Southern Cross Gold announces drilling results at Golden Dyke demonstrate high-grade gold mineralization and system expansion

Five High Level Takeaways:

1. Large Intersection with Multiple Gold Zones – Drillhole SDDSC177 intersected 168 m of continuous mineralization containing ten separate vein sets averaging 3.0 g/t gold equivalent (uncut). This result demonstrates that Golden Dyke is a large-scale system, one of five mineralized bodies at Sunday Creek.

2. High-Grade Gold Hits – Multiple ultra-high-grade intercepts including 254 g/t gold over 0.4 m, 244 g/t gold over 0.1 m, and 184 g/t gold over 0.2 m demonstrate the Sunday Creek’s ability to deliver spectacular individual high-grades.

3. New Discoveries at Depth – Drilling confirmed a 100 m vertical extension of known mineralization and discovered a new high-grade vein set that returned an exceptional antimony grade of 52.3% – the third-highest ever recorded at Sunday Creek.

4. Golden Dyke and Rising Sun May Be Connected – Growing evidence suggests these two deposits share the same characteristics and may form one continuous mineralized corridor—potentially doubling the scale of the system.

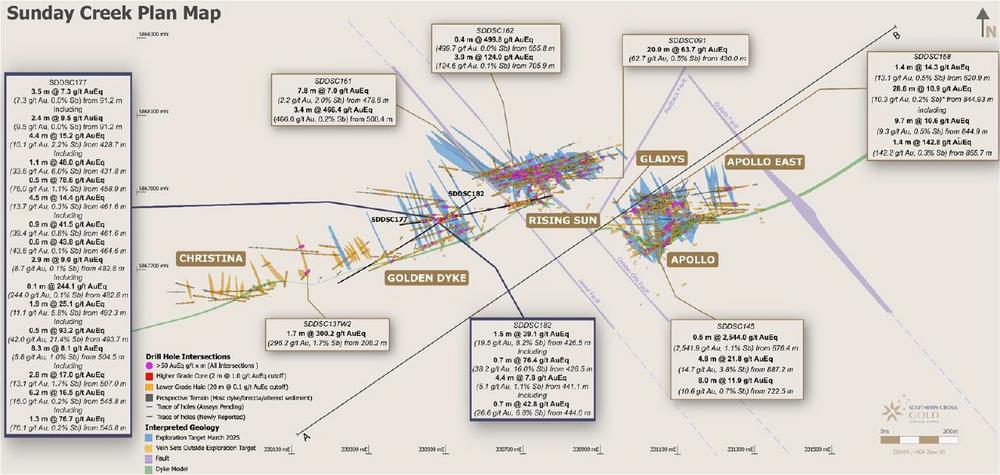

5. Further Drill Target Identified – Identification of an 80 to 100 m gap between Golden Dyke and Rising Sun that to date hasn’t been properly tested, and our rigs are now positioned to drill this high-priority target area (Figure 5).

Michael Hudson, President & CEO states: "SDDSC177’s intersection of ten distinct vein sets over 168 m at 3.0 g/t AuEq (uncut) with cumulative intercepts exceeding 500 g/t AuEq x m demonstrates the substantial metal endowment at Golden Dyke. We’ve confirmed a 100 m vertical extension on the GD120 vein set and discovered a new high-grade vein set that returned 52.3% Sb over 0.2 m with 35.9 g/t Au – the third-highest antimony assay across the entire Sunday Creek project.

“The 168 m intersection in SDDSC177 at 3.0 g/t AuEq (2.35 g/t Au, 0.26% Sb) represents a significant system-scale result at Golden Dyke, comparable in width and character to the landmark SDDSC050 intersection at Rising Sun. SDDSC050, announced in November 2022, returned 305.8 metres at 2.4 g/t AuEq (1.6 g/t Au, 0.5% Sb) from 319.2m depth and was drilled in a west-to-east orientation across the Rising Sun structure. Like SDDSC050, SDDSC177 was oriented at a high angle to the strike of the mineralized vein sets.

"Golden Dyke is increasingly looking like part of the same connected system as Rising Sun. We’re seeing consistent visible gold, high antimony approaching pure stibnite, and discrete high-grade cores within broader halos. The bonanza intercepts – 254 g/t Au over 0.4 m, 244 g/t Au over 0.1 m, and 184 g/t Au over 0.2 m with 14.8% Sb – are Rising Sun-style quality results.

"Our systematic drill review has identified 80 m to 100 m of inadequately tested strike length between Golden Dyke and Rising Sun – representing a potential 160 m strike extension equivalent to another Rising Sun scale deposit. This dual character of bonanza intercepts like 6.2 m @ 16.5 g/t AuEq (16.0 g/t Au, 0.2% Sb). nested within broader zones like 168 m at 3.0 g/t AuEq (uncut) gives us the potential for significant mining optionality. "We’ve repositioned our deep core rig to test these corridors and the deepest Golden Dyke sections. With 37

For Those Who Like the Details – Highlights:

1. Ten Vein Sets Intercepted in a Single Hole – SDDSC177 intersected 10 distinct mineralized vein sets within the main Golden Dyke zone 168 m at 3.0 g/t AuEq (2.4 g/t Au, 0.3% Sb) (uncut) from 392.4 m including 6.2 m @ 16.5 g/t AuEq (16.0 g/t Au, 0.2% Sb) from 545.8 m, demonstrating exceptional structural complexity and stacked mineralization geometry.

2. 500+ Gram-Metre Cumulative Grade – SDDSC177 achieved cumulative intercepts exceeding 500 gram-metres, with multiple intervals over 100 g/t AuEq x m and three intervals ranging from 50 to 100 g/t AuEq x m, indicating substantial metal accumulation in a single drill traverse.

3. 100-Metre Vertical Step-Out Confirmed – Successfully extended the GD120 vein set 100 m vertically below previous drilling, proving both significant mineralization continuity and depth potential.

4. New High-Grade Core Discovery (SDDSC177) – Identified a previously unknown high-grade core zone outside the current exploration target area, currently defined by only two pierce points but showing exceptional grade and tenor characteristics.

5. Project Record Antimony Grades (SDDSC177) – Returned 52.3% Sb and 35.9 g/t Au over 0.2m from 493.7 m – the third-highest individual antimony assay on the entire Sunday Creek project, approaching theoretical maximum of pure stibnite (71% Sb).

6. Bonanza Gold Intercepts Throughout System – SDDSC177 returned three individual assays exceeding 100 g/t Au, demonstrating consistent high-grade tenor across the mineralized envelope. The deepest intercept of 254 g/t Au over 0.4 m (from 545.9m downhole, 0.25% Sb) occurs within a broader 6.2 m @t 16.5 g/t AuEq from 545.8 m – exemplifying the nested high-grade shoots within economic envelopes. At mid-levels, 244 g/t Au over 0.1 m (from 482.8m downhole, 0.1% Sb) within a 2.9 m interval at 9.0 g/t AuEq demonstrates sharp, discrete high-grade cores characteristic of Rising Sun-style mineralization. Higher in the system, 184 g/t Au over 0.2 m with 14.8% Sb (from 431.8m downhole) forms part of a 4.4 m zone at 15.2 g/t AuEq, showing strong gold-antimony correlation typical of high-tenor zones.

7. Exceptional Combined Gold-Antimony Grades – The intersection of 93.2 g/t AuEq over 0.5 m (42.0 g/t Au, 21.4% Sb) from 493.7 m downhole within a 1.9 m interval at 25.1 g/t AuEq demonstrates the deposit’s dual-commodity potential and premium metallurgical characteristics, with both metals at economic concentrations.

8. Rising Sun Geological Fingerprints – Consistent visible gold observations across multiple vein sets, antimony tenors approaching theoretical maximum, discrete high-grade cores within broader halos, and comparable grade distributions all indicate Golden Dyke shares the same mineralizing system characteristics as the Rising Sun deposit.

9. Strategic Drill Gap Identified – Systematic drill coverage review identified 80 m to 100 m of inadequately tested strike length between Golden Dyke and Rising Sun, representing a potential 160 m strike extension—essentially equivalent to another Rising Sun-scale deposit. A deep core rig is now repositioned to systematically test these high-priority corridors.

Drill Hole Discussion

SDDSC177

Drillhole SDDSC177 was collared to test a 130 m vertical window within the Golden Dyke mineralized zone, positioned between historical holes SDDSC171 and SDDSC141. The hole was oriented east-west, sub-parallel to the main dyke and associated alteration envelope, at a high angle to the mineralization and vein orientations and was designed as a 60 m spaced infill hole to refine the geometry and continuity of known mineralization.

The hole intersected two vein sets at the margins of the Upper Rising Sun zone before intersecting the principal Golden Dyke target. Within Golden Dyke proper, SDDSC177 intercepted an intensely mineralized zone of ten vein sets, including one previously undefined high-grade core and a significant 100 m vertical step-out on the GD120 vein set, demonstrating the continued growth of the mineralized system at depth.

The complete Golden Dyke intersection returned a broad, stacked mineralized zone totalling 168 m @ 3.0 g/t AuEq (2.4 g/t Au and 0.3% Sb) uncut. Within this interval, a 2 m cut-off at 1.0 g/t AuEq encompasses discrete high-grade zones, including one interval exceeding 100 g/t AuEq x m and three intervals ranging from 50 g/t to 100 g/t AuEq x m. These results underscore the extensive, stacked nature of the mineralization package and the presence of broad, lower-grade halos surrounding higher-grade cores.

Key Highlights from SDDSC177:

Ten vein sets intercepted within the main Golden Dyke zone, demonstrating the density and complexity of the mineralized system

• A 100 m vertical step-out on the GD120 vein set, confirmed the depth extension of known mineralization

• Discovery of one new high-grade core zone outside the current exploration target area

• Cumulative grade intercept exceeding 500 gram-metres, demonstrating significant metal accumulation

• Frequent visible gold observations throughout the intersection, indicative of high-grade tenor

• Third-highest antimony assay recorded on the project (52.3% Sb), approaching theoretical maximum of pure stibnite

• Consistent high-grade cores with associated visible gold, exhibiting Rising Sun deposit characteristics

SDDSC177 returned three individual assays exceeding 100 g/t Au:

• 254 g/t Au over 0.4 m (from 545.9 m downhole, 0.25% Sb)

• 244 g/t Au over 0.1 m (from 482.8 m downhole, 0.1% Sb)

• 184 g/t Au over 0.2 m (from 431.8 m downhole, 14.8% Sb)

A high-grade antimony intercept was recorded, returning 52.3% Sb over 0.2 m, associated with 35.9 g/t Au at 493.65 m downhole. This represents the third-highest individual antimony assay on the project to date and approaches the theoretical maximum grade of pure stibnite (Sb₂S₃ ≈ 71% Sb). This result reinforces the deposit’s strategic significance as a potential source of critical antimony for Western markets.

Drill hole highlights include:

• 3.5 m @ 7.3 g/t AuEq (7.3 g/t Au, 0.0% Sb) from 91.2 m, including:

o 2.4 m @ 9.5 g/t AuEq (9.5 g/t Au, 0.0% Sb) from 91.2 m

• 0.6 m @ 23.8 g/t AuEq (17.0 g/t Au, 2.9% Sb) from 145.0 m, including:

• 0.2 m @ 60.3 g/t AuEq (41.7 g/t Au, 7.8% Sb) from 145.0 m

• 4.4 m @ 15.2 g/t AuEq (10.1 g/t Au, 2.2% Sb) from 428.7 m, including:

o 1.1 m @ 48.0 g/t AuEq (33.6 g/t Au, 6.0% Sb) from 431.8 m

• 0.5 m @ 78.6 g/t AuEq (76.0 g/t Au, 1.1% Sb) from 458.9 m

• 4.5 m @ 14.4 g/t AuEq (13.7 g/t Au, 0.3% Sb) from 461.6 m, including:

o 0.9 m @ 41.5 g/t AuEq (39.4 g/t Au, 0.8% Sb) from 461.6 m

o 0.6 m @ 43.8 g/t AuEq (43.6 g/t Au, 0.1% Sb) from 464.6 m

• 2.9 m @ 9.0 g/t AuEq (8.7 g/t Au, 0.1% Sb) from 482.8 m, including:

o 0.1 m @ 244.1 g/t AuEq (244.0 g/t Au, 0.1% Sb) from 482.8 m

• 1.9 m @ 25.1 g/t AuEq (11.1 g/t Au, 5.8% Sb) from 492.3 m, including:

o 0.5 m @ 93.2 g/t AuEq (42.0 g/t Au, 21.4% Sb) from 493.7 m

• 8.3 m @ 8.1 g/t AuEq (5.8 g/t Au, 1.0% Sb) from 504.5 m, including:

o 2.8 m @ 17.0 g/t AuEq (13.1 g/t Au, 1.7% Sb) from 507.0 m

o 1.4 m @ 7.2 g/t AuEq (5.6 g/t Au, 0.6% Sb) from 510.9 m

• 1.5 m @ 13.7 g/t AuEq (13.5 g/t Au, 0.1% Sb) from 528.3 m

• 6.2 m @ 16.5 g/t AuEq (16.0 g/t Au, 0.2% Sb) from 545.8 m, including:

o 1.3 m @ 76.7 g/t AuEq (76.1 g/t Au, 0.2% Sb) from 545.8 m

The intersection of multiple mineralized zones across significant intervals, combined with the discrete high-grade cores, demonstrates Golden Dyke’s potential to support both selective high-grade and bulk mining scenarios. This character builds towards Golden Dyke being increasingly analogous to the Rising Sun deposit in nature, with the capacity to generate value from both premium high-grade ore and broader mineralized envelopes. The consistency of high-grade tenor, frequent visible gold occurrence, and elevated antimony values mirror the characteristics observed at Rising Sun, supporting the interpretation that these deposits may be part of a continuous mineralized system.

SDDSC182

Drillhole SDDSC182 was an infill drillhole designed to test a 20 m to 50 m vertical window within the Golden Dyke mineralized zone. The hole was oriented west-east, sub-parallel to the main dyke and associated alteration envelope, at a high angle to the mineralization and vein orientations and was designed to refine the geometry and expand the continuity of known mineralization.

Five vein sets were intercepted in the main Golden Dyke zone, including one interval exceeding 50 g/t AuEq x m. Broad zones of lower grade were intercepted on the peripheries of the Golden Dyke system to the west in the upper portion of the hole (Figures 1 to 4).

SDDSC182 returned two significant individual intersections of antimony >30%:

• 39% Sb over 0.1 m (from 224.2 m downhole, 9.97g/t Au)

• 35.7% Sb over 0.3 m (from 426.9 m downhole, 86 g/t Au)

Drill hole highlights include:

• 0.7 m @ 19.4 g/t AuEq (2.7 g/t Au, 7.0% Sb) from 223.6 m

• 1.5 m @ 39.1 g/t AuEq (19.5 g/t Au, 8.2% Sb) from 426.5 m, including:

o 0.7 m @ 76.4 g/t AuEq (38.2 g/t Au, 16.0% Sb) from 426.5 m

• 6.5 m @ 1.8 g/t AuEq (0.9 g/t Au, 0.4% Sb) from 432.1 m

• 4.4 m @ 7.8 g/t AuEq (5.1 g/t Au, 1.1% Sb) from 441.1 m, including:

o 0.7 m @ 42.8 g/t AuEq (26.6 g/t Au, 6.8% Sb) from 444.0 m

• 4.9 m @ 2.0 g/t AuEq (1.3 g/t Au, 0.3% Sb) from 447.9 m

System-Wide Implications

The results from SDDSC177 and SDDSC182 continue to validate the extensive nature of the Golden Dyke mineralized system. The identification of previously untested corridors between Golden Dyke and Rising Sun, combined with the consistent grades intersected where drilling has been conducted, suggests significant exploration upside remains. Current drilling programs are now being positioned to test these gaps, with rigs being relocated to systematically evaluate approximately 80 m to 100 m of strike length that has not been adequately tested to date.

The consistency of mineralization characteristics across both Golden Dyke and Rising Sun – including high-grade cores, visible gold frequency, antimony tenor, and vein set architecture – increasingly supports the interpretation that these zones may represent a connected mineralized corridor exceeding 160 m in strike length, analogous to the scale of the Rising Sun deposit itself.

Pending Results and Update

Results are pending from 37 holes currently being processed and analyzed including nine holes that are actively being drilled and four abandoned holes (Figure 2). The Company continues its 200,000 m drill program through Q1 2027. Nine drill rigs are currently operational, including a deep core rig that has been relocated to test the deepest sections of Golden Dyke and to systematically drill through previously untested areas that may connect Golden Dyke and Rising Sun mineralization. A tenth rig will be mobilised to undertake regional work at Sunday Creek.

About Sunday Creek

The Sunday Creek epizonal-style gold project is located 60 km north of Melbourne within 16,900 hectares (“Ha”) of granted exploration tenements. SXGC is also the freehold landholder of 1,054.51 Ha that forms the key portion in and around the main drilled area at the Sunday Creek Project.

Gold and antimony form in a relay of vein sets that cut across a steeply dipping zone of intensely altered rocks (the “host”). These vein sets are like a “Golden Ladder” structure where the main host extends between the side rails deep into the earth, with multiple cross-cutting vein sets that host the gold forming the rungs. At Apollo and Rising Sun these individual ‘rungs’ have been defined over 600 m depth extent from surface to over 1,100 m below surface, are 2.5 m to 3.5 m wide (median widths) (and up to 10 m), and 20 m to 100 m in strike.

Cumulatively, 217 drill holes for 97,183.13 m have been reported from Sunday Creek since late 2020. This amount includes five holes for 929 m that have been drilled for geotechnical purposes and 19 holes for 2,120.27 m that were abandoned due to deviation or hole conditions. Fourteen drillholes for 2,383 m have been reported regionally outside of the main Sunday Creek drill area. A total of 64 historic drill holes for 5,599 m were completed from the late 1960s to 2008. The project now contains a total of Seventy-one (71) >100 g/t AuEq x m and seventy-eight (78) >50 to 100 g/t AuEq x m drill holes by applying a 2 m @ 1 g/t AuEq lower cut.

Our systematic drill program is strategically targeting these significant vein formations, which are currently defined over 1,350 m strike of the host from Christina to Apollo prospects, of which approximately 620 m has been more intensively drill tested (Rising Sun to Apollo). At least 86 ‘rungs’ have been defined to date, defined by high-grade intercepts (20 g/t Au to >7,330 g/t Au) along with lower grade edges. Ongoing step-out drilling is aiming to uncover the potential extent of this mineralized system (Figure 5).

Geologically, the project is located within the Melbourne Structural Zone in the Lachlan Fold Belt. The regional host to the Sunday Creek mineralization is an interbedded turbidite sequence of siltstones and minor sandstones metamorphosed to sub-greenschist facies and folded into a set of open north-west trending folds.

Further Information

Further discussion and analysis of the Sunday Creek project is available through the interactive Vrify 3D animations, presentations and videos all available on the SXGC website. These data, along with an interview on these results with President & CEO/Managing Director Michael Hudson can be viewed at www.southerncrossgold.com.

No upper gold grade cut is applied in the averaging and intervals are reported as drill thickness. However, during future Mineral Resource studies, the requirement for assay top cutting will be assessed. The Company notes that due to rounding of assay results to one significant figure, minor variations in calculated composite grades may occur.

Figures 1 to 6 show project location, plan and longitudinal views of drill results reported here and Tables 1 to 3 provide collar and assay data. The true thickness of the mineralized intervals reported individually as estimated true widths (“ETW”), otherwise they are interpreted to be approximately 60% to 70% of the sampled thickness for other reported holes. Lower grades were cut at 1.0 g/t AuEq lower cutoff over a maximum width of 2 m with higher grades cut at 5.0 g/t AuEq lower cutoff over a maximum of 1 m width unless specified unless otherwise* specified to demonstrate higher grade assays.

Critical Metal Epizonal Gold-Antimony Deposits

Sunday Creek (Figure 6) is an epizonal gold-antimony deposit formed in the late Devonian (like Fosterville, Costerfield and Redcastle), 60 million years later than mesozonal gold systems formed in Victoria (for example Ballarat and Bendigo). Epizonal deposits are a form of orogenic gold deposit classified according to their depth of formation: epizonal (<6 km), mesozonal (6 km to 12 km) and hypozonal (>12 km).

Epizonal deposits in Victoria often have associated high levels of the critical metal, antimony, and Sunday Creek is no exception. China claims a 56 per cent share of global mined supplies of antimony, according to a 2023 European Union study. Antimony features highly on the critical minerals lists of many countries including Australia, the United States of America, Canada, Japan and the European Union. Australia ranks seventh for antimony production despite all production coming from a single mine at Costerfield in Victoria, located nearby to all SXGC projects. Antimony alloys with lead and tin which results in improved properties for solders, munitions, bearings and batteries. Antimony is a prominent additive for halogen-containing flame retardants. Adequate supplies of antimony are critical to the world’s energy transition, and to the high-tech industry, especially the semi-conductor and defence sectors where it is a critical additive to primers in munitions.

In August 2024, the Chinese government announced it will place export limits from September 15, 2024 on antimony and antimony products. This puts pressure on Western defence supply chains and negatively affect the supply of the metal and push up pricing given China’s dominance of the supply of the metal in the global markets. This is positive for SXGC as we are likely to have one of the very few large and high-quality projects of antimony in the western world that can feed western demand into the future.

Antimony represents approximately 21% to 24% in situ recoverable value of Sunday Creek at an AuEq of 2.39 ratio.

About Southern Cross Gold Consolidated Limited (TSX:SXGC) (ASX:SX2) (OTCQX:SXGCF) (Frankfurt: MV3.F)

Southern Cross Gold Consolidated Ltd. (TSX: SXGC, ASX: SX2, OTCQX: SXGCF), controls the Sunday Creek Gold-Antimony Project located 60 km north of Melbourne, Australia. Sunday Creek has emerged as one of the Western world’s most significant gold and antimony discoveries, with exceptional drilling results including 71 intersections exceeding 100 g/t AuEq x m from just 102.8 km of drilling. The mineralization follows a "Golden Ladder" structure over 12 km of strike length, with confirmed continuity from surface to 1,100 m depth.

Sunday Creek’s strategic value is enhanced by its dual-metal profile, with antimony contributing approximately 20% of the in-situ value alongside gold, meaning Importantly, Sunday Creek can be developed primarily based on gold economics, which reduces antimony-related risks while maintaining strategic supply potential. This has gained increased significance following China’s export restrictions on antimony, a critical metal for defense and semiconductor applications. Southern Cross’ inclusion in the US Defense Industrial Base Consortium (DIBC) and Australia’s AUKUS-related legislative changes position it as a potential key Western antimony supplier.

Technical fundamentals further strengthen the investment case, with preliminary metallurgical work showing non-refractory mineralization suitable for conventional processing and gold recoveries of 93-98% through gravity and flotation.

With a strong cash position, over 1,000 Ha of strategic freehold land ownership, and a large 200 km drill program planned through Q1 2027, SXGC is well-positioned to advance this globally significant gold-antimony discovery in a tier-one jurisdiction.

This announcement has been approved for release by the Board of Southern Cross Gold Consolidated Ltd.

NI 43-101 Technical Background and Qualified Person

Michael Hudson, President and CEO and Managing Director of SXGC, and a Fellow of the Australasian Institute of Mining and Metallurgy, and Mr Kenneth Bush, Exploration Manager of SXGC and a RPGeo (10315) of the Australian Institute of Geoscientists, are the Qualified Persons as defined by the NI 43-101. They have prepared, reviewed, verified and approved the technical contents of this release.

Analytical samples are transported to the Bendigo facility of On Site Laboratory Services (“On Site”) which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 gram charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of Southern Cross Gold consists of the systematic insertion of certified standards of known gold content, blanks within interpreted mineralized rock and quarter core duplicates. In addition, On Site inserts blanks and standards into the analytical process.

SXGC considers that both gold and antimony that are included in the gold equivalent calculation (“AuEq") have reasonable potential to be recovered and sold at Sunday Creek, given current geochemical understanding, historic production statistics and geologically analogous mining operations. Historically, ore from Sunday Creek was treated onsite or shipped to the Costerfield mine, located 54 km to the northwest of the project, for processing during WW1. The Costerfield mine corridor, now owned by Alkane Resources (previously Mandalay Resources) contains two million ounces of equivalent gold (Mandalay Resources Q3 2021 Results), and in 2020 was the sixth highest-grade global underground mine and a top 5 global producer of antimony.

SXGC considers that it is appropriate to adopt the same gold equivalent variables as Mandalay Resources Ltd in its 2024 End of Year Mineral Reserves and Resources Press Release, dated February 20, 2025. The gold equivalence formula used by Mandalay Resources was calculated using Costerfield’s 2024 production costs, using a gold price of US$2,500 per ounce, an antimony price of US$19,000 per tonne and 2024 total year metal recoveries of 91% for gold and 92% for antimony, and is as follows:

𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔/𝑡) + 2.39 × 𝑆𝑏 (%)

Based on the latest Costerfield calculation and given the similar geological styles and historic toll treatment of Sunday Creek mineralization at Costerfield, SXGC considers that a 𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔/𝑡) + 2.39 × 𝑆𝑏 (%) is appropriate to use for the initial exploration targeting of gold-antimony mineralization at Sunday Creek.

JORC Competent Person Statement

Information in this announcement that relates to new exploration results contained in this report is based on information compiled by Mr Kenneth Bush and Mr Michael Hudson. Mr Bush is a Member of Australian Institute of Geoscientists and a Registered Professional Geologist in the field of Mining (#10315) and Mr Hudson is a Fellow of The Australasian Institute of Mining and Metallurgy. Mr Bush and Mr Hudson each have sufficient experience relevant to the style of mineralization and type of deposit under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Bush is Exploration Manager and Mr Hudson is President, CEO and Managing Director of Southern Cross Gold Consolidated Limited and both consent to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Certain information in this announcement that relates to prior exploration results is extracted from the Independent Geologist’s Report dated 11 December 2024 which was issued with the consent of the Competent Person, Mr Steven Tambanis. The report is included the Company’s prospectus dated 11 December 2024 and is available at www.asx.com.au under code “SX2”. The Company confirms that it is not aware of any new information or data that materially affects the information related to exploration results included in the original market announcement. The Company confirms that the form and context of the Competent Persons’ findings in relation to the report have not been materially modified from the original market announcement.

Certain information in this announcement also relates to prior drill hole exploration results, are extracted from the following announcements, which are available to view on www.southerncrossgold.com:

• 4 October, 2022 SDDSC046, 20 October, 2022 SDDSC049, 5 September, 2023 SDDSC077B, 12 October, 2023 SDDLV003 & 4, 23 October, 2023 SDDSC082, 9 November, 2023 SDDSC091, 14 December, 2023 SDDSC092, 5 March, 2024 SDDSC107, 30 May, 2024 SDDSC117, 13 June, 2024 SDDSC118, 5 September, 2024 SDDSC130, 28 October, 2024 SDDSC137W2, 28 November, 2025 SDDSC141, 9 December, 2024 SDDSC145, 18 December, 2024 SDDSC129 & 144, 28 May, 2025 SDDSC161, 16 June, 2025 SDDSC162, 26 August, 2025 SDDSC171, 8 September, 2025 SDDSC170A,

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original document/announcement and the Company confirms that the form and context in which the Competent Person’s findings are presented have not materially modified from the original market announcement.

Forward-Looking Statement

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. All statements other than statements of present or historical fact are forward-looking statements. Forward-looking statements include words or expressions such as “proposed”, “will”, “subject to”, “near future”, “in the event”, “would”, “expect”, “prepared to” and other similar words or expressions. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include general business, economic, competitive, political, social uncertainties; the state of capital markets, unforeseen events, developments, or factors causing any of the expectations, assumptions, and other factors ultimately being inaccurate or irrelevant; and other risks described in the Company’s documents filed with Canadian or Australian (under code SX2) securities regulatory authorities. You can find further information with respect to these and other risks in filings made by the Company with the securities regulatory authorities in Canada or Australia (under code SX2), as applicable, and available for the Company in Canada at www.sedarplus.ca or in Australia at www.asx.com.au (under code SX2). Documents are also available at www.southerncrossgold.com The Company disclaims any obligation to update or revise these forward-looking statements, except as required by applicable law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()