Gold as a hedge against crisis

Advertisement/Advertising – This article is distributed on behalf of Osisko Development Corp. and Gold X2 Mining Inc., with whom SRC swiss resource capital AG has paid IR advisory agreements. Creator: SRC swiss resource capital AG · Author: Ingrid Heinritzi · First published: January 7, 2026, 2:48 p.m. Zurich/Berlin

Two crises in particular are well remembered (actually badly remembered): the financial crisis of 2008 and the coronavirus pandemic of 2020. Both crises showed that gold is a kind of crisis insurance. In 2008, the stock markets crashed, but gold rose by around 25 percent. This is referred to as the negative correlation between gold and stocks. In 2020, the price of gold rose by around 30 percent. Gold shines due to its limited supply, in contrast to fiat currencies, and is therefore also considered a hedge against inflation. The fact that the precious metal does not generate any returns is often only of secondary importance. Physical gold incurs storage costs, but this is not the case when investors bet on gold companies.

The recent military action in Venezuela has impressively demonstrated that geopolitical disputes and risks are now part of everyday business. And these are precisely the factors to which gold tends to respond with price increases. Uncertainty causes investors to seek the safe haven of gold. At the end of 2025, the price of gold fell, but due to the geopolitical developments just mentioned, it rose significantly again. The all-time high of around US$4,510 per troy ounce is not far off. So even if there are corrections, the core trend for gold is upward. This is because falling interest rates, ongoing uncertainty, and continued strong demand from central banks and investors are generally expected. Well-positioned gold companies such as Osisko Development and Gold X2 Mining should be among investors‘ favorites.

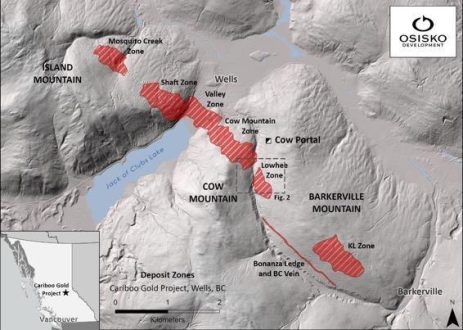

Osisko Development – https://www.commodity-tv.com/ondemand/companies/profil/osisko-development-corp/ – owns, among other things, the flagship Cariboo Gold project (Canada, 100 percent). Production at Cariboo (approximately 190,000 ounces of gold per year over ten years) is scheduled to start in 2027. A 70,000-meter drilling program has been launched at Cariboo to investigate potential resource growth.

Gold X2 Mining – https://www.commodity-tv.com/ondemand/companies/profil/gold-x2-mining-inc/ – owns the advanced Moss Gold Project (gold, silver, copper) in Ontario. Wholly owned, the project is well-serviced and has produced excellent drill results. Gold X2 Mining has just acquired Kesselrun Resources, thereby expanding the Huronian Gold Project and the land package of the Moss Project.

Current company information and press releases from Gold X2 Mining (- https://www.resource-capital.ch/en/companies/gold-x2-mining-inc/ -) and Osisko Development (- https://www.resource-capital.ch/en/companies/osisko-development-corp/ -).

Sources:

https://www.gold.org/goldhub/gold-focus/2026/01/weekly-markets-monitor-venezuelas-ripple-effect

In accordance with Section 85 of the German Securities Trading Act (WpHG) in conjunction with Article 20 of Regulation (EU) 2016/958 (MAR), we hereby disclose that authors/employees/affiliated companies of SRC swiss resource capital AG may hold positions (long/short) in issuers discussed. Remuneration/relationship: IR contracts/advertorial: Own positions (author): none; SRC net position: less than 0.5%; issuer’s stake in SRC ≥ 5%: no. Update policy: no obligation to update. No guarantee for the translation into German. Only the English version of this news release is authoritative.

Disclaimer: The information provided does not constitute any form of recommendation or advice. We expressly draw attention to the risks involved in securities trading. No liability can be accepted for any damage arising from the use of this blog. We would like to point out that shares and, in particular, warrant investments are generally associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the accuracy of all content. Despite the utmost care, I expressly reserve the right to errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but does not claim to be accurate or complete. Due to court rulings, the content of linked external sites is also our responsibility (e.g., Hamburg Regional Court, in its ruling of May 12, 1998 – 312 O 85/98), as long as we do not expressly distance ourselves from them. Despite careful content control, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of SRC swiss resource capital AG, which is available at https://www.resource-capital.ch/de/disclaimer-agb/, applies additionally.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()