrictions and difficulties in obtaining additional financing or refinancing; Sibanye-Stillwater’s ability to service its bond instruments; changes in assumptions underlying Sibanye-Stillwater’s estimation of its Mineral Resources and Mineral Reserves; any failure of a tailings storage facility; the ability to achieve anticipated efficiencies and other cost savings in connection with, and the ability to successfully integrate, past, ongoing and future acquisitions, as well as at existing operations; the ability of Sibanye-Stillwater to complete any ongoing or future acquisitions; the success of Sibanye-Stillwater’s business strategy and exploration and development activities, including any proposed, anticipated or planned expansions into the battery metals or adjacent sectors and estimations or expectations of enterprise value; the ability of Sibanye-Stillwater to comply with requirements that it operate in ways that provide progressive benefits to affected communities; changes in the market price of gold, silver, PGMs, battery metals (e.g., nickel, lithium, copper and zinc) and the cost of power, petroleum fuels, and oil, among other commodities and supply requirements; the occurrence of hazards associated with underground and surface mining; any further downgrade of South Africa’s credit rating; the impact of South Africa’s greylisting; a challenge regarding the title to any of Sibanye-Stillwater’s properties by claimants to land under restitution and other legislation; Sibanye-Stillwater’s ability to implement its strategy and any changes thereto; the outcome of legal challenges to the Group’s mining or other land use rights; the occurrence of labour disputes, disruptions and industrial actions; the availability, terms and deployment of capital or credit; changes in the imposition of industry standards, regulatory costs and relevant government regulations, particularly environmental, sustainability, tax, health and safety regulations and new legislation affecting water, mining, mineral rights and business ownership, including any interpretation thereof which may be subject to dispute; the outcome and consequence of any potential or pending litigation or regulatory proceedings, including in relation to any environmental, health or safety issues; failure to meet ethical standards, including actual or alleged instances of fraud, bribery or corruption; the effect of climate change or other extreme weather events on Sibanye-Stillwater’s business; the concentration of all final refining activity and a large portion of Sibanye-Stillwater’s PGM sales from mine production in the United States with one entity; the identification of a material weakness in disclosure and internal controls over financial reporting; the effect of US tax reform legislation on Sibanye-Stillwater and its subsidiaries; the effect of South African Exchange Control Regulations on Sibanye-Stillwater’s financial flexibility; operating in new geographies and regulatory environments where Sibanye-Stillwater has no previous experience; power disruptions, constraints and cost increases; supply chain disruptions and shortages and increases in the price of production inputs; the regional concentration of Sibanye-Stillwater’s operations; fluctuations in exchange rates, currency devaluations, inflation and other macro-economic monetary policies; the occurrence of temporary stoppages or precautionary suspension of operations at its mines for safety or environmental incidents (including natural disasters) and unplanned maintenance; Sibanye-Stillwater’s ability to hire and retain senior management and employees with sufficient technical and/or production skills across its global operations necessary to meet its labour recruitment and retention goals, as well as its ability to achieve sufficient representation of historically disadvantaged South Africans in its management positions, or maintain required board gender diversity; failure of Sibanye-Stillwater’s information technology, communications and systems, evolving cyber threats to Sibanye-Stillwater’s operations and the impact of cybersecurity incidents or breaches; the adequacy of Sibanye-Stillwater’s insurance coverage; social unrest, sickness or natural or man-made disaster in surrounding mining communities, including informal settlements in the vicinity of some of Sibanye-Stillwater’s South African-based operations; and the impact of contagious diseases, including global pandemics.

Further details of potential risks and uncertainties affecting Sibanye-Stillwater are described in Sibanye-Stillwater’s filings with the Johannesburg Stock Exchange and the United States Securities and Exchange Commission, including the 2024 Integrated Report and the Annual Financial Report for the fiscal year ended 31 December 2024 on Form 20-F filed with the United States Securities and Exchange Commission on 25 April 2025 (SEC File no. 333-234096).

These forward-looking statements speak only as of the date of the content. Sibanye-Stillwater expressly disclaims any obligation or undertaking to update or revise any forward-looking statement (except to the extent legally required). These forward-looking statements have not been reviewed or reported on by the Group’s external auditors.

NON-IFRS1 MEASURES

The information contained in this report may contain certain non-IFRS measures, including, among others, adjusted EBITDA, adjusted free cash flow, AISC, AIC and normalised earnings. These measures may not be comparable to similarly-titled measures used by other companies and are not measures of Sibanye-Stillwater’s financial performance under IFRS Accounting Standards. These measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS Accounting Standards. Sibanye-Stillwater is not providing a reconciliation of the forecast non-IFRS financial information presented in this report because it is unable to provide this reconciliation without unreasonable effort. These forecast non-IFRS financial information presented have not been reviewed or reported on by the Group’s external auditors.

1 IFRS refers to International Financial Reporting Standards Accounting Standards (IFRS Accounting Standards) as issued by the International Accounting Standards Board (IASB)

WEBSITES

References in this document to information on websites (and/or social media sites) are included as an aid to their location and such information is not incorporated in, and does not form part of, this report.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()