GoldMining Reports New Drill Results Highlighting Exploration Potential at São Jorge Project, Pará State, Brazil

The reverse circulation ("RC") drilling results detailed in this release comprise the continuation of the William South drilling program ("the Program"), a high priority part of the broader 2025 São Jorge Project exploration program which the Company designed to test new targets outside of the known areas of mineralization.

Highlights:

- William South RC Drilling Results:

- 12 metres ("m") at 2.38 grams per tonne ("g/t") gold ("Au") from 13 m depth, including 1 m at 22 g/t Au (SJRC-048-25)

- 4 m at 1.11 g/t Au from 46 m depth (SJRC-049-25)

- 1 m at 1.23 g/t Au from 16 m depth (SJRC-047-25)

- Preliminary processing of Induced Polarisation ("IP") data indicates drilling completed at William South to date has only tested the southern flank of a broad chargeability anomaly, which is similar in scale and intensity to the known IP signature of the São Jorge Deposit.

- Drilling over the highest chargeability core of the William South IP anomaly is planned in 2026.

- A total of 9,533 metres of drilling was safely and successfully completed on-budget during 2025.

- Exploration results received to date support the broader potential for discovery and delineation of new zones of mineralization across the 46,000 hectare São Jorge Project.

Alastair Still, Chief Executive Officer of GoldMining, commented: "GoldMining is further encouraged by the additional positive drill results yielded from the 2025 RC drilling completed to date at the William South prospect, an emerging gold discovery located a short distance from the known São Jorge gold deposit. The geology and geophysical signature at William South resembles the São Jorge gold deposit itself based on exploration to date. This work has been encouraging of the potential for this area, highlighting that significant additional systematic exploration is required, especially over the core of the IP anomaly which has not yet been tested by drilling.

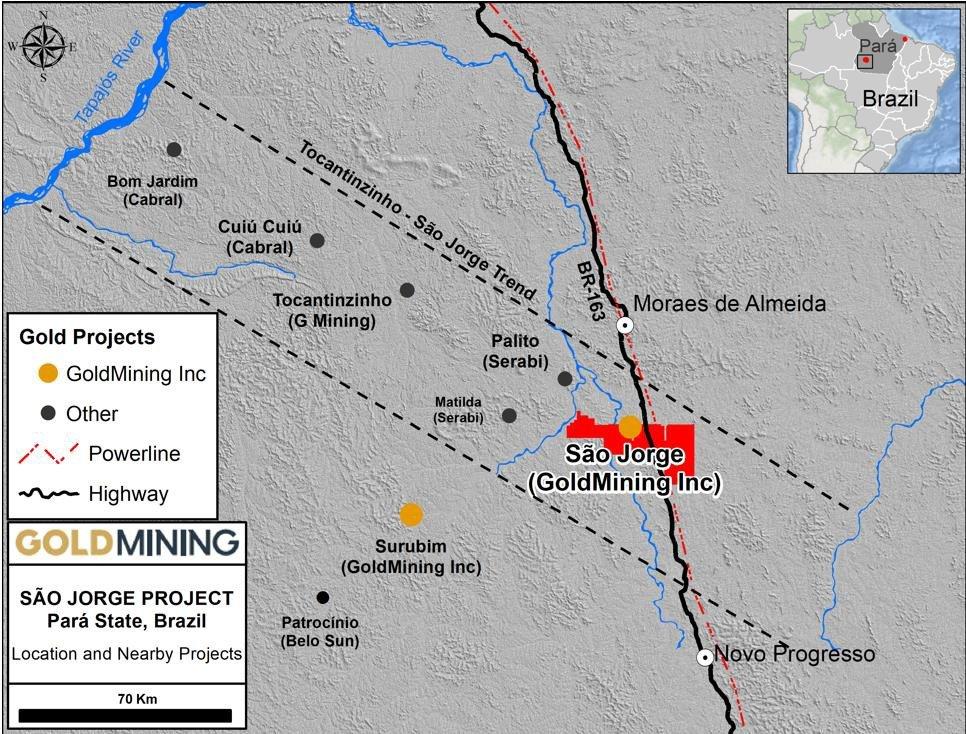

In conjunction with William South, we continue to explore additional targets across the broad 12 km x 7 km geochemical footprint overlying the São Jorge property-scale mineral system, where we have additional exploration results pending. The excellent infrastructure at the 100% owned 46,000 hectare São Jorge Project includes easy access to paved highway, grid power and an existing 50-person camp that has facilitated our exploration activities to date as we continue to systematically explore this highly prospective regional-scale property in the rapidly emerging Tapajós gold district.”

Project Overview

The São Jorge Gold Project is located in the Tapajós gold district (see Figure 1) in the south-central portion of the Amazon Craton. The São Jorge gold deposit is a granite-hosted, intrusion-related gold deposit which is a similar deposit style to the Tocantinzinho gold mine located approximately 80 km northwest of São Jorge. Exploration activities at the Project carried out by the Company over the past two years have successfully delineated several new exploration targets comprising gold ± copper ± molybdenum ± silver soil geochemical anomalies, which cumulatively outlines a large mineral system (see news releases dated March 18 and April 14, 2025).

2025 São Jorge Mineral System Exploration Program

The São Jorge mineral system is defined by a comprehensive exploration data set which the Company has developed over previous campaigns. Surrounding the previously delineated São Jorge deposit, which has a defined 1.4 km strike length, the broader mineral system comprises a zone of contiguous surface geochemical anomalies over an area of 12 km x 7 km, which the Company interprets to be the surface expression of a broad intrusive related gold system.

The 2025 São Jorge exploration program successfully and safely completed a total of 9,533 m of drilling, which exceeded the total planned meterage of 9,000 m while remaining on–budget. The Project benefitted from the introduction of RC drilling which is cheaper and more rapid than diamond core, while providing greater depth penetration and assay reliability than auger drilling. The Program comprised 3,862 m diamond core, 3,528 m RC and 2,143 m auger drilling.

Of the 84 RC holes drilled to date across the Project for a total of 3,528 metres, assays have been returned for 78 holes, with the remaining 18 holes pending assays. To date, four target areas have returned >1 g/t Au intercepts from RC drilling: William South, William North, Ivonette and Dragon West (see Figure 2).

Previously announced initial intercepts at the William South prospect included 4 m at 1.78 g/t Au from 12 m depth (see news release October 20, 2025).

New assay results are presented herein for additional drilling at the William South Prospect, which is located 1.5 km north of the Deposit. The full drilling program at William South comprised 20 RC holes drilled on three fences to test beneath a broad zone of elevated gold-in-soil and auger drilling geochemistry. The western–most drill fence returned the best assay results from weathered monzogranite containing disseminated pyrite mineralization. The strongest mineralized intercept to date, comprising 12 m at 2.38 g/t Au (including 1 m at 22.08 g/t Au), occurs adjacent to a contact between monzogranite and syenogranite intrusive phases. A similar intrusive contact localizes strain, hydrothermal alteration and gold mineralization at the São Jorge deposit. Mineralization remains open along strike and to depth.

Preliminary processing of the recently completed 40 line km of IP surveying indicates that a broad east-west oriented high tenor chargeability anomaly, with coincident high resistivity, occurs at the William South target. Overall, the William South geophysical signature is similar in nature, scale and intensity to the São Jorge deposit. Drilling completed to date primarily targeted the highest tenor gold-in-soil geochemical anomaly, which occurs south of the core geophysical anomaly. Future drilling will extend northwards to test the chargeability / resistivity high.

Further RC drilling was subsequently completed at the Ivonette and Dragon West targets, to follow up on previously returned +1 g/t Au drill intercepts, with the objective to expand the mineralization intersected to date and potentially define new mineral resources. Assays are pending. Also, additional results from other components of the Program, including diamond core drilling beneath the São Jorge deposit, expansion of the IP survey grid, and a garimpo (artisanal mine) mapping and sampling program, will be reported as results are available.

Data Verification

For drill core sampling, samples were taken from the NQ/HQ core by sawing the drill core in half, with one-half sent to SGS Geosol Laboratórios Ltda. ("SGS") in Brazil for assaying, and the other half of the core retained at the site for future reference. Sample lengths downhole were uniformly 1.0 m. For the auger drilling program, samples were collected at 1 m sample intervals, with the material being dried, homogenized and split in the field to obtain a 1 kg representative sample which was sent to SGS for analysis. The remaining auger sample material is stored until the lab results are received, and a 1 kg sample duplicate is maintained in the archive. For the RC drilling program, samples were collected at 1 m sample intervals, generating approximately 25 kg samples, with the material being dried, homogenized and split in the field to obtain a 1 kg representative sample which was sent to SGS for analysis. The remaining RC sample material is stored until the lab results are received, and approximately 20 kg of the original samples are maintained in the archive.

SGS is a certified commercial laboratory located in Vespasiano, Minas Gerais, Brazil, and is independent of GoldMining. GoldMining has implemented a quality assurance and quality control program for the sampling and analysis of drill core and auger samples, including duplicates, mineralized standards and blank samples for each batch of 100 samples. The gold analyses are completed by FAA505 method (fire-assay with an atomic absorption finish on 50 grams of material).

Qualified Person

Paulo Pereira, P. Geo., Country Manager, Brazil of GoldMining, has supervised the preparation of, verified and approved all scientific and technical information herein this news release. Mr. Pereira is also a qualified person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Visit www.goldmining.com for more information, including high-resolution figures, and to review the Technical Report titled “NI 43-101 Technical Report, São Jorge Project, Pará State, Brazil,” with an effective date of January 28, 2025.

About GoldMining Inc.

GoldMining Inc. is a public mineral exploration company focused on acquiring and developing gold assets in the Americas. Through its disciplined acquisition strategy, GoldMining now controls a diversified portfolio of resource-stage gold and gold-copper projects in Canada, the U.S.A., Brazil, Colombia, and Peru. The Company also owns approximately 21.5 million shares of Gold Royalty Corp. (NYSE American: GROY), 9.9 million shares of U.S. GoldMining Inc. (Nasdaq: USGO) and 19.1 million shares of NevGold Corp. (TSXV: NAU). See www.goldmining.com for additional information.

For additional information, please contact:

GoldMining Inc.

Amir Adnani, Co-Chairman, David Garofalo, Co-Chairman

Alastair Still, President and CEO

Telephone: (855) 630-1001

Email: info@goldmining.com

In Europe

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

Notice to Readers

Technical disclosure regarding São Jorge has been prepared by the Company in accordance with NI 43-101. NI 43-101 is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the U.S. Securities and Exchange Commission (“SEC”) and the scientific and technical information contained in this news release may not be comparable to similar information disclosed by domestic United States companies subject to the SEC’s reporting and disclosure requirements.

Cautionary Statement on Forward-looking Statements

Certain of the information contained in this news release constitutes “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws (“forward-looking statements”), which involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited to, statements respecting the Company’s expectations regarding the Project, ongoing exploration programs and other expected future work programs thereat, and often contain words such as "anticipate", "intend", "plan", "will", "would", estimate", "expect", "believe", "potential" and variations of such terms. Such forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the markets in which GoldMining operates, which may prove to be incorrect. Investors are cautioned that forward-looking statements involve risks and uncertainties, including, without limitation: the inherent risks involved in the exploration and development of mineral properties, fluctuating metal prices, unanticipated costs and expenses, risks related to government and environmental regulation, social, permitting and licensing matters, any inability to complete work programs as expected, the Company’s plans with respect to the Project may change as a result of further planning or otherwise, and uncertainties relating to the availability and costs of financing needed in the future. These risks, as well as others, including those set forth in GoldMiningꞌs most recent Annual Information Form and other filings with Canadian securities regulators and the SEC, could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements. There can be no assurance that forward-looking statements, or the material factors or assumptions used to develop such forward-looking statements, will prove to be accurate. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: js@resource-capital.ch

![]()