Private investors are betting on gold and silver

2025 was a very turbulent year. The price of silver rose by well over 100 percent, while the price of gold rose by around 65 percent in 2025. The survey shows that 51 percent of investors surveyed expect silver to outperform all other metals again in 2026. 29 percent predict that gold will see the biggest price increase in the new year. TD Securities forecasts silver prices of around US$45 per ounce for 2026.

Lower interest rates, ongoing currency depreciation, supply dynamics, and diversification should push the price of gold to a new high of over US$4,400 in the first half of the year. According to commodity analysts, a new quarterly record high of US$4,400 per ounce of gold will also be caused by the Fed’s interest rate decisions and concerns about whether the Fed’s independence will be maintained. Another factor that could drive up the price of gold is the assumption that the US government will advocate low interest rates in view of its enormous debt. And this is fueling the price of gold.

TD Securities also expects the US labor market to deteriorate, leading to further significant interest rate cuts by the Fed. These could be 100 or even 150 basis points – another plus for gold and silver. If the US dollar continues to depreciate and the de-dollarization sought by many countries increases, then the path to higher prices is more than clear. This particularly benefits mining companies with gold and silver.

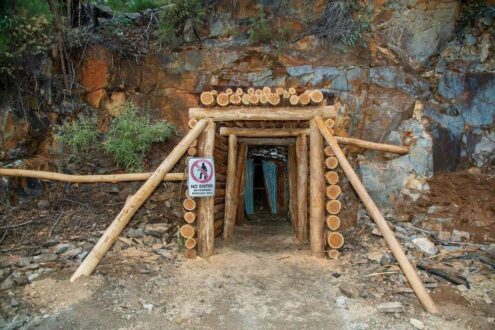

Sierra Madre Gold and Silver – https://www.commodity-tv.com/ondemand/companies/profil/sierra-madre-gold-silver-ltd/ – successfully started production at its Guitarra project (gold and silver) in Mexico at the beginning of the year. The focus is now on increasing production and minimizing costs. The company recently acquired another silver mine in Mexico, which includes three fully approved underground mines and a flotation plant.

Skeena Gold & Silver – https://www.commodity-tv.com/ondemand/companies/profil/skeena-gold-silver-ltd/ – is developing a high-grade, low-cost gold-silver project (Eskay Creek) in British Columbia with the support of the local community. Two other projects that were previously in production are also in the spotlight.

Current company information and press releases from Skeena Gold & Silver (- https://www.resource-capital.ch/en/companies/skeena-resources-ltd/ -) and

Sierra Madre Gold and Silver (- https://www.resource-capital.ch/en/companies/sierra-madre-gold-and-silver-ltd/ -).

Sources:

https://www.goldtelegraph.com/2025/02/22/sean-boyd-the-time-is-now-for-gold/.

In accordance with Section 85 of the German Securities Trading Act (WpHG) in conjunction with Article 20 of Regulation (EU) 2016/958 (MAR), we hereby disclose that authors/employees/affiliated companies of SRC swiss resource capital AG may hold positions (long/short) in issuers discussed. Remuneration/relationship: IR contracts/advertorial: Own positions (author): none; SRC net position: less than 0.5%; issuer’s stake in SRC ≥ 5%: no. Update policy: no obligation to update. No guarantee for the translation into German. Only the English version of this news release is authoritative.

Disclaimer: The information provided does not constitute any form of recommendation or advice. We expressly draw attention to the risks involved in securities trading. No liability can be accepted for any damage arising from the use of this blog. We would like to point out that shares and, in particular, warrant investments are generally associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the accuracy of all content. Despite the utmost care, I expressly reserve the right to errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but does not claim to be accurate or complete. Due to court rulings, the content of linked external sites is also our responsibility (e.g., Hamburg Regional Court, in its ruling of May 12, 1998 – 312 O 85/98), as long as we do not expressly distance ourselves from them. Despite careful content control, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of SRC swiss resource capital AG, which is available at https://www.resource-capital.ch/de/disclaimer-agb/, applies additionally.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()