Record price for copper

Advertisement/Advertising – This article is distributed on behalf of Axo Copper Corp., Arizona Sonoran Copper Company Inc., with which SRC swiss resource capital AG has paid IR consulting agreements. Creator: SRC swiss resource capital AG · Author: Ingrid Heinritzi · First published: December 09, 2025; 7:50 p.m. Zurich/Berlin

On the London Metal Exchange, copper for delivery in three months was trading at US$11,540 per tonne – a record price. Imports of copper components in semi-finished products into the US are subject to a 50% tariff. Copper ores are (still) exempt. But the future is uncertain, so warehouses in the US are being filled up. This copper probably comes from warehouses on the exchanges in Asia and Europe. On the supply side, there are still production interruptions in the mines. For example, a major mine in the Democratic Republic of Congo has significantly reduced its production forecasts. The second-largest mine in Indonesia is still shut down after an accident.

Supply bottlenecks are therefore looming, and if demand growth increases in 2026, the outlook for copper prices and copper companies looks good. Copper mine operators have performed above average this year. Industry heavyweight Glencore is planning to significantly increase copper production in the coming years. Looking at China, the most important sales market, sentiment indices for the construction industry and the official purchasing managers‘ index for the manufacturing sector are disappointing, but there is hope. Namely, that the Chinese government will support the economy with new measures next year.

This year, copper (and silver) has surpassed gold as the top precious metals, driven by supply fears. Investments in companies with copper in their projects could therefore be a lucrative opportunity.

Arizona Sonoran Copper Company – https://www.commodity-tv.com/ondemand/companies/profil/arizona-sonoran-copper-company-inc/ – owns the Cactus project in Arizona. It has a very good economic rating, is suitable for simple open-pit mining, and has a projected life of 22 years.

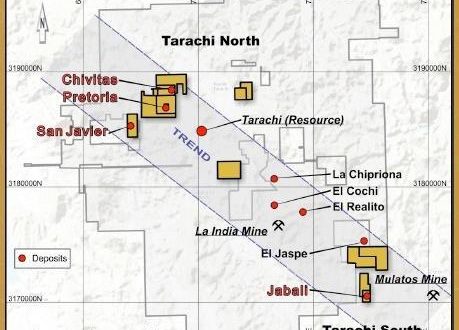

Axo Copper – https://www.commodity-tv.com/ondemand/companies/profil/axo-copper-corp/ – owns the La Huerta copper project in Mexico. It covers approximately 11,300 hectares and is a new copper discovery in the promising Sierra Madre belt.

Current company information and press releases from Axo Copper (- https://www.resource-capital.ch/en/companies/axo-copper-corp/ -) and Arizona Sonoran Copper Company (- https://www.resource-capital.ch/en/companies/arizona-sonoran-copper-company-inc/ -).

Sources:

https://www.jpmorgan.com/insights/global-research/commodities/copper-outlook

In accordance with Section 85 of the German Securities Trading Act (WpHG) in conjunction with Article 20 of Regulation (EU) 2016/958 (MAR), we hereby disclose that authors/employees/affiliated companies of SRC swiss resource capital AG may hold positions (long/short) in issuers discussed. Remuneration/relationship: IR contracts/advertorial: Own positions (author): none; SRC net position: less than 0.5%; issuer’s stake in SRC ≥ 5%: no. Update policy: no obligation to update. No guarantee for the translation into German. Only the English version of this news release is authoritative.

Disclaimer: The information provided does not constitute any form of recommendation or advice. We expressly draw attention to the risks involved in securities trading. No liability can be accepted for any damage arising from the use of this blog. We would like to point out that shares and, in particular, warrant investments are generally associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the accuracy of all content. Despite the utmost care, I expressly reserve the right to errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but does not claim to be accurate or complete. Due to court rulings, the content of linked external sites is also our responsibility (e.g., Hamburg Regional Court, in its ruling of May 12, 1998 – 312 O 85/98), as long as we do not expressly distance ourselves from them. Despite careful content control, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of SRC swiss resource capital AG, which is available at https://www.resource-capital.ch/de/disclaimer-agb/, applies additionally.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()