Osisko Development Reports Third Quarter 2025 Results

HIGHLIGHTS

Q3 2025 (at September 30, 2025)

- ~$401.4 million in cash and cash equivalents

- Drawn ~$137.2 million (US$100.0 million) under the US$450 million Appian financing facility executed during the quarter

- Completed private placements for ~$280.4 million (US$203.1 million) in gross proceeds

- Advanced pre-construction activities and underground mine development activities, and announced results of ore sorting and drilling programs at the permitted Cariboo Gold Project

- Sold 877 ounces of gold from the Tintic small-scale heap leach project

Subsequent to Q3 2025

- Completed an additional private placement for ~$82.5 million in gross proceeds

- Released infill drill results from the ongoing program at Cariboo; appointed Scott Smith as VP, Exploration

Osisko Development Corp. (NYSE: ODV, TSXV: ODV) ("Osisko Development" or the "Company") reports its financial and operating results for the three months ended September 30, 2025 ("Q3 2025").

Q3 2025 HIGHLIGHTS

Operating, Financial and Corporate Updates:

- As of September 30, 2025, the Company had approximately $401.4 million in cash and cash equivalents. Approximately $137.2 million (US$100.0 million) was outstanding as of the end of Q3 2025 under the Appian 2025 Financing Facility (as defined herein) following the initial draw.

- $4.4 million in revenues ($0.2 million in Q3 2024) and $3.0 million in cost of sales ($0.1 million in Q3 2024) generated from the sale of 877 gold ounces from the small-scale heap leach project at the Tintic Project by re-treating certain tailings and stockpile material.

- On July 7, 2025, the Company announced results from an ore sorting testing program conducted on a bulk tonnage sample of mineralized material extracted from the Cariboo Gold Project.

- On July 21, 2025, the Company entered into a credit agreement (the "Credit Agreement") with funds advised by Appian Capital Advisory Limited ("Appian") with respect to a senior secured project loan credit facility (the "2025 Financing Facility") totaling US$450 million for the development and construction of the Cariboo Gold Project. The 2025 Financing Facility provides strategic capital and enhanced financial flexibility as the Company advances the Cariboo Gold Project through the next phase of pre-construction and early works milestones toward construction readiness. It is structured in two tranches aligned with the Cariboo Gold Project’s planned development timeline. An initial draw of US$100 million was completed to: (i) undertake a 13,000-meter infill drill campaign to further de-risk project mine planning assumptions; (ii) fund pre-construction and construction activities for the development of the Cariboo Gold Project; (iii) repay the Company’s outstanding US$25 million term loan with National Bank of Canada; and (iv) support the Cariboo Gold Project’s general working capital requirements. Subsequent draws of US$350 million to be drawn in up to four subsequent tranches will be available for a period up to 36 months subject to the satisfaction of certain project milestones and other customary conditions. A copy of the Credit Agreement is available on SEDAR+ (www.sedarplus.ca) under the Company’s issuer profile.

- On August 15, 2025, the Company completed private placements for aggregate gross proceeds of US$203.1 million. This consisted of a "bought deal" brokered private placement of 58,560,000 units of the Company at a price of US$2.05 per unit for aggregate gross proceeds of US$120.0 million, which was announced on July 31, 2025, and a non-brokered private placement of 40,505,330 units at a price of US$2.05 for aggregate gross proceeds of approximately US$83.0 million. The non-brokered offering included an approximate US$75 million subscription by Double Zero Capital LP, a Delaware investment firm, representing approximately 15.4% of the issued and outstanding common shares of the Company immediately following the closing of the offering, on a non-diluted basis. Each unit consisted of one common share and one-half of one common share purchase warrant of the Company. Each whole warrant entitles the holder to acquire one Common Share at an exercise price of US$2.56 for a period of 24 months following the closing date. At any time following the 15-month anniversary of the closing date, if the closing price of the common shares exceeds the exercise price for 20 or more consecutive trading days, the Company may, within 10 days following such occurrence, deliver a notice to the holders thereof accelerating the expiry date of the warrants to a date that is 30 days after the date of such notice.

- On August 20, 2025, the Company granted 58,824 deferred share units of the Company to Ms. Susan Craig, an independent director, in connection with her appointment to the Company’s board of directors announced on June 16, 2025.

- On September 8, 2025, the Company announced results from its infill and exploration diamond drilling and development sampling campaigns conducted from November 2024 through early August 2025 in the Lowhee Zone within the Cariboo Gold Project. The program consisted of approximately 6,471 meters of underground infill drilling and approximately 398 meters of chip and rock saw channel sampling.

Cariboo Gold Project – British Columbia, Canada (100%-owned)

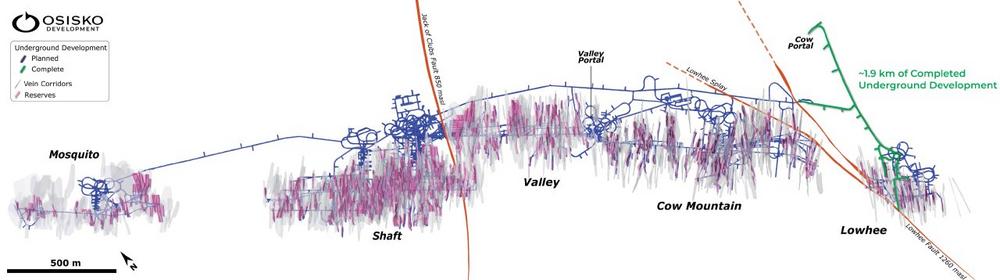

- Infill Drilling Program. During August 2025, the Company commenced a 13,000-metre infill drill program within the Lowhee Zone, being undertaken as part of the Appian 2025 Financing Facility obligations, from existing underground development infrastructure completed to date.

– The infill program is expected to provide a comprehensive data set that will inform resource modeling, mine planning and production stope design procedures and parameters. It will also support the development of a systematic approach to infill drilling for the underground mining operation.

– Subsequent to Q3 2025, the Company released 2,279 meters of underground infill drilling results (refer to Subsequent to Q3 2025) from this program.

– To date, an aggregate total of approximately 6,900 meters of drilling has been completed, representing approximately 51% of the total planned drill meters. Full assays are pending along with completion of associated quality assurance and quality control reviews. The Company expects to complete the infill drilling program in the first quarter of 2026.

- Pre-Construction Activities. The Company continues to advance pre-construction activities, including certain surface infrastructure and underground development.

– These include, among others, the upgrade of the Bonanza Ledge water treatment plant, construction of the waste rock storage facility and the sediment control pond, expansion of the Ballarat camp, ongoing underground development, the underground infill drilling program and related detailed engineering work.

– To date, approximately 1.9 kilometers of underground development has been completed from the existing Cow Portal into the Cariboo Gold Project’s Lowhee Zone and along the main access ramp towards the Cow Mountain Zone up to the Lowhee fault (see Figure 1).

Tintic Project – Utah, U.S.A. (100%-owned)

- Small-Scale Heap Leach Project. In the first quarter of 2025, a small-scale heap leach project was undertaken to re-treat certain tailings and stockpile material. As a result, a total of 877 gold ounces were sold in Q3 2025, with small-scale operations anticipated to continue into the fourth quarter of 2025. While management continues to evaluate options for the next steps at the Tintic Project, it is expected that limited activities will occur beyond care and maintenance.

San Antonio Gold Project – Sonora State, Mexico (100%-owned)

- The San Antonio Gold Project remains in care and maintenance and the Board of Directors of the Company has authorized a strategic review. The approval process for mining permits appears to be gaining traction, specifically for open-pit mining in the country, and the Company intends to re-submit its two permit applications in the foreseeable future.

SUBSEQUENT TO Q3 2025

- On October 6, 2025, the Company announced new infill drilling results from its ongoing 13,000-meter program on 10-meter drill spacing that commenced in August 2025 in the Lowhee Zone of the Cariboo Gold Project. The first three fans of this program consisted of approximately 2,279 meters of underground infill drilling, representing approximately 17.5% of the total planned drill meters.

- On October 27, 2025, the Company announced the filing of an early warning report regarding Falco Resources Ltd. ("Falco") wherein the Company acquired, indirectly through its wholly-owned subsidiary, Barkerville Gold Mines Ltd., 6,250,000 units of Falco at a price of $0.32 per unit for an aggregate purchase price of $2.0 million in connection with a "bought deal" private placement of 41,005,000 units completed by Falco. Each unit consisted of one common share of Falco and one-half of one common share purchase warrant of Falco. As a result of and immediately following completion of the private placement, the Company owned or controlled, indirectly through its wholly-owned subsidiary, an aggregate of 54,925,240 common shares and 4,915,000 warrants, representing approximately 15.9% of the issued and outstanding common shares on a basic non-diluted basis.

- On October 29, 2025, the Company completed a private placement offering of 15,409,798 common shares of the Company for aggregate gross proceeds of approximately $82.5 million comprised of the following issuances:

– 2,990,000 common shares that will qualify as "flow-through shares" ("FT Shares") within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the "Tax Act") at a price of $6.69 per FT Share for gross proceeds of approximately $20.0 million;

– 1,444,000 common shares to certain eligible British Columbia resident subscribers (the "BC FT Shares", and together with the FT Shares, the "Flow-Through Shares") that will qualify as "flow-through shares" within the meaning of subsection 66(15) of the Tax Act at a price of $6.93 per BC FT Share for gross proceeds of approximately $10.0 million; and

– 10,975,798 common shares at a price of $4.78 per common share for gross proceeds of approximately $52.5 million.

- On November 3, 2025, the Company announced the appointment of Mr. Scott Smith as Vice President, Exploration.

Consolidated Financial Statements

The Company’s unaudited condensed interim consolidated financial statements (the "Financial Statements") and related management’s discussion and analysis ("MD&A") for the three months ended September 30, 2025 have been filed with Canadian securities regulatory authorities and the U.S. Securities and Exchange Commission. These filings are available on the Company’s website at www.osiskodev.com, on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development’s issuer profile.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Victor Gauthier, ing., P.Eng., Manager – Technical Services of Osisko Development, and Eryn Doyle, P.Geo., Senior Exploration Manager of Osisko Development, each of whom is considered to be a "qualified person" within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Technical Reports

Information relating to the Cariboo Gold Project and the 2025 Feasibility Study on the Cariboo Gold Project is supported by the technical report titled "NI 43-101 Technical Report, Feasibility Study for the Cariboo Gold Project, District of Wells, British Columbia, Canada" and dated June 11, 2025 (with an effective date of April 25, 2025) (the "Cariboo Technical Report").

Information relating to the Tintic Project and the current mineral resource estimate for the Trixie deposit (the "2024 Trixie MRE") is supported by the technical report titled "NI 43-101 Technical Report, Mineral Resource Estimate for the Trixie Deposit, Tintic Project, Utah, United States of America" and dated April 25, 2024 (with an effective date of March 14, 2024) (the "Tintic Technical Report").

Information relating to San Antonio Gold Project is supported by the technical report titled "NI 43-101 Technical Report for the 2022 Mineral Resource Estimate on the San Antonio Project, Sonora, Mexico" and dated July 12, 2022 (with an effective date of June 24, 2022) (the "San Antonio Technical Report" and collectively with the Tintic Technical Report and the Cariboo Technical Report, the "Technical Reports").

For readers to fully understand the information in the Technical Reports, reference should be made to the full text of the Technical Reports in their entirety, including all assumptions, parameters, qualifications, limitations and methods therein. The Technical Reports are intended to be read as a whole, and sections should not be read or relied upon out of context. The Technical Reports were prepared in accordance with NI 43-101 and are available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development’s issuer profile and on the Company’s website at www.osiskodev.com.

ABOUT OSISKO DEVELOPMENT CORP.

Osisko Development Corp. is a continental North American gold development company focused on past-producing mining camps located in mining friendly jurisdictions with district scale potential. The Company’s objective is to become an intermediate gold producer by advancing its flagship permitted 100%-owned Cariboo Gold Project, located in central B.C., Canada. Its project pipeline is complemented by the Tintic Project in the historic East Tintic mining district in Utah, U.S.A., and the San Antonio Gold Project in Sonora, Mexico—brownfield properties with significant exploration potential, extensive historical mining data, access to existing infrastructure and skilled labour. The Company’s strategy is to develop attractive, long-life, socially and environmentally responsible mining assets, while minimizing exposure to development risk and growing mineral resources.

For further information, visit our website at www.osiskodev.com or contact:

Sean Roosen

Chairman and CEO

Email: sroosen@osiskodev.com

Tel: +1 (514) 940-0685

Philip Rabenok

Vice President, Investor Relations

Email: prabenok@osiskodev.com

Tel: +1 (437) 423-3644

CAUTIONARY STATEMENTS

Cautionary Statement Regarding Financing Risks

The Company’s development and exploration activities are subject to financing risks. As of the date hereof, the Company has exploration and development assets which may generate periodic revenues through test mining but has no mines in the commercial production stage that generate positive cash flows. The Company cautions that test mining at its operations could be suspended at any time. The Company’s ability to explore for and discover potential economic projects, and then to bring them into production, is highly dependent upon its ability to raise equity and debt capital in the financial markets. Any projects that the Company develops will require significant capital expenditures. To obtain such funds, the Company may sell additional securities including, but not limited to, the Company’s shares or some form of convertible security, the effect of which may result in a substantial dilution of the equity interests of the Company’s shareholders. Alternatively, the Company may also sell a part of its interest in an asset in order to raise capital. There is no assurance that the Company will be able to raise the funds required to continue its exploration programs and finance the development of any potentially economic deposit that is identified on acceptable terms or at all. The failure to obtain the necessary financing(s) could have a material adverse effect on the Company’s growth strategy, results of operations, financial condition and project scheduling.

Cautionary Statement Regarding Test Mining Without Feasibility Study

The Company cautions that its prior decision to commence small-scale underground mining activities and batch vat leaching at the Trixie test mine (Tintic Project) was made without the benefit of a feasibility study, or reported mineral resources or mineral reserves, demonstrating economic and technical viability, and, as a result there may be increased uncertainty of achieving any particular level of recovery of material or the cost of such recovery. The Company cautions that historically, such projects have a much higher risk of economic and technical failure. Small scale test-mining at Trixie was suspended in December 2022, resumed in the second quarter of 2023, and suspended once again in December 2023. If and when small-scale test-mining recommences at Trixie, there is no guarantee that production will continue as anticipated or at all or that anticipated production costs will be achieved. The failure to continue production may have a material adverse impact on the Company’s ability to generate revenue and cash flow to fund operations. Failure to achieve the anticipated production costs may have a material adverse impact on the Company’s cash flow and potential profitability. In continuing operations at Trixie after closing, the Company has not based its decision to continue such operations on a feasibility study, or reported mineral resources or mineral reserves demonstrating economic and technical viability.

Cautionary Statement to U.S. Investors

The Company is subject to the reporting requirements of the applicable Canadian securities laws and, as a result, reports information regarding mineral properties, mineralization and estimates of mineral reserves and mineral resources, including the information in its technical reports, financial statements and MD&A, in accordance with Canadian reporting requirements, which are governed by NI 43-101. As such, such information concerning mineral properties, mineralization and estimates of mineral reserves and mineral resources, including the information in its technical reports, financial statements and MD&A, is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the U.S. Securities and Exchange Commission ("SEC").

Risks related to the development of the Cariboo Gold Project

The development of a new mining operation, including the construction of processing facilities, tailings storage infrastructure, access roads, power supply and other supporting infrastructure, is a complex and costly undertaking. The Cariboo Gold Project remains in the development stage and there is no certainty that it will be brought into commercial production within anticipated timelines, at anticipated costs, or at all. The results of the Cariboo Technical Report are based on a number of assumptions, including, among others, geological interpretations, estimated mineral resources and mineral reserves, metallurgical recoveries, construction schedules, capital and operating costs, labour and equipment availability, transportation and energy costs, regulatory requirements, and projected commodity prices. These assumptions are inherently uncertain and may prove to be inaccurate.

Actual results, costs and development timelines may differ materially from those currently anticipated due to factors such as: unforeseen geological conditions; changes to mine plan optimization; equipment failures; shortages of skilled labour and contractors; increases in the cost of materials, equipment or energy; design modifications; delays related to permitting or receipt of government approvals; adverse weather or climate conditions; and community, indigenous or community opposition. In addition, the development of mining projects often requires substantial capital expenditures, and delays or cost overruns may require the Company to seek additional financing, which may not be available on favorable terms or at all. If the Company is unable to complete construction and development of the Cariboo Gold Project on a timely and cost-effective basis, or if operating performance following commissioning is materially lower than expected, the project may fail to achieve anticipated economic results. Any such events could have a material adverse effect on the Company’s business, financial condition and results of operations.

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this news release may be deemed "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (together, "forward-looking statements"). These forward-looking statements, by their nature, require Osisko Development to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Forward-looking statements are not guarantees of performance. Words such as "may", "will", "would", "could", "expect", "believe", "plan", "anticipate", "intend", "estimate", "continue", "objective", "strategy", variants of these words or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including statements pertaining to the results and significance of the ore sorter testwork as an indicator of quality; the availability and use of proceeds of the 2025 Financing Facility (including the ability and timing to satisfy conditions precedents to subsequent draws under the 2025 Financing Facility (if at all)); other financing arrangements that the Company may negotiate (including, the indications of interest, the type of financing arrangements, the size and quantum of such financing arrangements and the ability and timing to reach a definitive agreement in respect of such potential financings (if at all)); expectations regarding having access to sufficient funding to construct the Cariboo Gold Project; expectations regarding the Company’s capital requirements to advance the Cariboo Gold Project to production; the ability of the Company to raise or arrangement for the remaining funding required to complete the construction of the Cariboo Project; the timing and ability of the Company to make a final investment decision in respect of the Cariboo Project; the Company’s strategy and objectives relating to the Cariboo Gold Project as well as its other projects; the impact of the 2025 Financing Facility on the Company and its financial position and allocation; the ability of the Company to service and repay principal related to the 2025 Financing Facility whether from the operation of Cariboo or other sources of funds; the assumptions, qualifications and limitations relating to the Cariboo Gold Project being permitted and the commencement of construction activities; assumptions, qualifications and parameters underlying the Cariboo Technical Report (including, but not limited to, the mineral resources, mineral reserves, production profile, mine design and project economics); the results of the Cariboo Technical Report as an indicator of quality and robustness of the Cariboo Gold Project, as well as other considerations that are believed to be appropriate in the circumstances; the ability of the Company to achieve the estimates outlined in the Cariboo Technical Report in the timing contemplated (if at all); the ability to achieve the capital and operating costs outlined in the Cariboo Technical Report (if at all); the ability, progress and timing in respect of pre-construction activities at Cariboo including the 13,000-meter infill drill program, and other surface infrastructure works; the utility and significance of the infill drill program and its ability to inform resource modeling, mine planning and stope design procedures and parameters (if at all); the timing and status of permitting of the transmission line for the Cariboo Gold Project; the contemplated work plan and activities at the Cariboo Gold Project and the timing, scope and results thereof and associated costs thereto; the ability of the Company to sustain ongoing small-scale heap leach activities at Tintic (if at all); the continuation of limited activities beyond care and maintenance continuing at the Tintic Project; the long-term prospects of San Antonio, including the permitting process (and impact of delays), status on care and maintenance and status and outcome of the strategic review; ability and timing to re-submit its two permit applications at San Antonio (if at all); the potential impact of tariffs and other trade restrictions (if any); mineral resource category conversion; the future development and operations at the Cariboo Gold Project and the Tintic Project; the results of ongoing stakeholder engagement; the capital resources available to the Company; the ability of the Company to access capital as and when required and on terms acceptable to the Company; the ability of the Company to execute its planned activities, including as a result of its ability to seek additional funding or to reduce planned expenditures; management’s perceptions of historical trends, current conditions and expected future developments; future mining activities; the potential of high grade gold mineralization on Trixie and Cariboo; the ability and timing for Cariboo to reach commercial production (if at all); sustainability and environmental impacts of operations at the Company’s properties; the results (if any) of further exploration work to define and expand mineral resources; the ability of exploration work (including drilling and sampling) to accurately predict mineralization; the ability of the Company to expand mineral resources beyond current mineral resource estimates; the ability of the Company to complete its exploration and development objectives for its projects in the timing contemplated and within expected costs (if at all); the ongoing advancement of the deposits on the Company’s properties; future gold prices; the costs required to advance the Company’s properties; the ability to adapt to changes in gold prices, estimates of costs, estimates of planned exploration and development expenditures; the profitability (if at all) of the Company’s operations; regulatory framework remaining defined and understood as well as other considerations that are believed to be appropriate in the circumstances, and any other information herein that is not a historical fact may be "forward looking information". Osisko Development considers its assumptions to be reasonable based on information currently available but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko Development, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko Development and its business. Such risks and uncertainties include, among others, risks relating to third-party approvals, including the issuance of permits by governments, capital market conditions and the Company’s ability to access capital on terms acceptable to the Company for the contemplated exploration and development at the Company’s properties; the ability to continue current operations and exploration; regulatory framework and presence of laws and regulations that may impose restrictions on mining; errors in management’s geological modelling; the timing and ability of the Company to obtain and maintain required approvals and permits; the results of exploration activities; risks relating to exploration, development and mining activities; the global economic climate; fluctuations in metal and commodity prices; fluctuations in the currency markets; dilution; environmental risks; and community, non-governmental and governmental actions and the impact of stakeholder actions. Osisko Development is confident a robust consultation process was followed in relation to its received BC Mines Act and Environmental Management Act permits for the Cariboo Gold Project and continues to actively consult and engage with Indigenous nations and stakeholders. While any party may seek to have the decision related to the BC Mines Act and/or Environmental Management Act permits reviewed by the courts, the Company does not expect that such a review would, were it to occur, impact its ability to proceed with the construction and operation of the Cariboo Gold Project in accordance with the approved BC Mines Act and Environmental Management Act permits. Readers are urged to consult the disclosure provided under the heading "Risk Factors" in the Company’s annual information form for the year ended December 31, 2024 as well as the financial statements and MD&A for the year ended December 31, 2024 and quarter ended September 30, 2025, which have been filed on SEDAR+ (www.sedarplus.ca) under Osisko Development’s issuer profile and on the SEC’s EDGAR website (www.sec.gov), for further information regarding the risks and other factors facing the Company, its business and operations. Although the Company’s believes the expectations conveyed by the forward-looking statements are reasonable based on information available as of the date hereof, no assurances can be given as to future results, levels of activity and achievements. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. Forward-looking statements are not guarantees of performance and there can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()