Gold price rises steeply

A weak US dollar has given the price of the precious metal a boost. The dollar index is made up of a basket of currencies and the dollar has depreciated significantly against the basket of currencies. The index has lost almost 13% of its value so far in 2025. If this trend continues, this will be positive for the gold price. In addition, the US president has threatened Japan with new punitive tariffs.

Meanwhile, the budget deficit in the US continues to rise and it is uncertain what results talks on trade agreements will bring. The upward trend in the gold price continues. There are many reasons for this: China is busy buying gold, and many countries want to become less dependent on the US dollar and are therefore turning to gold. According to the World Gold Council, the proportion of gold in international reserves has doubled since 2015.

Bonds have become less attractive in recent years. In addition to geopolitical uncertainties around the world, there are also smouldering trade disputes. Conflicts and wars are on the rise. Fiat currencies are losing value as the money supply increases. In the long or medium term, investors should not go wrong with gold. It retains its value and not only preserves savings but also increases them. Over the past three years, the price of gold has risen by around 83 percent and there is still room for improvement.

The price of gold and silver is therefore moving in a bull market that is supported by strong fundamental factors. And general investor interest in the precious metal is also growing. Add to this the expected interest rate cuts by the Fed, and gold and gold stocks should shine.

Goldshore Resources – https://www.commodity-tv.com/ondemand/companies/profil/goldshore-resources-inc/ -, for example, with its advanced Moss gold project in Ontario, is a good example. The 100% wholly owned project is equipped with the best infrastructure.

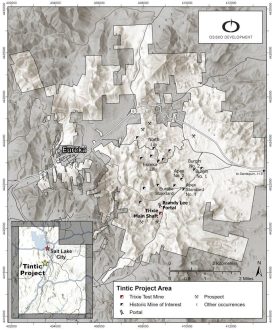

Revival Gold – https://www.commodity-tv.com/ondemand/companies/profil/revival-gold-inc/ – is developing the Mercur gold project in Utah, which is ready for production at relatively short notice. The company is also working on the approval process for the Beartrack-Arnett gold project in Idaho.

Current company information and press releases from Goldshore Resources (- https://www.resource-capital.ch/en/companies/goldshore-resources-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()